Digital transformation is the key to sustainable development

With the goal of becoming the most convenient digital finance company, Mcredit quickly grasped the digital transformation trend. With strong support in capital and management experience, Mcredit combined its internal strengths with a number of technology providers such as Amazon Web Services to develop new product modules, exploiting many features to meet and anticipate the increasingly diverse consumption trends of the market.

Since 2021, when the COVID-19 epidemic broke out in many localities across the country, Mcredit has made strong shifts from a traditional business model to online services.

Through the website, app and using solutions such as electronic customer authentication (eKYC), electronic contracts (eContract), optical character recognition (OCR), electronic signatures (eSignature) ... customers can still use Mcredit's services conveniently, saving time and costs, promptly meeting the need for contactless transactions to prevent disease.

In 2022, Mcredit mobilized more than 100 engineers, along with domestic and international information technology experts to build the Vay TikTak product - Fast Loan via App - based on the application of the latest technologies. Customers only need an electronic ID card, the entire process from the time the customer submits the application to disbursement takes only 6 minutes with an approval limit of up to 15 million VND.

In addition, Mcredit deploys a Call bots - Chat bots system with interactive scenarios, customer care is performed automatically to help resolve customer questions/problems quickly and effectively, and also helps Mcredit optimize resource costs.

In the digital transformation roadmap, in early 2023, Mcredit officially announced its cooperation with Vietnam National Payment Joint Stock Company (NAPAS) to develop a domestic credit card line that promises to bring many outstanding utilities and superior features to customers.

TikTak Loan product - Fast loan via App is in the Top 10 Digital financial products - Trusted services in Vietnam 2022.

The effectiveness of methodical and proper investment not only helps improve the quality of products and services, but is also demonstrated by growth figures. At the end of 2022, the rate of customers using Mcredit's digital channels reached 57.6%, exceeding the plan by 15%. Mcredit is also the only financial company that an international credit rating organization (Fitch Ratings) has assessed as having "positive prospects" in 2022.

Mr. Nguyen Manh Khang, Deputy General Director and Director of Information Technology of Mcredit, said that Mcredit focuses on building a comprehensive, unified platform revolving around customer experience. The company applies digital payment solutions and automates financial processes, thereby improving efficiency and reducing costs. With lower, faster, and cheaper operating costs, not only does Mcredit's operations run more smoothly, but it also reduces interest rates for customers.

D.CEO - CIO Mcredit Nguyen Manh Khang (right) at the World Financial Innovation Conference. (Photo: WFIS)

Focus on digitizing internal services

Not only applying 4.0 technology to financial products serving customers, Mcredit also focuses on digitizing internal processes and services to optimize and improve operational efficiency, create more effective thinking and working methods, and increase management capacity. A series of internal processes and services at Mcredit have been digitized such as Digital Office, Workplace, 360 internal services, etc.

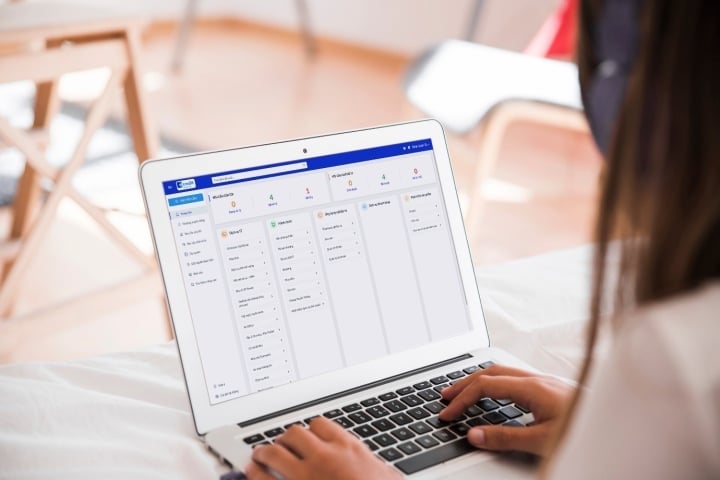

With 360 internal services, users can create proposals when needed, proactively monitor and be notified of the processing via email and receive results from service providers quickly. Managers can also authorize approvals.

With the internal social network “Workplace”, employees receive information and interact internally in a consistent and friendly experience. In addition to news, group creation, voting, commenting, etc., there are many new features to connect the community such as: "Send love", "Accumulate points to redeem gifts", play mini-games to win prizes, etc.

In addition, other internal processes and services are also in the process of continuing to be optimized based on digital thinking, with the goal of 100% of internal service processes being fully digitalized by 2026.

The 360 service system brings a convenient and time-optimized experience to users. (Photo: Mcredit)

Mcredit identifies digital transformation as an inevitable trend and an important strategic foundation. To truly become the most convenient digital finance company, in the coming time, Mcredit will continue to prioritize investment in digital transformation in both digital thinking in business administration and technology, system platforms, thereby enhancing connectivity, increasing customer experience convenience, serving customers better, in line with the spirit of "service" established in Mcredit's second 5-year strategy.

Bao Anh

Useful

Emotion

Creative

Unique

Wrath

Source

Comment (0)