SGGPO

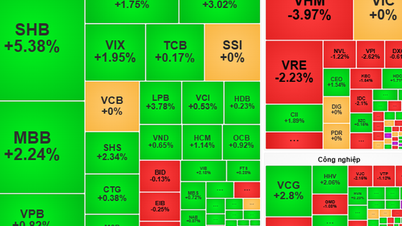

On July 26, in Hanoi, the Vietnam Securities Journalists Club organized a July dialogue with the theme "Macroeconomics and the stock market".

Sharing at the dialogue, Mr. Pham Chi Quang, Director of the Monetary Policy Department of the State Bank of Vietnam (SBV), said that Vietnam's credit/GDP ratio is currently at 126%, the highest among developing countries. The economy's reliance on bank credit poses many risks to the macroeconomy.

The economy is too dependent on credit capital channels, which poses risks and lacks sustainability for the credit institution system in particular and the economy in general because bank capital is short-term, while the demand for medium and long-term loans is very large. In that context, the recovery and development of the stock market is expected to help reduce the burden of capital supply for banks.

Sharing the same view, Mr. Nguyen Quoc Hung, General Secretary of the Vietnam Banking Association, also said that the development of the stock market will help reduce pressure on the monetary market, reduce the burden on the banking system regarding capital for the economy and businesses.

Meanwhile, Ms. Vu Thi Chan Phuong, Chairwoman of the State Securities Commission, said that it is expected that in August 2023, the State Securities Commission will work with rating organizations to assess the potential of the Vietnamese stock market in order to upgrade the market to emerging market status. When the stock market is upgraded, it will bring many benefits to the domestic capital market and the economy in general.

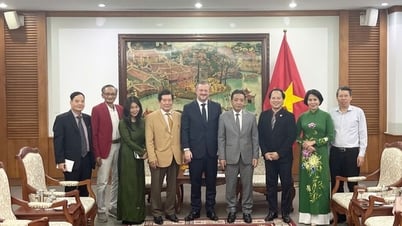

|

Ms. Vu Thi Chan Phuong, Chairwoman of the State Securities Commission |

According to estimates by the International Monetary Fund (IMF), an estimated 70% of capital allocation decisions in securities depend on the classification of the securities market. Meanwhile, the World Bank (WB) also expects about 7.2 billion USD/year to flow into Vietnam if the market is upgraded.

In addition, another benefit of upgrading the market is the ability to improve stock valuation, which has a positive impact on the equitization process and divestment of state capital in state-owned enterprises. Upgrading to an emerging market also helps investors diversify.

However, according to the representative of the State Securities Commission, in order to be upgraded to a stock market, Vietnam still has a lot of work to do. First of all, it is necessary to restructure the investor base when the current stock market has nearly 90% of individual investors. Along with that, the State Securities Commission also needs to strengthen supervision and post-inspection to ensure the quality and transparency of products brought to the market.

Source

![[Photo] National Assembly Chairman Tran Thanh Man meets with Thai Prime Minister Paetongtarn Shinawatra](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/15/e71160b1572a457395f2816d84a18b45)

![[Photo] Prime Minister Pham Minh Chinh receives Country Director of the World Bank Regional Office for Vietnam, Laos, Cambodia](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/15/2c7898852fa74a67a7d39e601e287d48)

Comment (0)