"The trump card" that has brought profits to SSI over the years.

SSI Securities was established on December 27, 1999, and registered for business on April 5, 2000.

Initially, SSI had a charter capital of 6 billion VND, but in April 2023, the Securities Commission allowed the company to increase its charter capital to over 15,000 billion VND.

SSI's main activities include securities brokerage, securities trading, securities underwriting, securities custody, financial and investment consulting, followed by securities margin trading and derivatives trading.

However, looking back at SSI's capital increase history and financial reports over the years, it shows that SSI's securities brokerage activities have been sluggish and have yielded poor profits.

Meanwhile, margin lending has been outstanding, consistently bringing SSI profits of thousands of billions of dong.

According to the parent company's audited financial report for 2022, SSI's profit from lending and receivables reached over VND 1,800 billion, compared to over VND 1,570 billion in the same period of 2021. In 2020, SSI's profit from lending activities reached VND 525 billion.

It is clear that profits from margin lending and advance payments for customer sales have become a lucrative source of income for SSI over the years.

However, SSI's revenue from brokerage and other activities over the years has been rather lackluster, due to high operating costs.

Specifically, the securities brokerage operating expenses recorded in the parent company's financial statements in 2022 reached VND 1,336 billion. This was VND 1,494 billion in 2021 and VND 625 billion in 2020.

Is SSI violating the Law on Credit Institutions?

In addition to increasing bank loans and charter capital to provide margin loans, as previously reported by Lao Dong newspaper, SSI's deposits have continuously increased dramatically over the years.

I recall that at the end of April 2023, a number of investors at SSI Securities received notifications from their consultants about SSI's new term deposit product, similar to bank deposit operations.

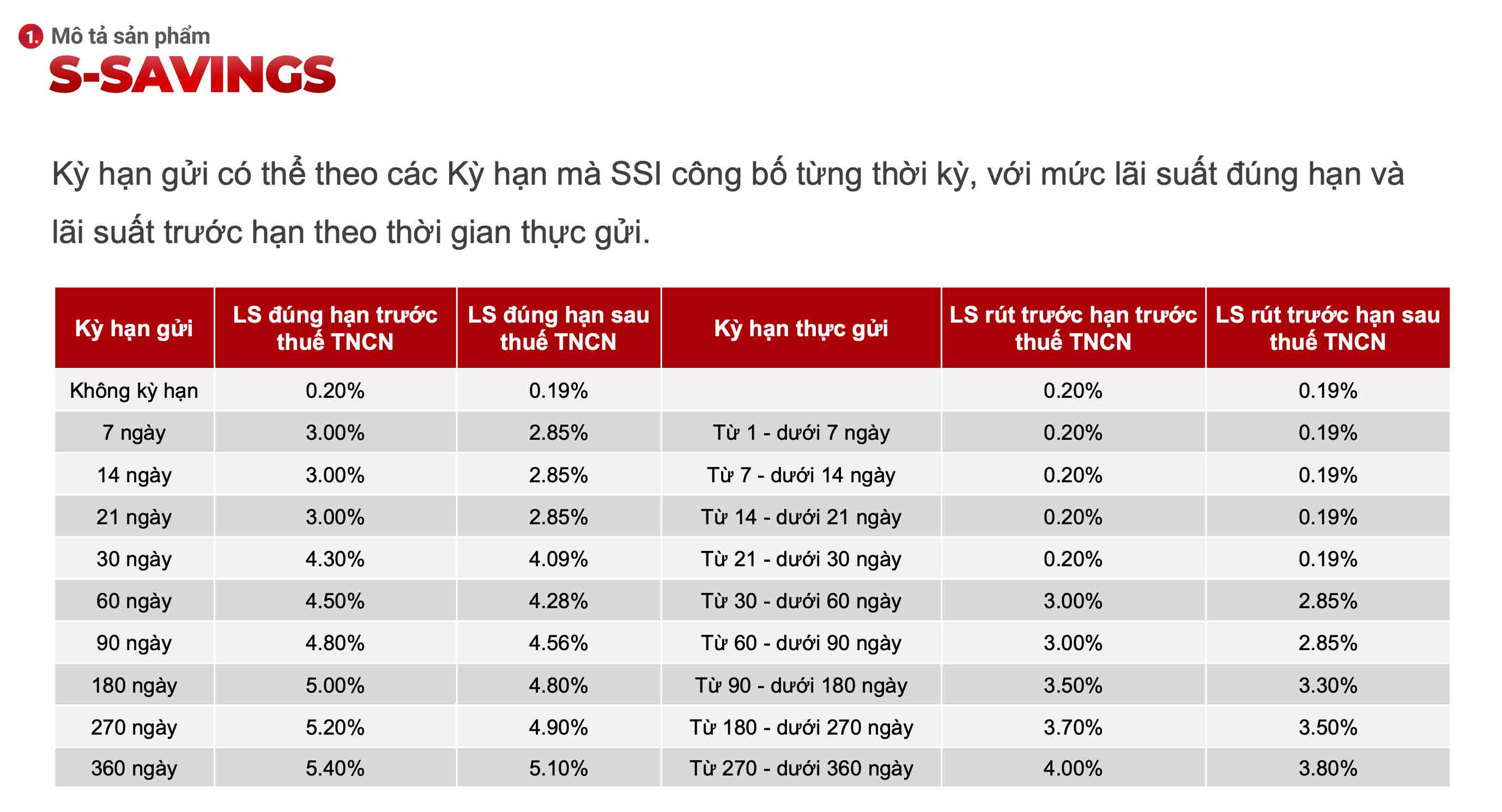

According to the promotional materials, SSI's deposit product, called S-savings, optimizes idle cash flow; offers flexible terms; and links to securities purchasing power... At this time, the stock market has low liquidity, while savings interest rates at banks have been adjusted downwards. Therefore, many investors have shown interest in this SSI product.

SSI believes that the development of the S-Savings product aims to maximize profits on available funds in a regular trading account or margin account within a specified period.

According to the advertisement, investors can achieve an interest rate of 4.5% per year for ultra-short terms of 1-2 weeks, and even 7-7.7% per year for terms shorter than 6 months.

Notably, Clause 2, Article 8 of the Law on Credit Institutions stipulates: "Individuals and organizations that are not credit institutions are strictly prohibited from engaging in banking activities, except for margin transactions and securities repurchase transactions by securities companies."

The ambiguity in SSI Securities Company's product introduction, S-Savings, raises questions about whether or not this unit is actually engaging in deposit mobilization.

In December 2023, the Securities Commission had to issue an ultimatum requiring securities companies not to engage in activities that mislead customers/investors into believing that the securities company has the function of accepting deposits, and to settle all transactions arising from this activity no later than June 30, 2024.

In cases where securities companies have already engaged in activities allowing customers/investors to receive/support interest rates on amounts not yet transacted, they must immediately cease any new agreements/signings and settle all transactions related to this activity no later than June 30, 2024.

The cumulative financial report for 2023 shows that customer deposits at SSI reached nearly VND 5,300 billion, of which deposits from investors for securities trading managed by the securities company amounted to VND 4,643 billion (accounting for 88%).

In 2022, 2021, and 2020, customer deposits recorded at the end of the year reached VND 4,715 billion, VND 7,246 billion, and VND 4,812 billion, respectively.

It is estimated that investor deposits for securities trading managed by securities companies account for 85-90% of the total deposits.

Meanwhile, according to Article 17 of Circular 121/2020/TT-BTC, securities companies must establish a system for managing client funds in a segregated manner.

Specifically, customers open accounts directly at commercial banks selected by the securities company to manage their securities trading funds.

In addition, securities companies are still allowed to open dedicated accounts at banks to manage customers' securities trading deposits.

This regulation aims to limit risks for investors, preventing capital misuse or liquidity problems.

Previously, in December 2022, the State Securities Commission issued a decision to impose an administrative fine of 200 million VND on SSI Securities Joint Stock Company for violations in the field of securities and securities market.

The reason for the fine is that the company violated lending restrictions by lending to customers through bond deposit and trading contracts, and securities subscription contracts.

Source

Comment (0)