|

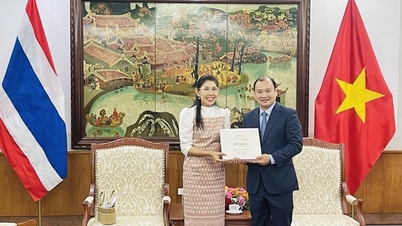

| Mr. Nguyen Xuan Hoa - Vice Chairman of the Board of Directors/General Director of PVI Holdings received honors for the achievements of the entire PVI system in exceeding the 2023 plan from the leaders of Talanx Group and HDI Global SE. |

PVI's steady growth in recent years is a clear testament to this model. Specifically, with training support from Talanx Group, PVI has completed the implementation of projects on compliance and risk management, becoming the first and only unit to apply the latest international financial reporting standard IFRS 17 in the insurance sector in Vietnam.

From this effective cooperation, PVI has made a big change internally in the past three years and put in place a clear profit plan, focusing on operational efficiency rather than revenue. PVI has taken advantage of the consensus among shareholders and effective management from abroad to improve performance and financial indicators.

Supported by Talanx’s subsidiary HDI Global SE HDI, PVI has piloted a lab model to leverage Talanx’s most effective products globally. With a well-trained staff and good compensation policies, PVI has improved its performance and become one of the leading insurance companies in Vietnam, maintaining a steady growth rate even during the difficult economic period due to the impact of the Covid-19 pandemic.

By the end of 2023, the entire PVI system had successfully completed the tasks and plans assigned by the Shareholders' Meeting with a total consolidated revenue of VND 16,083 billion, completing 119% of the plan. Consolidated pre-tax profit reached VND 1,253 billion, exceeding the plan by 26%, the expected dividend payout ratio was higher than the level set by the Shareholders' Meeting.

At the same time, the subsidiaries in the system maintained their results and position in the market, especially PVI Insurance, the core company of PVI, was upgraded by the financial credit rating organization AM Best (USA) from B++ (good) to A- (excellent) - the highest credit rating that Vietnamese companies have ever achieved, this is also the prerequisite for PVI to develop the international market.

The most obvious result of this financial ranking is that reinsurance premium revenue has grown more than 55% compared to the same period in 2023.

In 2024, in addition to consolidating its position as a leading unit in providing insurance solutions in Vietnam, PVI is on the path to becoming a professional Financial - Insurance institution with a strong position in the regional and world markets.

After 28 years of establishment and development, from an internal insurance company of Vietnam Oil and Gas Corporation, with a capital of only 22 billion VND, PVI has implemented a series of reforms to become a professional Finance - Insurance institution with a strong position in the Vietnamese and regional markets. PVI has achieved many pioneering milestones in the industry with support in governance and risk management from strategic shareholders HDI Global SE, PVN and the International Finance Corporation IFC.

Ahead of the state visit to Vietnam by German President Frank-Walter Steinmeier from January 23-24, a delegation of senior officials from Talanx Group and its subsidiary HDI Global SE (HDI) came to Vietnam to visit and work at the Vietnam National Oil and Gas Group - PetroVietnam (PVN) and PVI Holdings - one of the largest financial and insurance names in Vietnam.

On January 22, Mr. Torsten Leue - General Director of Talanx Group and Mr. Edgar Puls - General Director of HDI Global SE visited and worked at PVI Holdings Headquarters in PVI Building. At the meeting, senior leaders of Talanx Group and HDI Global SE expressed their recognition and congratulations for the achievements that the entire PVI system has achieved in 2023 in particular and in the 28-year development journey in general.

Headquartered in Hanover, Talanx Group is a leading German multinational financial services group, operating in the fields of insurance, reinsurance and asset management. As the third largest insurance group in Germany and one of the largest insurance groups in Europe in terms of premium income, Talanx plays an important role in the global financial markets.

HDI Global SE – a company 100% owned by Talanx Group – one of Germany’s leading industrial insurers, is currently a strategic shareholder and holds a controlling stake in PVI at 51.5%.

PetroVietnam is a pillar enterprise of the Vietnamese economy, with the task of managing and implementing oil and gas activities in Vietnam and investing abroad. After nearly half a century of development, PetroVietnam has made remarkable and comprehensive progress in both scale and depth, currently holding 35% of shares in PVI.

Source

![[Photo] Prime Minister Pham Minh Chinh chairs the regular Government meeting in April 2025](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/6/48eb0c5318914cc49ff858e81c924e65)

![[Photo] Sparkling lanterns to celebrate Vesak 2025](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/7/a6c8ff3bef964a2f90c6fab80ae197c3)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to review preparations for trade negotiations with the United States](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/6/1edc3a9bab5e48db95318758f019b99b)

![[Photo] Prime Minister Pham Minh Chinh receives Mr. Tomas Heidar, Chief Justice of the International Tribunal for the Law of the Sea (ITLOS)](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/6/58ba7a6773444e17bd987187397e4a1b)

Comment (0)