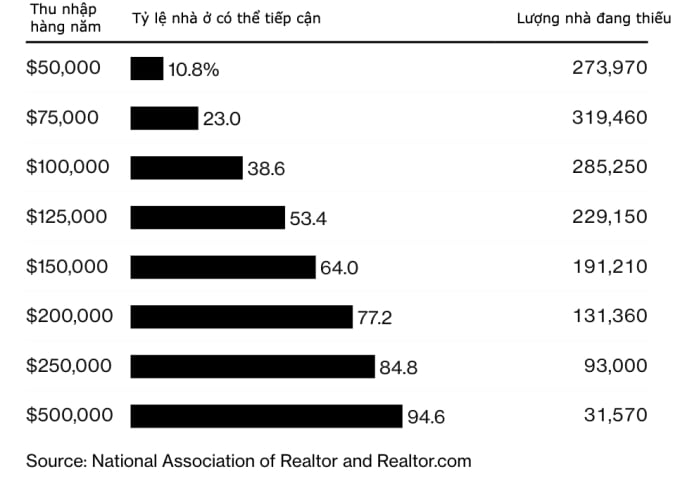

According to the National Association of Realtors (NAR) and Realtors, the country is short about 320,000 homes priced under $256,000.

This price is considered reasonable for homebuyers with annual incomes of no more than $75,000, a group classified as “middle income”. They can now buy only 23% of the existing homes for sale across the US, down by half from five years ago.

The shortage of affordable homes has been going on for years, and it has only gotten worse since the pandemic heated up the US housing market. Now, many people cannot afford to buy a home because prices remain high and interest rates have risen. Homeowners are reluctant to sell because they had low-interest loans. If they were to change their home now, they would have to pay higher interest rates.

Housing shortages across US consumer segments (based on annual income). Graphics: Bloomberg

"Continued high housing costs and a shortage of available homes continue to pose budget challenges for many potential buyers. Some may have to continue renting or delay buying until their finances improve," said Danielle Hale, Realtor Chief Economist .

Middle-income earners face the greatest housing shortage of all income groups, said Nadia Evangelou, director of real estate research at NAR. Therefore, an approach is needed that addresses both low affordability and limited housing supply. “We have to increase the number of homes at prices that most people can afford,” she said.

The report also found that homebuyers need to earn at least $125,000 a year or more to access half of the homes on the market.

Mr. Ky ( according to WSJ )

Source link

![[Photo] Worshiping the Tuyet Son statue - a nearly 400-year-old treasure at Keo Pagoda](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F02%2F1764679323086_ndo_br_tempimageomw0hi-4884-jpg.webp&w=3840&q=75)

![[Photo] Parade to celebrate the 50th anniversary of Laos' National Day](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F02%2F1764691918289_ndo_br_0-jpg.webp&w=3840&q=75)

![[Video] Protecting World Heritage from Extreme Climate Change](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/12/03/1764721929017_dung00-57-35-42982still012-jpg.webp)

Comment (0)