Steel stocks were sold heavily, banking stocks "carried" the market on August 22

Banking stocks such as SSB, TCB, CTG... all increased and contributed to supporting the general market. Meanwhile, red dominated. VN-Index closed at 1,282.78 points, down 1.27 points (-0.1%) compared to the previous session.

The green color in the market continued to extend after the increasing session on August 21.

Previously, the Center for Industry and Trade Information forecast that the CPI in August 2024 could increase by about 0.2% compared to the previous month. Inflationary pressure in the last months of the year may come from the State adjusting the basic salary, increasing the price of medical services, education, and electricity prices according to the roadmap. However, in the remaining months of 2024, factors that slow down the growth rate of the price index such as major economies keeping interest rates unchanged or slowly lowering them, and the world economy continuing to stagnate will make it difficult for world commodity prices to increase sharply.

International macro information was also quite positive when the minutes of the US Federal Reserve (Fed) meeting in July showed that monetary policy makers believed that the possibility of cutting interest rates at the September meeting had increased. Most members believed that easing monetary policy would be appropriate if economic data continued to develop in line with forecasts.

However, the excitement did not last long. Instead, profit-taking pressure increased, causing many stock groups to decline, pushing the indices below the reference level. Trading on the market continued to fluctuate with alternating increases and decreases.

Steel stocks had relatively negative fluctuations in today's session, in which HPG decreased by more than 1.5% and was the factor with the most negative impact on VN-Index when it took away 0.62 points from this index. Besides HPG, other steel stocks such as NKG, HSG... were also in red. NKG decreased by 1.38%, HSG decreased by 1.43%...

Along with that, other large stocks such as VNM, VCB, MBB or GVR also decreased in price and put great pressure on VN-Index. VNM decreased by 1.46% and took away 0.56 points. Two bank stocks that increased strongly yesterday, VCB and MBB, now adjusted down again by 0.4% and 1.4%.

|

| SSB, TCB and CTG are the locomotives pulling VN-Index up. |

On the other hand, other bank stocks such as TCB, SSB, CTG, VIB and TPB all increased in price and were the driving force to help VN30-Index maintain its green color as well as support VN-Index. Of which, SSB increased by 4.85%, TCB increased by 1.59%, CTG continued to increase by 1.17%. SSB contributed 0.64 points to VN-Index. TCB and CTG contributed 0.6 points and 0.52 points respectively.

In addition, several other large stocks such as VRE, MSN or FPT also maintained positive growth momentum in today's session.

Real estate stocks were strongly differentiated, in which NVL and PDR attracted attention in the real estate group, in which NVL increased by 2.38% and PDR increased by 1.82%. Recently, the Department of Construction of Dong Nai province issued a document on the conditions of future real estate to be put into business for some low-rise houses in part of area 2, Aqua Waterfront City Urban Area Project of Da Lat Valley Real Estate Company Limited - a subsidiary of Novaland. Accordingly, the Department of Construction confirmed that 98 future houses in part of area 2, Aqua Waterfront City Urban Area Project are eligible to be put into business according to regulations.

However, many other real estate stocks adjusted, NTL decreased by 1.4%, QCG decreased by 3%, KHG decreased by 0.91%, KDH decreased by 0.3%... Securities stocks received good demand at the end of the session. Of which, VDS increased by 2.56%, HCM increased by 1.8%, MBS increased by 1%...

At the end of the trading session, VN-Index closed at 1,282.78 points, down 1.27 points (-0.1%) compared to the previous session. The entire floor had 171 stocks increasing, 228 stocks decreasing and 87 stocks remaining unchanged. HNX-Index increased 0.05 points (0.02%) to 238.47 points. The entire floor had 67 stocks increasing, 82 stocks decreasing and 62 stocks remaining unchanged. UPCoM-Index increased 0.01 points (0.01%) to 94.49 points.

|

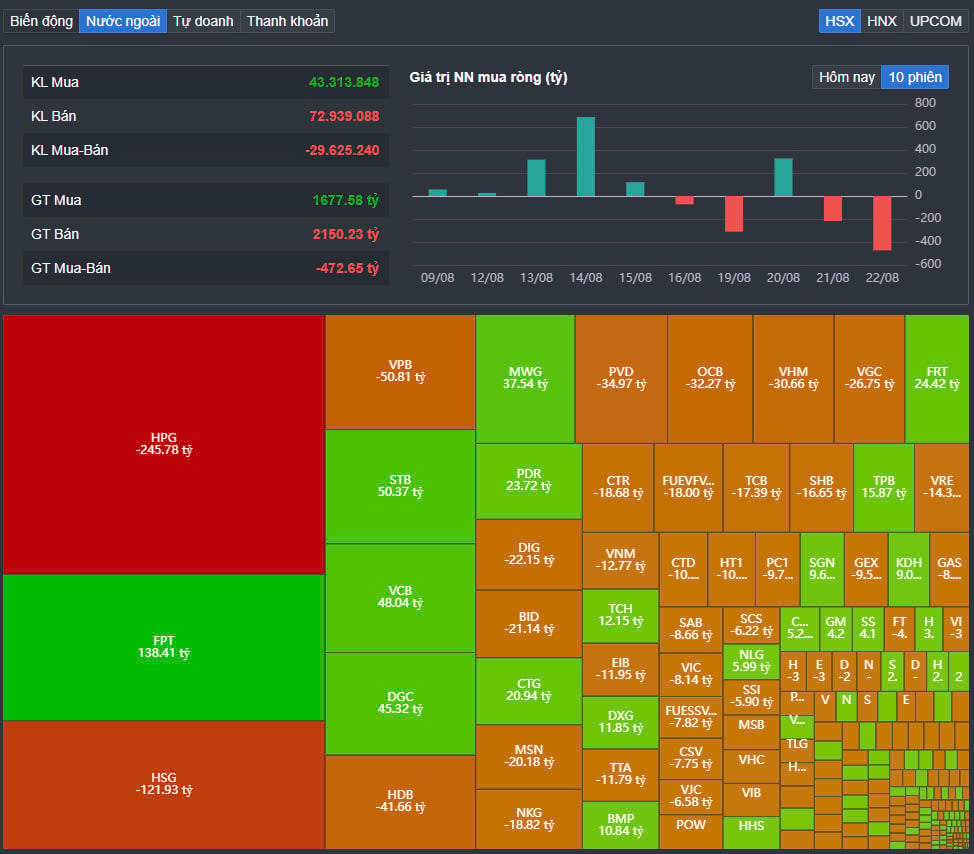

| Foreign investors had the second consecutive net selling session. |

Total trading volume on HoSE reached 687 million shares (down about 18% compared to the previous session), equivalent to a trading value of VND15,607 billion. Trading value on HNX and UPCoM reached VND1,196 billion and VND535 billion, respectively.

Foreign investors continued to net sell about 470 billion VND on HoSE, in which, this capital flow net sold the most HPG code with a value of 146 billion VND. HSG and VPB were net sold 122 billion VND and 51 billion VND respectively. In the opposite direction, FPT was net bought the most with a value of 138 billion VND. STB and VCB were net bought 50 billion VND and 48 billion VND respectively.

Source: https://baodautu.vn/loat-co-phieu-thep-bi-ban-manh-dong-ngan-hang-ganh-thi-truong-phien-228-d223073.html

![[Photo] Prime Minister Pham Minh Chinh works with the Standing Committee of Thai Binh Provincial Party Committee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/f514ab990c544e05a446f77bba59c7d1)

![[Photo] Prime Minister Pham Minh Chinh receives Swedish Minister of International Development Cooperation and Foreign Trade](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/ae50d0bb57584fd1bbe1cd77d9ad6d97)

![[Photo] Prime Minister Pham Minh Chinh starts construction of vital highway through Thai Binh and Nam Dinh](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/52d98584ccea4c8dbf7c7f7484433af5)

Comment (0)