Series of tycoons "fall off horses"

China’s property market has been facing prolonged turmoil. Private property developer Country Garden recently defaulted on its US dollar bonds, underscoring the company’s plight as China’s property sector shows no signs of recovery.

Country Garden missed a $15.4 million interest payment on its USD bonds at the end of a 30-day grace period, after missing the original payment deadline of Sept. 17. Country Garden’s failure to pay interest during the grace period that ended last week is considered an event of default, according to a notice sent to bondholders.

The default was all but confirmed after the company said last week it expected it would be unable to meet all its foreign debt obligations on time. Country Garden may be planning one of China’s biggest-ever debt restructurings.

Country Garden has also seen sales slump recently and thousands of development projects stalled across China, underscoring Beijing’s struggles to cope with the prolonged crisis that has rocked the world’s second-largest economy.

Sales in the first six months of the year fell 44% from the same period last year. The company's shares have also fallen about 70% this year.

The group is expected to join dozens of other developers in pursuing debt restructuring overseas, but its large debts, including loans from banks and investment firms, remain uncertain.

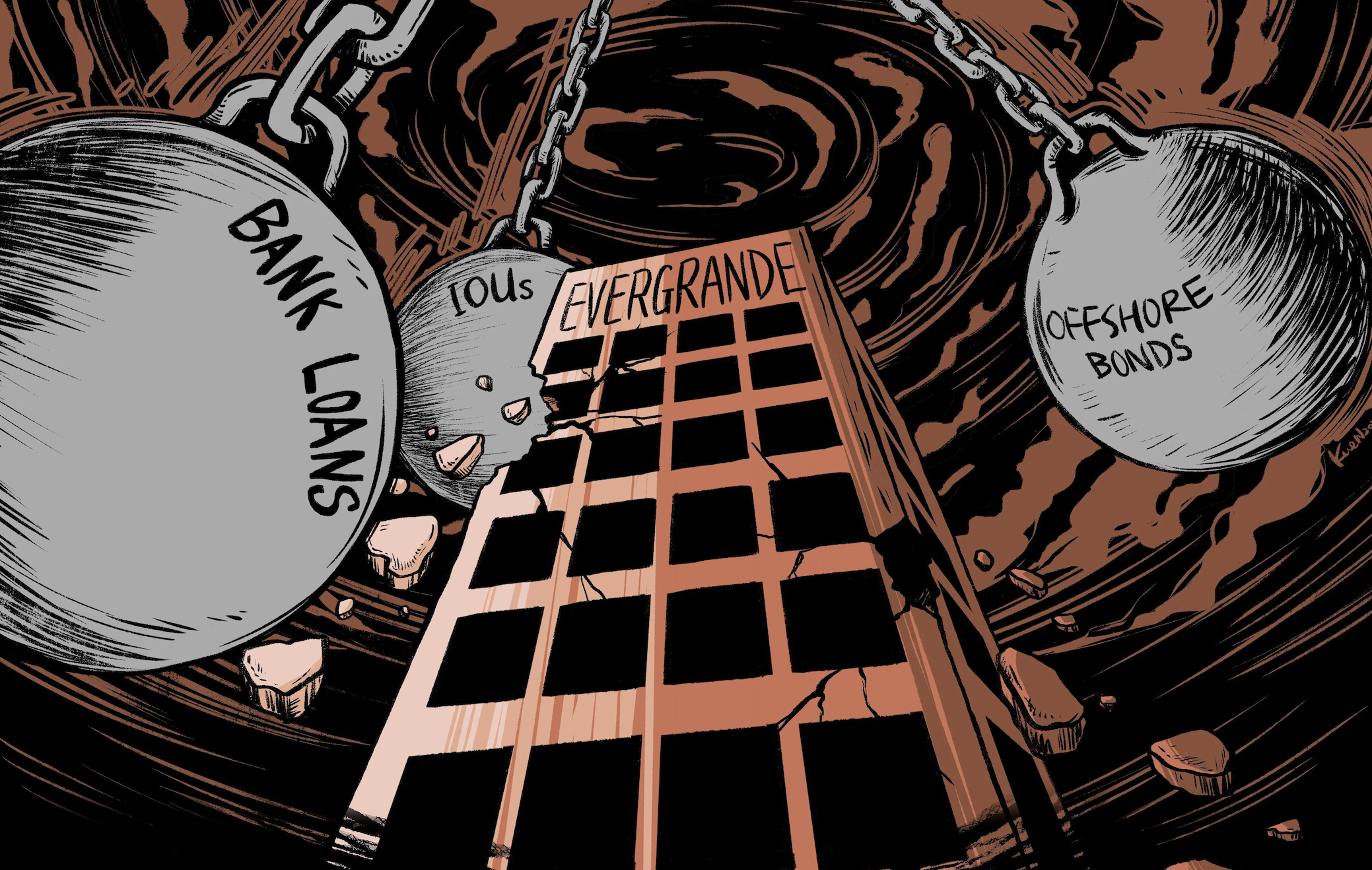

Evergrande is the world's most indebted real estate developer. (Photo: SCMP).

Two years ago, the default of another developer, Evergrande, also raised concerns about China’s real estate situation. Once China’s leading real estate company, Evergrande is now known as the world’s most indebted company, with debts of more than $300 billion.

Evergrande is still struggling to complete its long-term restructuring plan, which was derailed recently when it failed to refinance its foreign debt.

According to the Bloomberg Billionaires Index , the assets of Mr. Xu Ka-yin, founder of Evergrande Group, are now only 979 million USD. The reason is that the company's shares have decreased 86% since trading resumed at the end of August.

The Evergrande chairman was China’s second-richest man in 2017, with a fortune of $42 billion. His fortune has since fallen by 98%. He is also under investigation by Chinese authorities for suspected illegal activities.

He had to sell his company shares and personal assets, including artwork and calligraphy, when the Chinese government refused to bail out Evergrande. Last year, he is said to have sold another villa worth more than $200 million in London (UK).

The fate of the company depends on a Hong Kong court hearing on a creditor’s request for liquidation. If the court rules in favor of the request, Evergrande will face more difficulties as it tries to complete a restructuring plan to repay its creditors.

Many businesses may be dragged into the "quagmire"

Gary Ng, senior economist at Natixis bank, said other real estate businesses were at risk of being dragged into the "quagmire".

Chinese property developers have for years relied on issuing bonds onshore and offshore to fund reinvestment. Real estate companies often sell apartments before they are completed and continue to use the money to invest in new developments.

But as policymakers sought to curb new lending with a strict “three red lines” policy in 2020, the old model for property developers collapsed.

More than 25 of the largest real estate companies in 2020 are now bankrupt (Photo: SCMP).

In 2020, most of China's top 10 real estate groups also faced sharp declines in sales amid declining consumer confidence, adding to concerns about developers' liquidity.

Experts say Chinese people are showing signs of preferring to buy homes from state-backed developers because they are less likely to go bankrupt.

Trying to correct course, Chinese policymakers announced support measures for the real estate sector last November.

Banks have also opened new credit lines to higher-quality developers, including Country Garden. But they have so far failed to stem the liquidity crunch.

More than 25 of the largest developers of 2020 have now defaulted. Chinese developers have defaulted on about $115 billion of the $175 billion in outstanding dollar bonds from 2021, according to data compiled by Bloomberg. A large number of domestic bank loans also face restructuring or reinvestment.

As developers reel, Beijing and local governments have so far stressed the need to complete unfinished housing projects.

While there is no comprehensive data on the number of uncompleted development projects, available data suggests that the total number of unfinished projects has decreased compared to 2021 but remains high.

Policy dilemma

This year, the Chinese government has sought to provide more support to buyers. Banks cut interest rates to cover half of all mortgages in September. Some city governments lifted restrictions on home purchases in July.

The real estate crisis has yet to cause any major fluctuations in home prices, experts say. New home prices, a key gauge of China’s property market, have fallen in some major cities but are still rising in others.

“Many policies are aimed at stabilizing the domestic market and providing developers with enough liquidity to complete existing apartments and reduce debt. But when there are so many targets, making sure everything is okay is a difficult task,” an expert from Natixis bank emphasized to the Financial Times .

Analysts say China has introduced a number of policies to revive the property market, but those policies have not been effective as they struggle to strike a balance between providing enough liquidity support and trying to curb speculation in the sector.

According to experts, the crisis in the real estate sector has not yet caused any strong fluctuations in house prices (Photo: CNBC).

"China has been struggling to strike a balance in its real estate policy over the past two years. They are still struggling to find a way to resolve the property crisis. However, so far, the measures they have taken have not been enough to reduce the credit risks associated with large real estate groups," Larry Hu, chief economist at Macquarie University, told the Financial Times .

The real estate crisis is a difficult problem for China because construction and real estate are big drivers of the country's growth. Real estate and related industries contribute about a quarter of China's GDP.

Rory Green, an expert at TS Lombard bank, said Chinese policymakers appeared to have understood the important need to cut leverage two years ago.

“But the mistake is not to have a plan for how they are going to change it and prepare for the changes that may come in the sector. It is very difficult to suddenly change the growth model and try to reallocate resources away from real estate, especially when it has such a large asset linkage with households and local governments in the financial system,” Mr Green explained.

Source

![[Photo] Prime Minister Pham Minh Chinh chairs conference on anti-smuggling, trade fraud, and counterfeit goods](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/14/6cd67667e99e4248b7d4f587fd21e37c)

Comment (0)