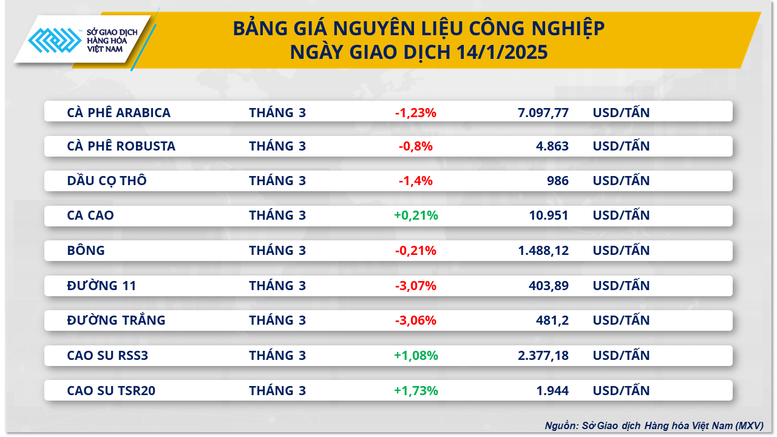

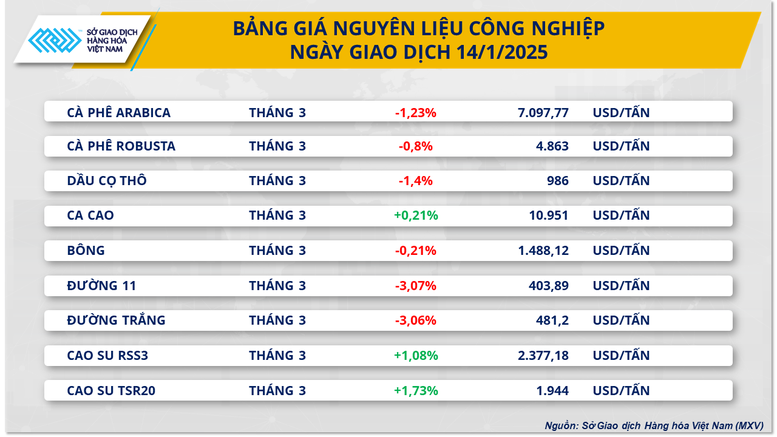

According to the Vietnam Commodity Exchange (MXV), on January 14th, the industrial raw materials group faced the strongest pressure, with prices falling in 6 out of 9 items, including Robusta coffee, which extended its decline for the third consecutive session.

Commodity market in the industrial raw materials sector

For industrial raw materials, yesterday's trading session saw a significant drop in prices. Specifically, in the coffee market, Arabica prices reversed course and fell by more than 1% after two consecutive days of gains. Robusta coffee prices decreased by 0.8% to $4,863 per ton, reaching their lowest level since the first week of December 2024. Both coffee prices continued to face pressure as the market reacted to positive news regarding supply.

Recently, according to the General Department of Vietnam Customs, in December 2024, the total volume of Vietnamese coffee exports reached 127,655 tons, a sharp increase of 102.6%; the total export value also increased by more than 95%, equivalent to over 686.5 million USD. This information has contributed to putting pressure on Robusta coffee prices since the end of last week.

Furthermore, according to Embrapa Coffee, in the year from October 2023 to September 2024, total world coffee production reached 178 million bags, equivalent to a 5.82% increase compared to the same period of the previous year. In addition, production in Colombia, the world's second-largest producer of Arabica coffee, reached 13.9 million 60kg bags in 2024, equivalent to a 23% increase compared to 2023 and 300,000 bags higher than the previous forecast. Regarding exports, in 2024, Colombia exported 12.3 million 60kg bags of coffee, a 16% increase compared to the same period of the previous year. In December alone, FNC reported that Colombia's coffee production reached 1.79 million 60kg bags, a 47% increase compared to the same period of the previous year. Exports reached 1.28 million 60kg bags, a 20% increase compared to the same period last year.

In other news, November sugar futures lost more than 3% of their value, falling to $403.9 per ton, marking the sharpest decline in a month. Positive supply signals were the main reason for the downward pressure on prices.

Commodity markets in the energy sector

In the energy market , according to MXV, the market closed yesterday with 3 out of 5 commodities in the group recording price decreases, ending the previous upward trend. Crude oil prices reversed course and fell, ending a streak of 3 consecutive days of increases. Specifically, WTI crude oil prices fell 1.67% to $77.5 per barrel, while Brent crude oil prices fell 1.35% to below $80 per barrel.

Profit-taking by investors put significant pressure on oil prices yesterday, after news of tighter sanctions on Russia's oil and gas industry last weekend raised concerns about global supply disruptions and pushed prices into overbought territory.

Besides profit-taking pressure, the gloomy January Short-Term Energy Outlook (STEO) report from the U.S. Energy Information Administration (EIA) also contributed to the weakening oil prices. According to the EIA, oil prices will remain under pressure for the next two years as global production growth outpaces overall demand. EIA analysts predict a surplus in the crude oil market this year due to significantly slower demand growth in the world's two largest economies , the U.S. and China, in 2024.

Furthermore, the positive outlook for security stability in the Middle East is also putting pressure on oil prices. According to Qatar, a ceasefire agreement between Hamas and Israel is very close to being signed after a long period of negotiations. This helps reduce the risk of disruption to crude oil supplies from the region.

The fact that US oil inventories fell less than market expectations last week also put downward pressure on oil prices yesterday.

Source: https://baodaknong.vn/thi-truong-hang-hoa-15-1-2025-luc-ban-quay-lai-chiem-uu-the-240338.html

![[Photo] Prime Minister Pham Minh Chinh receives the Director General of TASS News Agency (Russian Federation)](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2026/02/25/1772024599891_dsc-8041-jpg.webp)

![[Photo] Prime Minister Pham Minh Chinh presides over the meeting of the Steering Committee for the Development of Science, Technology, Innovation, Digital Transformation and Project 06.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2026/02/25/1772024613089_1772024091685-jpg.webp)

![[Photo] Lung Phinh is covered in white plum blossoms.](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2026/02/25/1772036291497_tl-z7563533595318-d0f6815e01d4b292632a5f65d005af7d-8745-jpg.webp)

Comment (0)