A surprise appeared in the afternoon session. After being submerged in red for most of the trading session and approaching the 1,220 point mark, a series of large stocks recovered strongly at the end of the session.

Bottom-fishing demand surged at the end of the session, VN-Index recovered to 1,235 points

A surprise appeared in the afternoon session. After being submerged in red for most of the trading session and approaching the 1,220 point mark, a series of large stocks recovered strongly at the end of the session.

VN-Index ended last week at 1,230.48 points, down 1.92% with trading volume increasing by 24% and equal to 70% of the average. The market was negatively affected by the exchange rate factor when the DXY index measuring the strength of the greenback continuously anchored at the 108-109 point mark.

Entering the trading session on January 13, investor sentiment continued to be weighed down by the continued rise of the DXY index. Stock indices quickly fell below the reference level. After one hour of trading, the VN-Index showed signs of recovery but not significantly. Cash flow appeared cautious, the recovery was only focused on a few stocks, causing the market to lack diffusion. Immediately after that, selling pressure increased again and maintained until the end of the morning trading session, showing that investor sentiment was quite negative in the face of market instability.

In the afternoon session, a surprise appeared. The market was under strong selling pressure after the lunch break, but bottom-fishing demand appeared immediately after that, helping a series of stock groups recover. VN-Index closed above the reference level thanks to the very good recovery of some large-cap stocks with high leading factors. Market liquidity also improved compared to the session at the end of last week.

At the end of the trading session, VN-Index increased by 5.17 points (0.42%) to 1,235.65 points. HNX-Index increased by 0.13 points (0.06%) to 219.62 points. UPCoM-Index increased by 0.07 points (0.08%) to 92.22 points.

The whole market had 344 stocks increasing, while 313 stocks decreased and 923 stocks remained unchanged/no trading. The market still had 19 stocks hitting the ceiling and 13 stocks hitting the floor.

The focus of today's session must be CTG stock. Right from the beginning of the trading session, CTG faced great pressure and fell quite a bit since then, putting great pressure on investor sentiment. At one point, this stock fell by nearly 3.5% to 36,200 VND/share. However, the recovery of the general market at the end of the session helped CTG avoid a downward session. This stock quickly recovered and even closed in the green. At the end of the session, CTG increased by 0.53% to 37,700 VND/share.

|

| Top stocks impacting VN-Index |

The recovery at the end of the session focused heavily on stocks in the VN30 group, with 18 stocks increasing in price while only 7 stocks decreased. Codes such as SSI, TCB, HPG... received strong demand and recovered very well. These are stocks with high market factors and significantly impacted investor sentiment. At the end of the session, SSI increased by 1.9%, TCB increased by 1.7%, HPG increased by 1.4%. TCB was also the stock with the most positive impact on the VN-Index, contributing 0.68 points. VCB increased by 0.55% and also contributed 0.68 points.

On the other hand, although HVN is not in the VN30 portfolio, with a sharp decrease of nearly 3%, it is the stock with the most negative impact on the VN-Index, taking away 0.43 points. VPB, NVL, VIC, MSN... are all in red and have a negative impact on the VN-Index. NVL continued to plummet, falling 4.33% and moving away from its par value. NVL closed at only VND9,490/share.

The recovery was generally quite good in most stock groups. In the securities group, under the leadership of SSI, codes such as BVS, FTS, CTS, HCM... were also pulled above the reference level. The seafood group also recorded the recovery of VHC, ANV, FMC or ABT.

The public investment group continues to attract attention as it maintains a good growth momentum despite the general market's fluctuations. PLC increased by 4.2%, FCN increased by 2.5%, HHV increased by 2.2%...

|

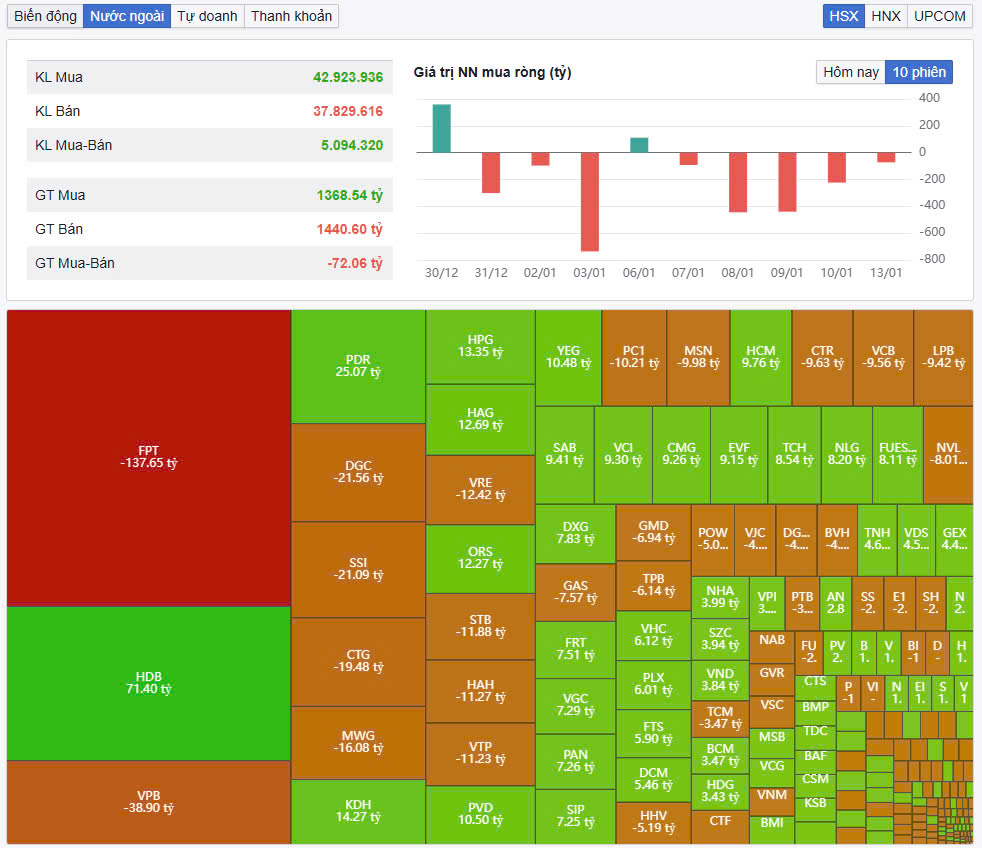

| Foreign investors extend net selling streak to 5th session |

Market liquidity continued to improve compared to the session at the end of last week. Total trading volume reached nearly 520 million shares, equivalent to a trading value of VND12,119 billion (up 8%), of which negotiated transactions contributed VND2,831 billion. Trading values on HNX and UPCoM reached VND837 billion and VND613 billion, respectively.FPT topped the list of transactions in the entire market with VND511 billion. HPG, CTG and HDB all traded over VND300 billion in today's session.

Foreign investors net sold about 78 billion VND in the whole market. Of which, FPT was still strongly net sold by foreign investors with 137 billion VND. VPB was behind with a net selling value of 39 billion VND. In the opposite direction, HDB was the strongest net bought with 71 billion VND. PDR was also net bought 25 billion VND.

Source: https://baodautu.vn/luc-cau-bat-day-tang-vot-cuoi-phien-vn-index-hoi-phuc-len-1235-diem-d240493.html

Comment (0)