Moody's also continues to give HDBank a B1 rating for long-term counterparty risk in local and foreign currencies, and maintains the long-term counterparty risk assessment at B1. The issuer credit rating in local and foreign currencies and short-term deposit credit rating in local and foreign currencies are all maintained at B1.

"The maintenance of HDBank's credit rating and baseline assessment (BCA) reflects the bank's stable financial capacity throughout the economic cycle, thanks to its diversified loan portfolio, strong profitability and consolidated capital base," the rating agency said in a statement.

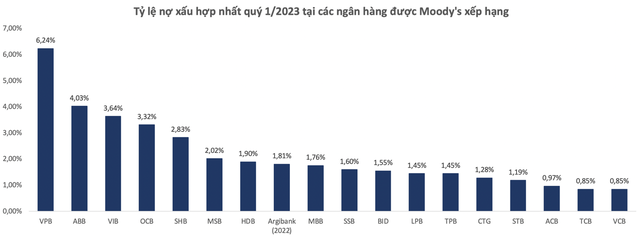

Specifically, according to Moody's assessment, HDBank's non-performing loan (NPL) ratio as of March 31, 2023 is 1.9%, lower than the average NPL ratio of 2.3% of Vietnamese banks currently being rated. Moody's also recognizing that prioritizing credit for individual customers and small and medium enterprises has help HDBank reduce portfolio concentration risks and limit the sudden increase in bad debt.

Commenting on profitability, Moody's said that in the first 3 months of 2023, HDBank's net profit to total assets (ROA) reached 2.4%, higher than the average ROA of only 1.7% of rated Vietnamese banks.

Regarding the credit rating outlook, Moody's expressed a cautious view on the possible impacts in case HDBank participates in restructuring a commercial bank and the growth rate of HDBank's outstanding loans in recent times.

According to Mr. Pham Quoc Thanh, General Director of HDBank, Moody's cautious stance is appropriate, but HDBank has also had strategies for this task. Regarding the growth rate of outstanding loans, HDBank is proud that the quality of the bank's assets is very good thanks to the strategy of lending for agricultural and rural development and chain financing.

In the first quarter of 2023, HDBank recorded better-than-expected business results, with pre-tax profit reaching VND2,743 billion. Notably, capital adequacy ratios, bad debt ratios, and profitability ratios continued to remain at good levels in the industry . HDBank's capital adequacy ratio (CAR) according to Basel II standards reached 12.5%, of which the Tier 1 capital adequacy ratio reached 10%.

The consolidated NPL ratio is 1.9% and the individual NPL ratio is 1.5%, lower than the industry-wide NPL ratio (about 2.9% by the end of February 2023). Operating expenses are effectively managed, with the cost/income ratio at 34.6%, a sharp improvement from 39.3% at the end of 2022.

Source link

![[Photo] Prime Minister Pham Minh Chinh attends the 5th National Press Awards Ceremony on preventing and combating corruption, waste and negativity](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/31/1761881588160_dsc-8359-jpg.webp)

![[Photo] Da Nang: Water gradually recedes, local authorities take advantage of the cleanup](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/31/1761897188943_ndo_tr_2-jpg.webp)

Comment (0)