Loc Phat Vietnam Commercial Joint Stock Bank ( LPBank - HoSE: LPB) has just announced the Resolution of the Board of Directors on supplementing and updating documents for the 2024 Extraordinary General Meeting of Shareholders.

Develop, LPBank plans to submit to the General Meeting of Shareholders for approval of capital contribution and share purchase. specifically, in the information submission, in addition to the central role of banking business activities, investing in listed stocks will help the bank diversify investment channels and optimize shareholder capital.

Through assessment, the Board of Directors found that FPT Corporation (HoSE: FPT) shares have the potential to bring attractive profit margins based on the fact that FPT is a leading technology company in Vietnam, has a sustainable business foundation with high growth rates maintained over a long period of time.

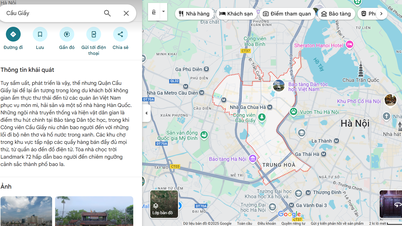

FPT stock price movements over the past year.

The company is moving higher up the technology value chain by focusing on Al, Cloud, Big Data and specialized areas with great growth potential.

In addition, FPT stock is one of the few stocks that has maintained a steady increase in price over the years and paid dividends regularly. Currently, FPT stock has good liquidity and is a component of the VN30 index.

On that basis, LPBank plans to invest a maximum of 5% of FPT's charter capital at the time of implementation and execution of the share purchase transaction, and the total investment value shall not exceed the permitted investment ratio as prescribed by law.

The expected time for implementing the share purchase is in 2024, 2025 or at a suitable time after approval from competent state agencies, legal regulations and actual situation.

The proposal also requests the General Meeting of Shareholders to authorize the Board of Directors to fully decide/approve, perform/organize the implementation of all tasks/actions, take all necessary steps, sign documents and other materials,... or resolve arising matters related to LPBank's investment in FPT.

In the market, in the afternoon session of September 19, FPT shares were traded at 135,200 VND/share with a trading volume of nearly 4.8 million units. Since the beginning of the year, FPT shares have increased by 59.12%, from the reference price of 84,967 VND/share to 135,200 VND/share, with an average trading volume of 3.6 million units/day.

In addition to the above additional content, at the extraordinary General Meeting of Shareholders on September 22, LPBank's Board of Directors will also consider submitting to the General Meeting of Shareholders for approval an adjustment to the plan to increase charter capital in 2024 through the form of issuing shares to pay dividends.

The source of money will be taken from undistributed profit after tax in 2023 with an expected dividend payout ratio of 16.8%. If this plan is approved, the bank's charter capital will increase from VND25,576 billion to more than VND29,873 billion.

LPBank said the increase in charter capital aims to improve financial capacity, increase the bank's competitiveness in the process of international economic integration, and maximize benefits for shareholders, customers and partners.

Another notable content at the extraordinary shareholders' meeting this September is that the bank will submit to shareholders for approval the election of additional members to the Board of Directors after being approved by the State Bank.

created, adding new members to the Board of Directors is a step to help the bank strengthen its supervisory capacity and further improve its governance capacity according to the Law on Credit Institutions 2024, which comes into effect.

Source: https://www.nguoiduatin.vn/lpbank-muon-mua-5-von-co-phan-cua-fpt-204240919143221988.htm

Comment (0)