| How to register for family deductions for dependents? Need to study family deduction tax when salary increases |

Starting July 1, 2024, workers will receive a new salary. With more than 20 years of working experience, Ms. Nguyen Thu Hoa (Hoang Mai, Hanoi ) is excited because with the new salary, she has more money to pay for her daily life.

|

| Rising wages lead to price pressure (Photo: Nguyen Hanh) |

However, the joy of a pay rise comes with many worries. Rising commodity prices, rising education costs, little by little, wages cannot keep up.

Another thing that she wondered about was that policies do not go together. For example, when salaries increase, personal income tax also increases, while the income tax rate and family deductions remain the same. This means that employees will have to use a portion of their additional income from salary increases to pay personal income tax.

Therefore, many workers like her want to have their family deductions and personal income tax adjusted to match the current prices of goods and people's spending.

Talking to reporters of Cong Thuong Newspaper on this issue, Associate Professor, Dr. Nguyen Thuong Lang - Senior Lecturer of the Institute of International Trade and Economics , National Economics University - assessed that increasing the basic salary from 1.8 million VND/month to 2.34 million VND/month according to Decree 73/2024/ND-CP dated June 30, 2024 is expected to help improve the lives of workers.

"However, in my view, every time the salary increases, the price increases, even before the salary increases. This is the reaction of the labor market affecting the price market. When the salary increases, the cost of salary in the cost of goods increases, pushing the price of goods up. The salary increase applies to the public sector, while the private sector and freelance workers are not given much attention, so they will have no choice but to increase prices to regain their equilibrium " - Associate Professor, Dr. Nguyen Thuong Lang expressed his opinion.

This salary increase, along with the adjustment of the Land Law, will lead to a new price level in the land market, real estate market, and labor market. This is inevitable.

However, we are only half way through the policy story. Because when wage regulations change, it certainly requires us to change personal income tax regulations as well.

Making a proposal on this, Associate Professor, Dr. Nguyen Thuong Lang said that it is necessary to reduce the personal income tax rate from 7 to 4 or 5, and at the same time consider widening the income gap in the tax rates to ensure higher regulation for high-income groups. It is possible to adjust the taxable income level to 30% higher than the old level, equivalent to the increase in wages. Harmonizing workers' income will help increase the total demand of the economy and consumer welfare.

“The regulation of 7 levels of personal income tax is too dense and confusing for people,” Associate Professor, Dr. Dinh Trong Thinh, an economic expert, commented, and said that the personal income tax should be reduced to only 3 levels, the low level for income groups under 30 million VND/month, the medium level from over 30 million VND/month to 100 million VND/month, and the high level from 100 million VND/month and above. Regarding tax rates, the low level should only be taxed at 2% instead of 5% as it is now, the medium level should have a tax rate of 10% and the high level should have a tax rate of 20%.

|

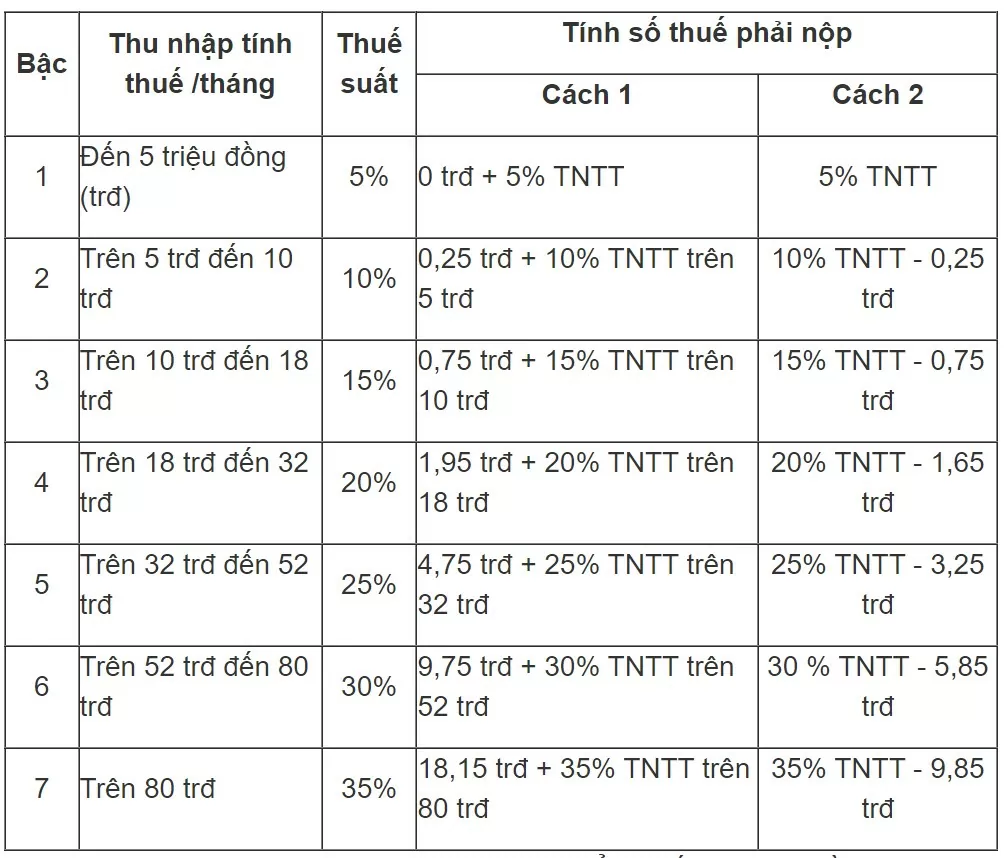

| According to Appendix No. 01/PL-TNCN issued with Circular 111/2013/TT-BTC, there are 7 levels of personal income tax calculation (based on monthly income). |

Another issue mentioned by Associate Professor, Dr. Dinh Trong Thinh is that, according to the provisions of the Personal Income Tax Law from 2020 to present, the family deduction for taxpayers is 11 million VND/month and for each dependent is 4.4 million VND/month. After more than 4 years of maintenance, this family deduction is considered outdated and no longer suitable for actual conditions. Meanwhile, the price of goods tends to increase, if the current family deduction continues to be applied, it will more or less affect the meaning and goal of increasing wages for workers.

Salary increase is something that all employees look forward to. However, if salary increase is not accompanied by raising the taxable income threshold and family deductions, it will put pressure on employees to pay income tax.

Therefore, in addition to increasing wages and curbing inflation, experts recommend that the Government should soon submit amendments to the Personal Income Tax Law by the end of 2024 and submit them to the National Assembly for approval in May 2025 to ensure synchronous adjustment of the legal system as well as benefits for workers. Only then will the purpose of increasing wages for workers truly be meaningful.

Source: https://congthuong.vn/muc-giam-tru-gia-canh-hien-nay-da-lac-hau-332786.html

![[Photo] Panorama of the Opening Ceremony of the 43rd Nhan Dan Newspaper National Table Tennis Championship](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/5e22950340b941309280448198bcf1d9)

![[Photo] Close-up of Tang Long Bridge, Thu Duc City after repairing rutting](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/086736d9d11f43198f5bd8d78df9bd41)

![[Photo] President Luong Cuong presents the 40-year Party membership badge to Chief of the Office of the President Le Khanh Hai](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/a22bc55dd7bf4a2ab7e3958d32282c15)

![[Photo] General Secretary To Lam attends the conference to review 10 years of implementing Directive No. 05 of the Politburo and evaluate the results of implementing Regulation No. 09 of the Central Public Security Party Committee.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/2f44458c655a4403acd7929dbbfa5039)

![[Photo] Prime Minister Pham Minh Chinh inspects the progress of the National Exhibition and Fair Center project](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/35189ac8807140d897ad2b7d2583fbae)

![[VIDEO] - Enhancing the value of Quang Nam OCOP products through trade connections](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/17/5be5b5fff1f14914986fad159097a677)

Comment (0)