The Provincial People's Committee has just signed Decision No. 43/2024/QD-UBND promulgating the Coordination Regulation on State management, ensuring security and developing e-commerce activities in Binh Phuoc province.

According to the regulations, the Provincial Tax Department shall preside over and coordinate with relevant authorities to strengthen tax management for e-commerce activities and digital business; deploy electronic invoices generated from cash registers, and implement measures to encourage people and businesses to use electronic invoices. Provide tax payment data of organizations and individuals participating in e-commerce activities such as selling via social networks, mobile applications, and online advertising.

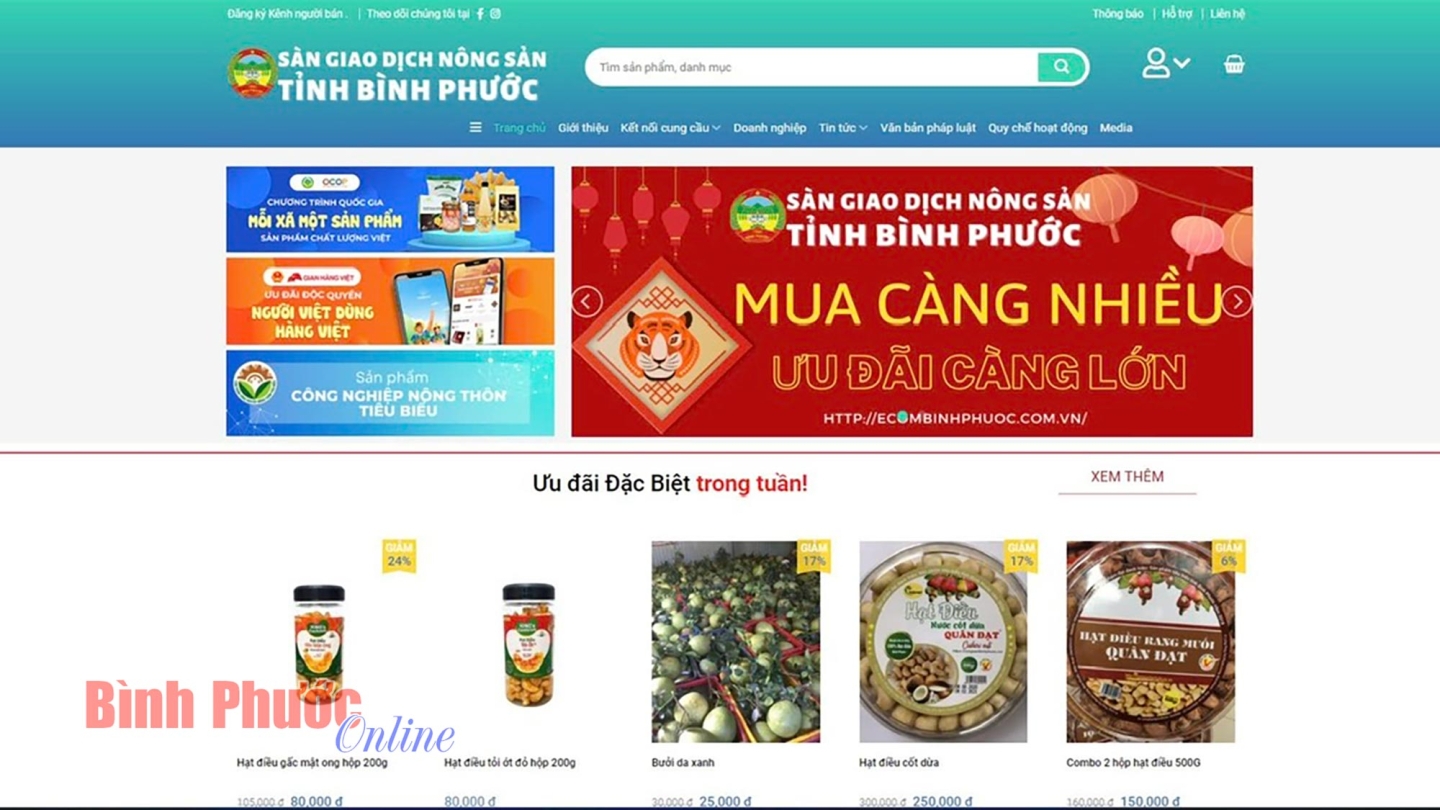

Trading on the agricultural product floor of Binh Phuoc province helps manage e-commerce activities effectively.

Strengthen tax inspection and examination of organizations and individuals with e-commerce activities and coordinate to participate in periodic or unscheduled inter-sectoral inspections of e-commerce activities in the province when requested by the presiding agency.

Promote the dissemination and popularization of tax policies to all organizations and individuals; regularly review, urge and guide the implementation of tax declaration and payment according to regulations. Strengthen coordination and sharing of tax management data for e-commerce with relevant departments, branches and localities.

Agencies, units, district-level People's Committees, and organizations coordinate with tax authorities to implement measures to encourage people and businesses to use electronic invoices; declare and fulfill tax obligations for organizations and individuals operating and doing business in the online environment. |

The Department of Information and Communications coordinates in providing information to serve tax management for entities providing telecommunications services, online advertising, software products and services, digital information products and services, and products and services through digital platforms.

The provincial police continue to effectively implement Project 06/CP, connecting the national population database with databases and information systems of ministries, branches and localities to perform electronic identification and authentication; synchronizing population data with civil status, tax, banking data... to serve the identification and authentication of individuals and organizations to prevent fraud and tax evasion in e-commerce activities; closely coordinating with tax authorities and departments and branches to connect, automatically share, and regularly update the common database on citizen information authentication between the national population database and the tax registration database; coordinating to verify and provide information of organizations and individuals with e-commerce activities and businesses on digital platforms when requested by tax authorities...

Source: https://baobinhphuoc.com.vn/news/4/166060/nang-cao-hieu-qua-quan-ly-thue-doi-voi-hoat-dong-thuong-mai-e-tu

![[Photo] Prime Minister Pham Minh Chinh chairs meeting on science and technology development](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/ae80dd74c384439789b12013c738a045)

![[Photo] More than 17,000 candidates participate in the 2025 SPT Competency Assessment Test of Hanoi National University of Education](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/e538d9a1636c407cbb211b314e6303fd)

![[Photo] Readers line up to visit the photo exhibition and receive a special publication commemorating the 135th birthday of President Ho Chi Minh at Nhan Dan Newspaper](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/85b3197fc6bd43e6a9ee4db15101005b)

![[Photo] Nearly 3,000 students moved by stories about soldiers](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/21da57c8241e42438b423eaa37215e0e)

Comment (0)