There were 1.18 billion shares traded on the HoSE today (March 4), with a transaction value of VND28,606.54 billion. These figures show that although it has just surpassed the peak of August and September 2023 and is gradually approaching the peak of September 2022, the cash flow is still very strong.

Investors are eagerly looking for new opportunities in the market, while a corresponding amount of money is withdrawn to realize profits.

Liquidity on HNX reached 104.17 million shares equivalent to VND 2,082.49 billion and on UPCoM was 40.66 million shares equivalent to VND 535.85 billion.

With the support of strong cash flow, VN-Index maintained its upward trend, today's increase was 3.13 points, equivalent to 0.25%, to 1,261.41 points; VN30-Index increased by 1.46 points, equivalent to 0.12; HNX-Index increased by 0.95 points, equivalent to 0.4%, and UPCoM-Index adjusted insignificantly, decreasing by 0.03 points, equivalent to 0.03%.

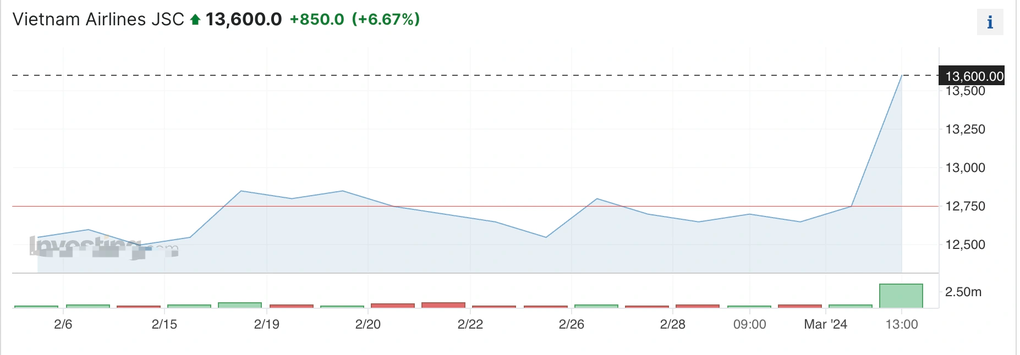

HVN increased to the ceiling

HoSE had 7 stocks hitting the ceiling, of which HVN hit the ceiling to 13,600 VND/share, matching orders of nearly 3.8 million shares - liquidity jumped in the context of the average trading volume of this code being about 642,000 units/session in the past 3 months. Meanwhile, VJC also increased slightly by 0.3% to 103,600 VND/share.

HVN stock price has increased sharply in recent sessions (Source: Investing).

Shares of the national airline "took off" and increased sharply in the context of Circular 34 of the Ministry of Transport officially taking effect from the beginning of this month, allowing the ceiling price of domestic air tickets to be raised.

According to Circular 34 of the Ministry of Transport amending and supplementing a number of articles of Circular 17 on the price frame for passenger transport services on domestic flights, flights with a distance of less than 500km have a ceiling price of 1.6 million VND/ticket/way for socio -economic development flights and 1.7 million VND/ticket/way for other flights.

The remaining flight groups will have a price increase of 50,000-250,000 VND/ticket/way compared to the old regulations, depending on the length of each flight.

Speaking to Dan Tri reporter, Mr. Le Hong Ha - General Director of Vietnam Airlines - commented that this is a condition for airlines to compensate for costs that have been adjusted over the past 10 years, and at the same time is an opportunity for airlines to continue adjusting their price ranges on domestic routes.

Another leader of Vietnam Airlines also shared in the press that the airline has overcome the most difficult period, recovering more than 90% of its flight routes compared to before the Covid-19 pandemic.

Real estate and construction stocks remain hot

The entire market had 562 stocks increasing in price, 28 stocks hitting the ceiling compared to 362 stocks decreasing, 12 stocks hitting the floor. While many financial stocks were being sold for profit, real estate stocks increased positively in price, with active trading.

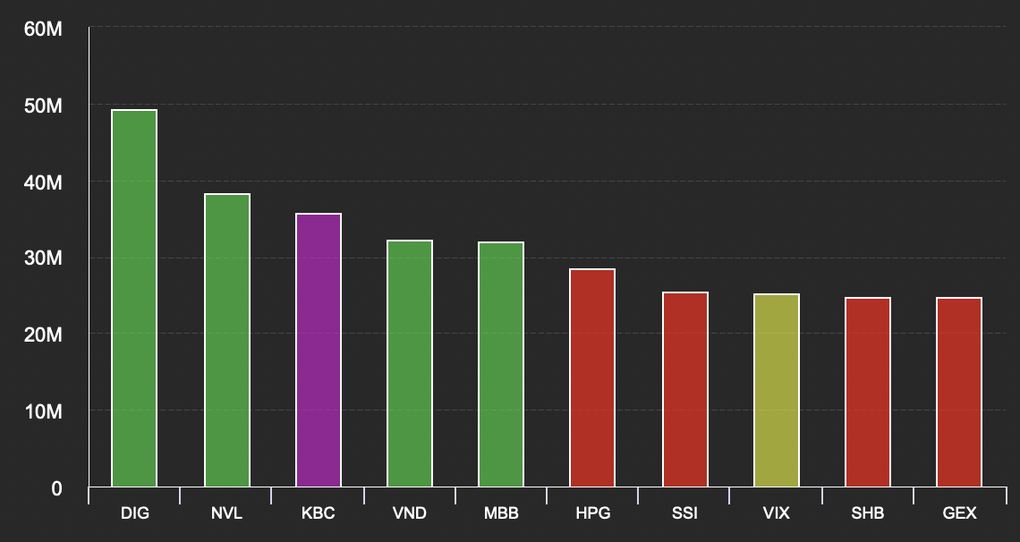

DIG led the market in liquidity, with a trading volume of 42.3 million units and a trading value of VND470 billion; NVL traded 38.2 million units and KBC traded 35.6 million units. At the closing time, TIP, KBC and NLG all hit the ceiling with a large ceiling price buy order.

Top stocks with the strongest trading on the market on March 4 (Source: VDSC).

In addition, many other stocks also increased in price on the same day, such as ITC increased by 3.1%; KDH increased by 2.9%; BCM increased by 2.8%; QCG increased by 2.5%; HDC increased by 2.4%; LHG increased by 2.3%...

Many construction and material stocks were also sought after by investors, had good liquidity and increased strongly. CTD increased by 4.3%; EVG increased by 4%; FCM increased by 3%; HBC increased by 3%; NHA increased by 2.3%; VGC increased by 2.2%.

Banking stocks were slightly differentiated. While CTG, LPB, MBB, VIB, EIB increased, in the opposite direction, VCB, TPB, MSB, STB, SSB, SHB and VPB adjusted.

The same goes for financial service stocks. The codes that were sold off included EVF, VDS, TCI, CTS, SSI, TVS, BSI, the overall decrease was not too large; on the contrary, TVB still increased by 3.9%; APG increased by 1.4%; FIT increased by 1.4%; VND, HCM remained green.

Source

![[Photo] National Assembly Chairman Tran Thanh Man meets with Thai Prime Minister Paetongtarn Shinawatra](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/15/e71160b1572a457395f2816d84a18b45)

![[Photo] Prime Ministers of Vietnam and Thailand visit the Exhibition of traditional handicraft products](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/15/6cfcd1c23b3e4a238b7fcf93c91a65dd)

Comment (0)