Salary increase by millions

According to the Government's proposal, from July 1, the basic salary, pension, social insurance allowance, preferential treatment for meritorious people and social allowance will be adjusted. Accordingly, the Government proposed to increase the basic salary of cadres, civil servants, public employees and public sector workers by 30% from VND1.8 million to VND2.34 million; increase the current pension and social insurance allowance by 15%; supplement the bonus fund of the public sector... Minister of Home Affairs Pham Thi Thanh Tra said that this is the highest increase in basic salary ever, contributing to improving the lives of workers and creating motivation to increase productivity.

Employees do personal income tax procedures

Photo: Dao Ngoc Thach

At the same time, the Government also proposed to increase the current pension and social insurance benefits by 15%, the highest level ever (previously it increased by only more than 7%) to ensure the highest support and care from the state for retired workers.

Not only in the public sector, from July 1, the monthly and hourly minimum wages are also proposed to increase by 6% compared to the current level, corresponding to an increase of 200,000 - 280,000 VND. Specifically, the minimum wage in region I will increase from 4.68 million VND/month to 4.96 million VND/month (an increase of 280,000 VND); region II will increase from 4.16 million VND/month to 4.41 million VND/month (an increase of 250,000 VND); region III will increase from 3.64 million VND/month to 3.86 million VND/month (an increase of 220,000 VND). The hourly minimum wage will also increase by 6%, region I will reach 23,800 VND/hour, region II will increase to 21,200 VND/hour, region III will be 18,600 VND/hour, and region IV will be 16,600 VND/hour.

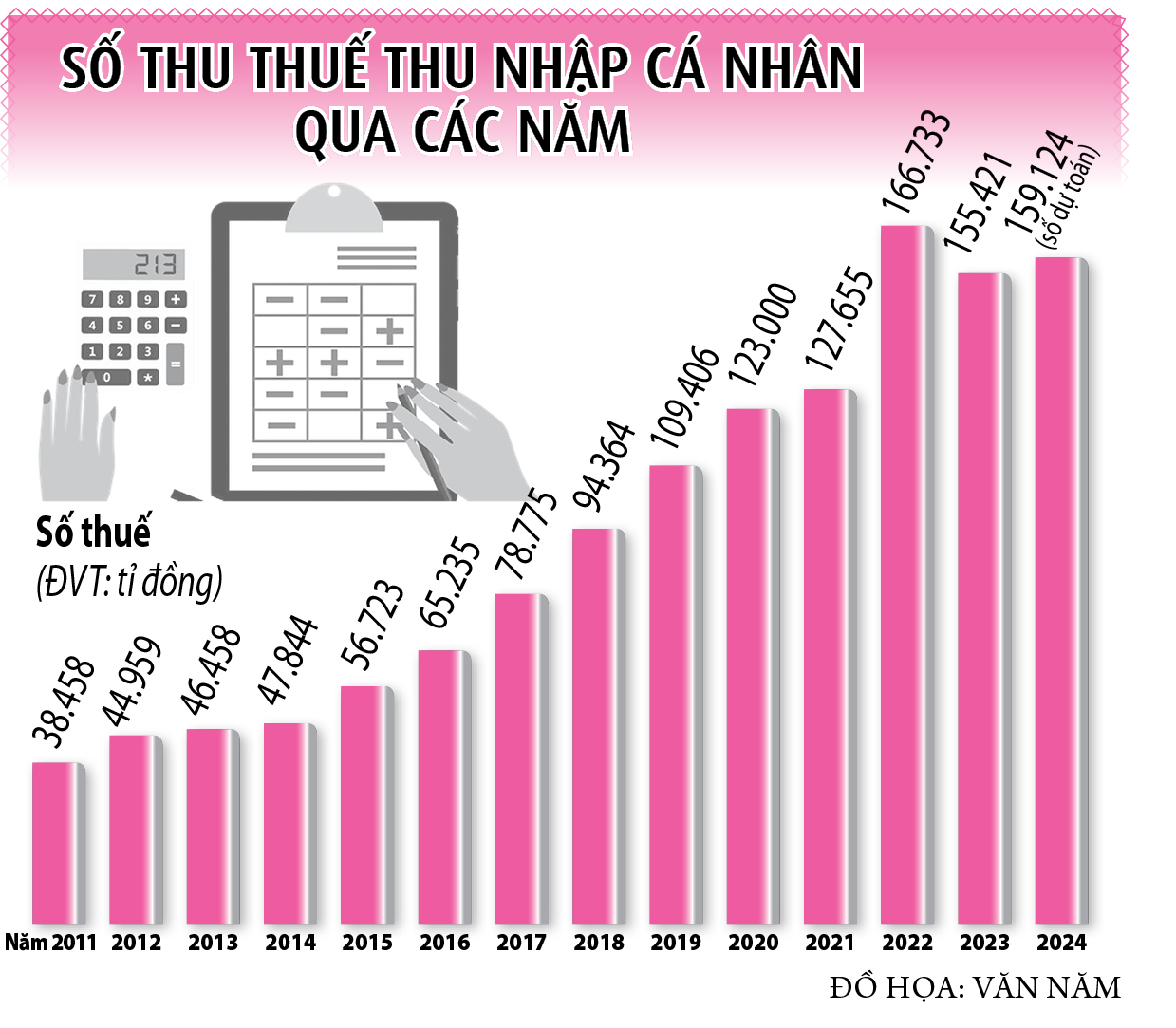

The highest increase in basic salary ever, when applied, will bring joy to tens of millions of workers and civil servants in general. However, along with joy comes worry for many workers because in reality, after previous salary increases, the price of goods also increased. At the same time, the regulations on personal income tax (PIT) have not been changed, which means that some people who receive a salary increase will have to pay more tax. Many people even become subject to PIT even though they were not previously subject to this tax.

Tax increase, tax jump

Hearing the news of salary increase from 1.7, many civil servants and public employees were both happy and nervous. Ms. Kim Ngan (Tan Binh District, Ho Chi Minh City) said that in early July 2023, when the Government increased the basic salary from 1.49 million VND to 1.8 million VND, her salary had a salary coefficient of 2.34, so it increased by more than 700,000 VND. In addition, the agency also paid the additional salary according to business results and some other allowances, so the total salary increased from nearly 11 million VND/month before to more than 11.7 million VND. As a result, from a person who has not paid personal income tax, because the salary increased to over 11 million VND, she is subject to tax. "Although the tax payment of 36,000 VND is not too large, I suddenly feel disappointed. It is not known exactly how much the salary and allowance will increase, but it is estimated to be more than 1 million VND and the monthly tax payment will be higher than the current one. The salary increase has not yet compensated for the increase in the price of goods, but I have to pay taxes," said Ms. Kim Ngan.

That is also the feeling of Ms. TH (District 3, Ho Chi Minh City), when the basic salary increases, it means that every month she will receive an additional salary and some other income that the company pays, bringing her total income from more than 18 million VND/month to more than 20 million VND and the tax payment will also increase. Preliminary calculation, the current personal income tax she has to pay is 450,000 VND/month, but from July 1, the estimated personal income tax to be paid is 650,000 VND, an increase of 200,000 VND. This increase is equivalent to 10% compared to the additional salary, and accounts for nearly 1/3 of the tax payable. "I hope my salary will increase to compensate for the increased living expenses, but when I hear the accountant report the tax deduction, I am not happy. The family deduction for taxpayers is 11 million VND/month, which has been maintained for many years, while all expenses change every year in an upward direction. For example, a bowl of pho used to cost 45,000 VND, now it has increased to 60,000 VND... but the family deduction remains unchanged," Ms. TH lamented.

In the same situation, Mr. NV (District 1, Ho Chi Minh City) is worried that when his salary increases, the amount of personal income tax he has to pay will also increase as it did last year. In particular, this year, by the beginning of July, his child will no longer be of school age and will no longer be considered a dependent. Therefore, it is estimated that the personal income tax he has to pay will be much higher due to the increase in taxable income. According to his estimate, his personal income tax rate was previously at 15%, now that his salary has increased to more than 2 million VND plus the reduction in the number of dependents, the tax rate will probably increase to 20%.

The problem of increased wages and increased taxes has occurred in recent years, when the Government has repeatedly adjusted the basic salary increase, but the personal income tax law, although considered outdated, has not been changed. This is the reason why every time wages increase, workers and civil servants have to pay more taxes.

Mr. Nguyen Ngoc Tu, a lecturer at Hanoi University of Business and Technology, said that an increase in salary means an increase in income, but the personal income tax rate is not adjusted, which will lead to the problem of taxpayers' tax rates jumping to a higher level. Notably, this makes the 30% salary increase policy proposed by the Government meaningless because the income of many civil servants and public employees does not actually increase to this level. Or according to the provisions of the personal income tax law, only when the CPI inflation index increases by more than 20% will the personal income tax rate be adjusted. For many years now, the personal income tax rate has been considered outdated, so waiting for the CPI to increase by 20% before adjusting will cause a burden on taxpayers. Therefore, it is necessary to push forward the plan to amend the personal income tax law faster than expected. If following the roadmap for building the revised personal income tax law announced by the Ministry of Finance, it will not be approved by the National Assembly until May 2026. Thus, the new law is likely to take effect by 2027.

Therefore, Mr. Nguyen Ngoc Tu proposed to speed up the personal income tax amendment roadmap by 1 year, submitting the amendment to the National Assembly in October this year. In addition, to avoid the shortcomings as in the past when introducing a fixed personal income tax rate, the revised personal income tax law should stipulate that the personal income tax rate can be equivalent to 8 times the basic salary. If calculated according to the new revised salary from July 1 to 2.34 million VND/month, the personal income tax rate is equivalent to 18.7 million VND for taxpayers. Dependents account for 50% of the personal income tax rate of taxpayers. "With such a method of calculating the sliding personal income tax rate, when the basic salary is adjusted to increase, the personal income tax rate will also increase accordingly, causing no inconvenience when applying as well as frustration for taxpayers. Personal income tax is easy on the people, so with a reasonable method, taxpayers will also feel more comfortable when paying taxes," Mr. Nguyen Ngoc Tu commented.

Control the situation of "salary-based price gouging"

In fact, in recent days, although the new basic salary proposed by the Government has not yet come into effect, many items have quietly increased in price, especially in some small retail markets. According to Ms. Nguyen Ngoc Thuy, residing in Binh Thanh District (HCMC), many products have increased by 1,000 - 2,000 VND/kg, so sometimes buyers do not notice. Recently, the price of sugar has increased to 35,000 VND/kg, an increase of 5,000 VND compared to about 2 months ago. Or in early June, rice prices increased sharply, especially ST25 rice increased by nearly 3,000 VND/kg. Many sellers explained that because the winter-spring crop ended, the large amount of exported goods caused a shortage in the supply of winter-spring rice...

According to economic expert, Associate Professor, Dr. Ngo Tri Long, in reality, there is always a situation where goods are "slashed in price" every time salaries are adjusted to increase. This makes the state's salary increase no longer have its full meaning. For example, if previously the salary of a civil servant was enough to buy 10 kg of beef in a month, then after the increase, it must be able to buy 11-12 kg to be meaningful. However, in reality, the price of beef increased more than the salary increase, so this civil servant can only buy less than 10 kg with his salary.

"If the price of goods increases due to objective reasons such as weather or natural disasters causing a sudden shortage of supply, it is acceptable. However, if the price of goods increases silently due to the "follow the flow" mentality, it needs to be rectified. The government must require ministries and branches to closely monitor, inspect and impose strong penalties to deter when unreasonable price increases are detected. At the same time, goods currently under state price control such as gasoline, electricity or medical services, education, etc. must calculate the appropriate time to adjust prices if necessary. All solutions must ensure that goods cannot increase in price faster than the increase in basic salary. Only then can we ensure stability in the lives of workers, civil servants and public employees," Mr. Long emphasized.

Agreeing, economic expert, Associate Professor, Dr. Dinh Trong Thinh said that it is necessary to implement a number of measures to control the price increases of goods according to wages. Specifically, the Price Management Department (Ministry of Finance), the General Department of Market Management (Ministry of Industry and Trade) will conduct inspections of the formation of prices of essential goods. Market management agencies in coordination with local authorities will strengthen inspections and supervision of enterprises, households, individual traders, small traders at markets, supermarkets, restaurants, etc. to avoid unreasonable price increases according to wages. At the same time, at the time of wage increase, goods and services such as electricity, water, healthcare, tuition fees, etc. should not increase to avoid creating a sudden increase in prices during this period. This inspection also needs to be maintained in the following months to keep the prices of goods and services strictly in accordance with regulations. If violations are detected, they will be strictly handled. Controlling price fluctuations at a reasonable level helps stabilize people's lives and keeps inflation within the set target.

Basic salary changes but family deduction remains the same

From 2004 to present, the basic salary has changed 14 times and increased 6.2 times. According to statistics, in the period from 2011 to 2020, the basic salary increased by an average of 7.6%/year. Particularly from 2020 to present, the basic salary has also been adjusted from 1.49 million VND/month to 1.8 million VND/month and soon to 2.34 million VND, corresponding to an increase of more than 63%, but the GTGC level in the personal income tax payment regulations from 2020 to present remains unchanged.

The longer the time to amend the Personal Income Tax Law is delayed, the more inappropriate it becomes.

The government's adjustment to increase the basic salary or regional minimum wage without simultaneously adjusting the personal income tax regulations is not consistent and reduces the significance of the salary increase policy. Because the actual income of wage earners may not increase or increase insignificantly, when they may "suddenly" become subject to personal income tax and have an amount deducted immediately after the salary increase adjustment. Meanwhile, the current reality is that every time the government increases the basic salary or regional minimum wage, the price of goods and living expenses increase by a new level. This makes the real life of many people more difficult than before the salary increase. Therefore, it is necessary to consider adjusting the personal income tax regulations and correspondingly follow the roadmap for adjusting the basic salary or regional minimum wage. Some contents that need to be considered for adjustment include raising the threshold of income subject to personal income tax and the level of VAT to be closer to reality.

Dr. Chau Huy Quang , Managing Attorney of Rajah & Tann LCT Law Firm

Family deduction regulations based on minimum wage

The CPI index is calculated on 725 items, while the cost of living of workers is only focused on a few essential items. Therefore, adjusting the personal income tax based on the CPI index is unreasonable. The principle of income tax is that the minimum cost must be deducted before calculating tax, similar to corporate income tax. Moreover, the standard of living and costs of each region are different. Therefore, the minimum wage is also divided by region to ensure the living standard of workers. Taxpayers' income has increased according to the minimum wage in recent years, but the personal income tax has remained stagnant, leading to a situation where when income increases, many individuals have to pay more tax. Therefore, when amending the personal income tax law, it is necessary to base the annual personal income tax on the minimum wage instead of just relying on the CPI index. This level can be 4 times the minimum wage. Since amending the personal income tax law takes several years, if possible, it is possible to immediately reduce personal income tax by 50% in the last months of 2024. This will not only support taxpayers but can also stimulate domestic consumption.

Mr. Nguyen Duc Nghia , Deputy Director of Support Center

Small and medium enterprises of Ho Chi Minh City Business Association

Source: https://thanhnien.vn/lo-gia-tang-thue-tang-theo-luong-185240626230609074.htm

![[Photo] Magical moment of double five-colored clouds on Ba Den mountain on the day of the Buddha's relic procession](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/9/7a710556965c413397f9e38ac9708d2f)

![[Photo] Russian military power on display at parade celebrating 80 years of victory over fascism](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/9/ce054c3a71b74b1da3be310973aebcfd)

![[Photo] General Secretary To Lam and international leaders attend the parade celebrating the 80th anniversary of the victory over fascism in Russia](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/9/4ec77ed7629a45c79d6e8aa952f20dd3)

![[Photo] Prime Minister Pham Minh Chinh chairs a special Government meeting on the arrangement of administrative units at all levels.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/9/6a22e6a997424870abfb39817bb9bb6c)

Comment (0)