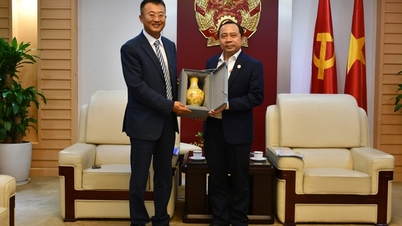

MSB has just decided to make a strategic investment in the Backbase Interactive Banking Platform with implementation support from SmartOSC - a provider of high-quality digital transformation solutions and Backbase's partner in Vietnam.

This event marks an important step in MSB's customer-centric modernization journey, contributing to digital transformation and delivering seamless experiences, driving financial innovation in Vietnam.

By adopting the Backbase interactive banking platform, MSB is consolidating its disparate applications into a single platform in a comprehensive and efficient manner. This strategic transformation enables MSB’s digital platform to provide a seamless digital banking experience, thereby enhancing customer engagement, simplifying product offerings, accelerating the development of new features, and reducing the cost of serving its existing 5.5 million customers.

The flexible architecture of the interactive banking platform enables MSB to develop a unique technology ecosystem that integrates easily with other platforms to drive greater synergies and innovation. MSB estimates that its regular digital customers will increase by 30%; and the number of new customers through digital channels will increase by 20% to 40% annually thanks to the provision of comprehensive digital experiences after the launch of this platform.

Mr. Nguyen Hoang Linh - General Director of MSB said: "We are improving MSB's digital platform by combining the strengths of Backbase's Interactive Banking Platform with internal solutions in a flexible and efficient way. By using this platform, we will consolidate, modernize and launch retail and corporate banking channels on a single platform within the next 12 months; at the same time, expand the differentiated customer experience. This investment aims to reduce MSB's cost-to-income ratio (CIR) by 8%, reduce service costs by 30% through a seamless journey from registration to use, increase customer satisfaction scores to 93 points for retail banking services and 85 points for corporate banking services."

“Rather than having to completely overhaul and start from scratch, the ‘adopt and build’ approach allows MSB to reinvent existing channels and applications, upskill their digital platforms, and empower internal talent to tap into cutting-edge efficiencies and innovations,” said Riddhi Dutta, Vice President, Asia, Backbase. “Backbase provides a strategic architecture that enhances the operations MSB is already doing, driving growth without disrupting existing work. This approach ensures business continuity while driving digital transformation in MSB’s own unique way.”

SmartOSC will be responsible for adapting and customizing the Backbase platform to suit MSB’s specific needs, ensuring it operates efficiently and meets expectations and regulations in Vietnam. With its experienced resources and extensive knowledge of the financial sector in Vietnam, SmartOSC is the partner that will help MSB achieve its goal of launching retail and corporate banking channels within one year.

Mr. Nguyen Chi Hieu - Chairman of SmartOSC's Board of Directors said: "Not only is it simply building a multi-layer, multi-channel architecture for the entire banking ecosystem, the project also has a vision of transforming the business model from traditional to comprehensive digital banking. The new platform will allow MSB to enhance the level of personalization; products, services and incentives are specially customized, suitable for the individual needs of each customer at each time. The highlight of the Backbase system that MSB applies is its outstanding flexibility, allowing for quick customization of products and services to promptly respond to changes in business operations."

With this investment, MSB aims to improve key performance indicators in line with its five-year strategic plan, including increasing the number of omnichannel customers by 10-20% through comprehensive digital journeys, increasing the number of digitally active customers by 20% for retail banking and 23% for corporate banking, ensuring 60% of retail customers and 40% of corporate customers are reached via digital channels. The adoption of the Interactive Banking Platform also helps MSB strengthen its goal of becoming the most customer-aware and profitable bank in Vietnam.

Le Thanh

Source: https://vietnamnet.vn/msb-trien-khai-nen-tang-ngan-hang-tuong-tac-backbase-2349173.html

![[Photo] General Secretary To Lam meets former British Prime Minister Tony Blair](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/30/1761821573624_tbt-tl1-jpg.webp)

![[Photo] Touching scene of thousands of people saving the embankment from the raging water](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/30/1761825173837_ndo_br_ho-de-3-jpg.webp)

![[Photo] The Third Patriotic Emulation Congress of the Central Internal Affairs Commission](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/30/1761831176178_dh-thi-dua-yeu-nuoc-5076-2710-jpg.webp)

![[Photo] General Secretary To Lam attends the Vietnam-UK High-Level Economic Conference](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/30/1761825773922_anh-1-3371-jpg.webp)

Comment (0)