| Commodity market today, July 31, 2024: Mixed developments in the agricultural and industrial raw materials markets. Commodity market today, August 1, 2024: Metals and energy markets begin to heat up. |

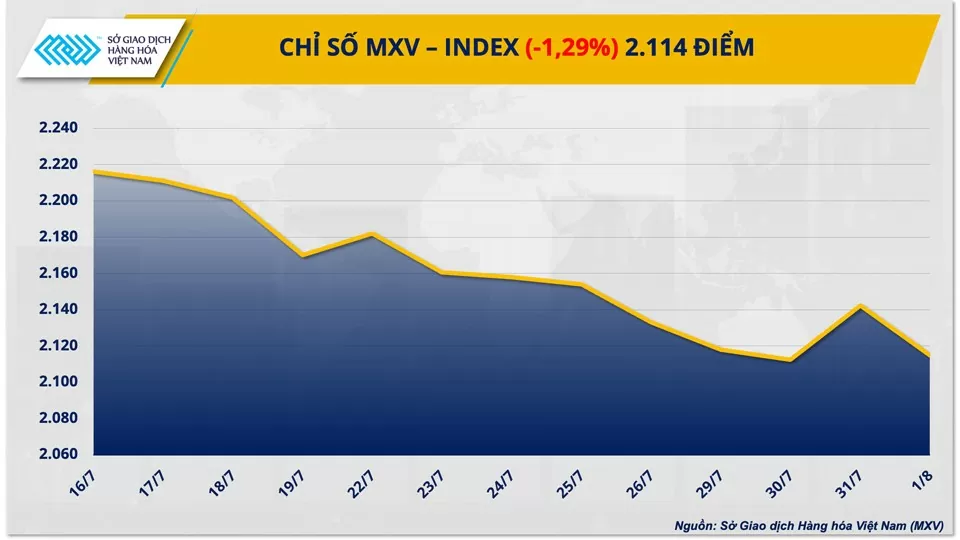

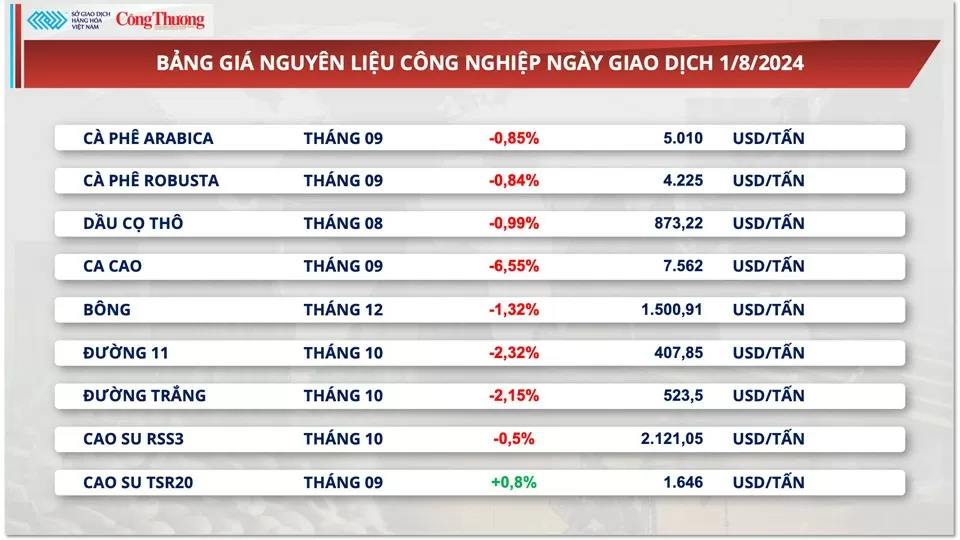

According to the Vietnam Commodity Exchange (MXV), at the close of trading on the first day of August, selling pressure returned, dominating the global raw materials market and causing the MXV-Index to fall 1.29% to 2,114 points. All nine industrial raw materials saw price declines, with cocoa prices plummeting by over 6.5% and sugar by over 2%. Following the previous positive session, red continued to appear in the metals market as prices weakened in seven commodities.

|

| MXV-Index |

Cocoa prices fell by more than 6.5%.

At the close of trading yesterday (August 1st), cocoa prices led the decline among industrial raw materials, falling sharply by 6.55% to a one-month low of $7,562 per ton. Market attention was focused on signs of improved supply from the world's leading cocoa-producing and exporting countries.

The La Nina weather pattern, replacing El Nino, is bringing more rain to Ivory Coast and Ghana, two countries that produce over 60% of the world's cocoa, improving soil moisture and boosting cocoa yields.

In Ivory Coast, alternating periods of sunshine and light rain last weekend boosted the main cocoa crop (October to the end of March next year). Cocoa growers also expect a significant harvest in September, gradually increasing from October to December.

|

| Industrial raw material price list |

Additionally, Nigeria's cocoa exports in June increased by 18% year-on-year, also contributing to the current improved supply in the market.

Furthermore, weakening global demand for cocoa is also putting pressure on prices. BMI, a unit of Fitch Solutions, reported that global ground cocoa production, a measure of demand, fell 4.2% in the second quarter compared to the first.

Following the same trend as cocoa, sugar prices fell by nearly 2.32% at closing, marking the second consecutive session of weakness. The market reacted to positive signals regarding the harvest in India, the world's second-largest sugar producer. Sugarcane fields in India are expected to thrive in the coming period as the country received 9% more rainfall than average in July.

In addition, the prices of the two coffee commodities also decreased by 0.85% for Arabica and 0.84% for Robusta, respectively, due to the increase in the USD/BRL exchange rate, more active coffee exports from Brazil compared to last year, and a recovery in coffee inventories in Europe.

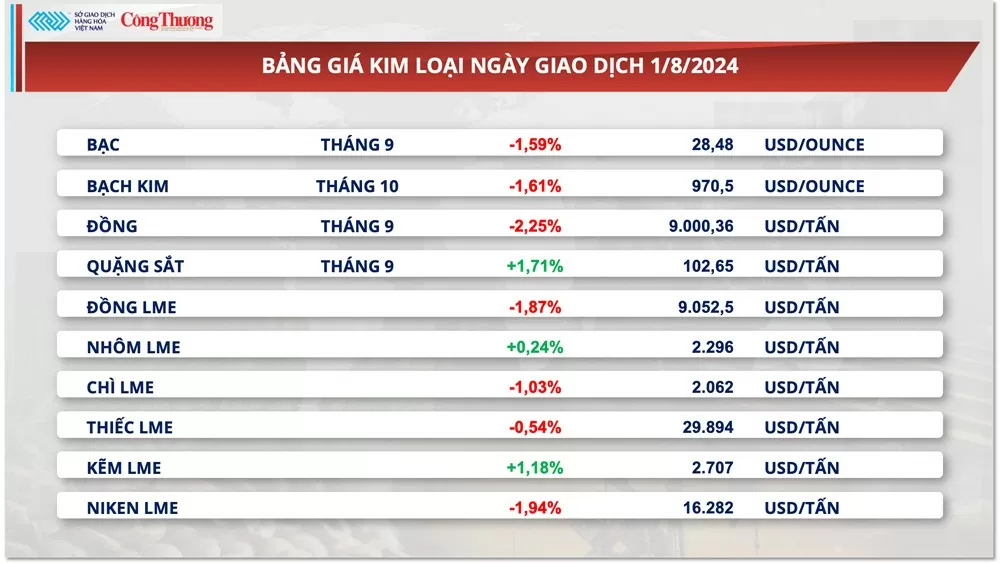

Metals market loses momentum, prices fall.

Following the previous positive trading session, red returned to the metal price chart as seven commodities reversed course and fell in price. For precious metals, despite macroeconomic support, silver and platinum prices reversed course and fell by more than 1%, closing at $28.48/ounce and $970.5/ounce respectively.

Yesterday, silver and platinum prices fell primarily due to profit-taking by investors after the sharp surge in the previous session. Towards the end of the session, prices of both commodities recovered as market sentiment remained optimistic about the Federal Reserve's interest rate outlook, especially after the July meeting announcement.

|

| Metal price list |

The dovish message from the Fed's recent meeting, combined with Chairman Jerome Powell's signal of a September interest rate cut, has led the market to increasingly believe that the Fed will cut interest rates at its September meeting. This optimism in the market is likely to continue, at least until the US Department of Labor releases its non- farm payrolls report tonight.

Regarding base metals, COMEX copper prices reversed course and fell by more than 2%, closing at $9,000 per ton, the lowest level in four months. The gloomy consumption outlook continued to put pressure on copper prices yesterday.

According to research firm Antaike, copper prices may fall in the second half of this year due to weak demand while supply grows steadily. Specifically, growth in refined copper demand in China, the world's largest copper consumer, is projected to slow to 2.5% in 2024, down from 5.3% last year, due to a weakening construction sector. Regarding supply, the global surplus of refined copper is expected to be 300,000 tonnes in 2024, higher than last year.

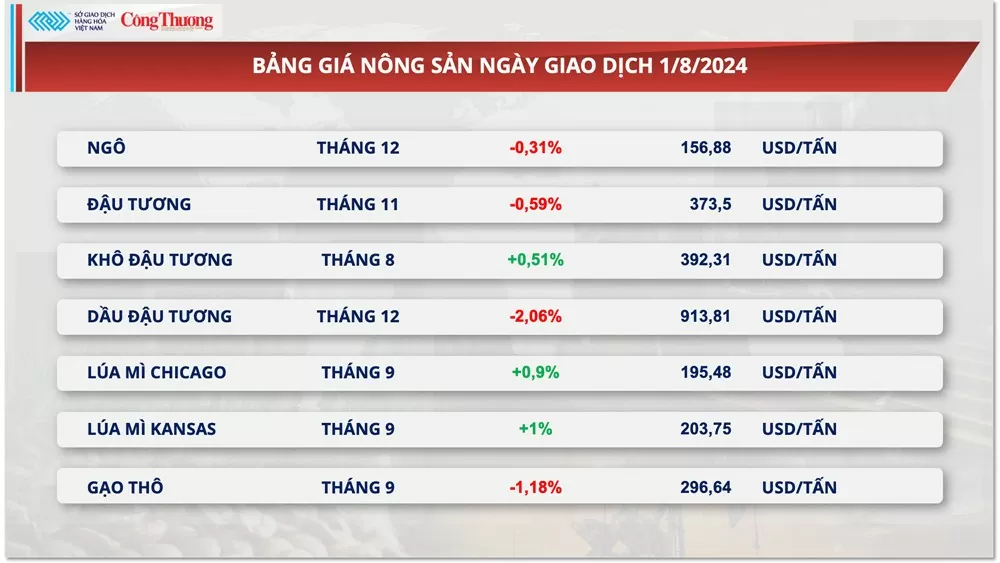

Prices of some other agricultural products

|

| Agricultural product price list |

|

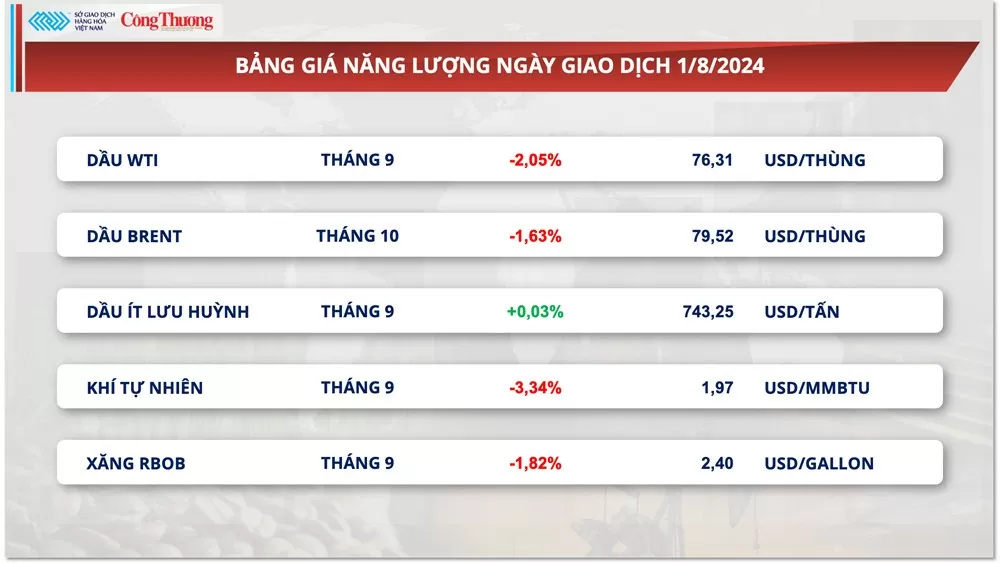

| Energy price list |

Source: https://congthuong.vn/thi-truong-hang-hoa-hom-nay-ngay-282024-mxv-index-chua-thoat-khoi-sac-do-336412.html

![[Image] Ho Chi Minh City simultaneously commences construction and breaks ground on 4 key projects.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2026/01/15/1768472922847_image.jpeg)

Comment (0)