In the next 12 months, there will be about VND109,000 billion of bonds maturing in the residential real estate sector. Of this, an estimated VND30,000 billion of bonds are at risk of late principal repayment.

Concerns about tens of thousands of billions of dong in bonds at risk of late principal repayment

In the next 12 months, there will be about VND109,000 billion of bonds maturing in the residential real estate sector. Of this, an estimated VND30,000 billion of bonds are at risk of late principal repayment.

11% of October bond issuers have low credit rating

VIS Rating's October 2024 corporate bond market report said that the amount of newly issued corporate bonds in October 2024 reached VND 28,100 billion, lower than the VND 56,200 billion newly issued in September 2024. Commercial banks issued a total of VND 15,800 billion, continuing to account for the majority of new issuances.

Of the bonds issued by banks in October 2024, 20% are subordinated bonds eligible for Tier 2 capital calculation, issued by Vietnam Joint Stock Commercial Bank for Industry and Trade, Tien Phong Commercial Joint Stock Bank, Loc Phat Vietnam Commercial Joint Stock Bank and Bac A Commercial Joint Stock Bank. These Tier 2 capital bonds have maturities ranging from 7 to 15 years and interest rates ranging from 6.5% to 7.9% in the first year. The other bonds are unsecured bonds with maturities of 3 years and fixed interest rates ranging from 5.0% to 6.0%.

October 2024 recorded one issuer in the infrastructure industry group and one issuer in the banking group issuing to the public with a total value of VND 1,800 billion.

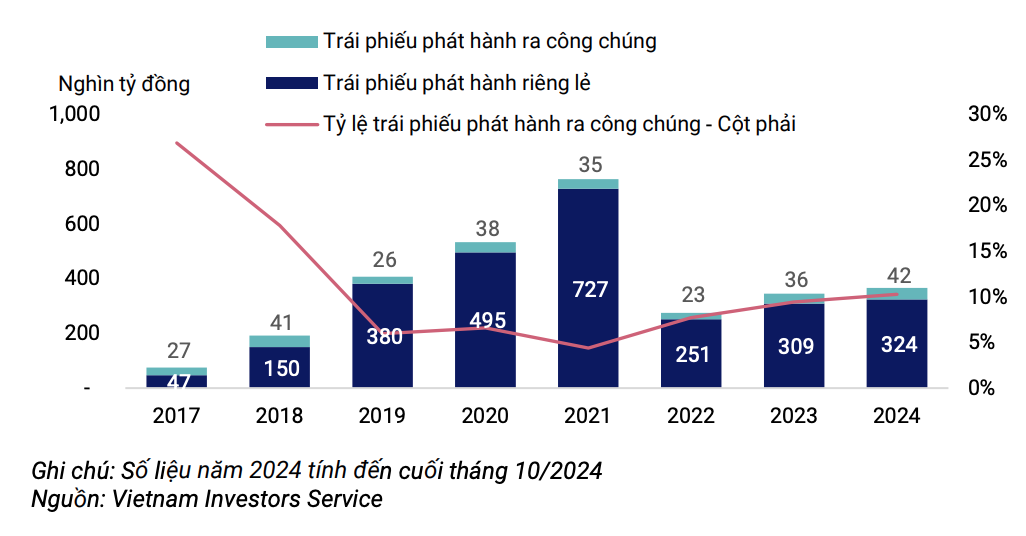

In total, the amount of new bonds issued in the first 10 months of 2024 reached VND366,000 billion, higher than the total issuance in 2023. Of which, 11.5% of the total amount of newly issued bonds came from public issuances.

|

Private/public bond issuance volume by year. |

In October, the number of issuers with credit profiles of “below average” or weaker accounted for 11%, an improvement from the previous month (24%). Issuers with weak credit profiles are in the Non-Financial group. These organizations have Leverage and Debt Service Ratio at “Extremely Weak”, reflecting that their business operations do not generate enough income and cash flow to repay principal and interest.

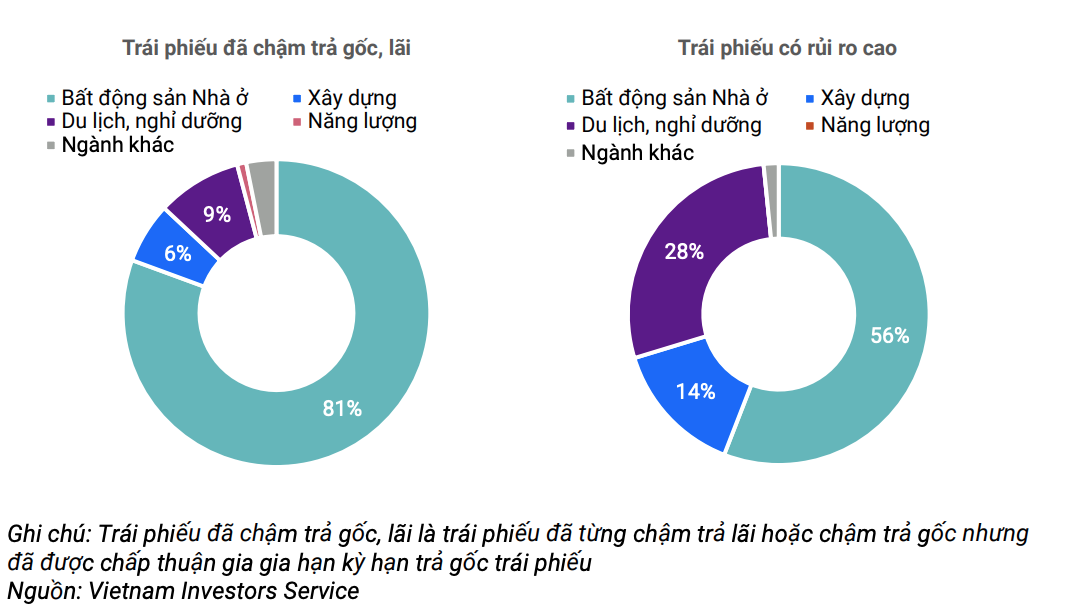

Since the beginning of the year, 56% of issuers with weak credit profiles have been in the real estate, housing and construction sectors. More than half of issuers with weak credit profiles are newly established companies without core business activities, VIS Rating said.

According to the credit rating agency, several financial institutions issuing bonds in 2024 have weak credit profiles. This group includes small banks, finance companies and securities companies, with Solvency and Liquidity both at “Below Average” or lower.

It is estimated that about 30,000 billion VND of bonds are at risk of late principal repayment.

VIS Rating recorded that no new overdue bonds were announced last month, the total overdue rate of the market by the end of October 2024 was 14.9%, unchanged from the previous month.

There were 13 issuers that paid part or all of the outstanding principal of overdue bonds with a total value of VND 269 billion in October 2024. The rate of overdue principal recovery increased by 0.1% to 21.5%.

Some indicators improved in the primary market. In the secondary market, corporate bond turnover in October increased to the highest level since July 2023. Of which, about 75% of the transaction value belonged to the Banking and Real Estate groups.

In the first 10 months of 2024, the total value of newly issued overdue bonds was VND 16,600 billion, VND 137,600 billion lower than the same period last year. The cumulative overdue rate at the end of October 2024 was stable at 14.9%. The Energy group had the highest cumulative overdue rate at 45%, while the residential real estate group accounted for 60% of the total overdue bonds.

VIS Rating said that 14 out of 42 bonds maturing in November 2024 are still at high risk of not being able to repay principal on time. Most of these bonds have been late in paying interest on previous bonds. 33% of bonds maturing in November 2024 are at risk of late principal payment, higher than the rate of 10.5% of bonds late in paying principal in the first 10 months of 2024.

In the next 12 months, there will be about VND109,000 billion of bonds maturing in the residential real estate sector, accounting for nearly half of the total value of maturing bonds. Of this, an estimated VND30,000 billion of bonds are at risk of late principal repayment.

|

| Bonds maturing in the next 12 months by industry group. |

Regarding the handling of overdue corporate bonds, in October, 13 overdue issuers in the fields of residential real estate, energy, and tourism and resorts repaid a total of VND269 billion in principal to bondholders. Of which, 50% of the total outstanding debt repaid in the month came from Yang Trung Wind Power Joint Stock Company. This energy company has delayed bond interest payments in 2022 and 2023.

The late collection rate of overdue bonds increased by 0.1% to 21.5% at the end of October 2024.

Source: https://baodautu.vn/lo-ngai-hang-chuc-nghin-ty-dong-trai-phieu-co-nguy-co-cham-tra-no-goc-d229617.html

![[Photo] Magical moment of double five-colored clouds on Ba Den mountain on the day of the Buddha's relic procession](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/9/7a710556965c413397f9e38ac9708d2f)

![[Photo] General Secretary To Lam and international leaders attend the parade celebrating the 80th anniversary of the victory over fascism in Russia](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/9/4ec77ed7629a45c79d6e8aa952f20dd3)

![[Photo] Russian military power on display at parade celebrating 80 years of victory over fascism](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/9/ce054c3a71b74b1da3be310973aebcfd)

![[Photo] Prime Minister Pham Minh Chinh chairs a special Government meeting on the arrangement of administrative units at all levels.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/9/6a22e6a997424870abfb39817bb9bb6c)

Comment (0)