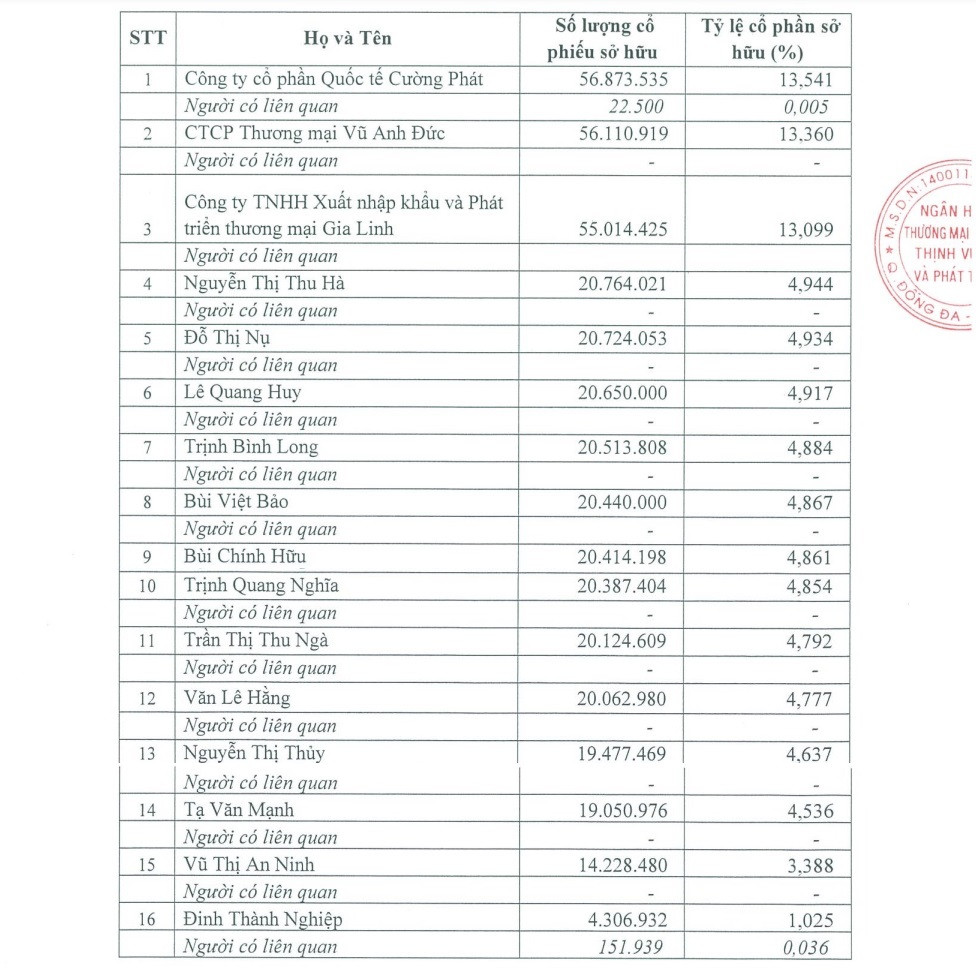

Prosperity and Development Joint Stock Commercial Bank (PGBank) has just announced information about shareholders owning more than 1% of PGBank's charter capital and related persons.

In the list, PGBank has 16 shareholders, including organizations and individuals owning 1% or more of charter capital. Of which, the 3 largest legal shareholders are, respectively:

Cuong Phat International Joint Stock Company holds more than 56.873 million shares, accounting for 13.541% of the bank's charter capital; Vu Anh Duc Trading Joint Stock Company owns more than 56.110 million shares, accounting for 13.36% and Gia Linh Import-Export and Trade Development Company Limited owns more than 55.014 million shares, accounting for 13.099%.

In addition to the 3 large institutional shareholders mentioned above, individual shareholders owning 1% of PGBank's charter capital include:

Nguyen Thu Ha (4.944%), Do Thi Nu (4.934%), Le Quang Huy (4.917%), Trinh Binh Long (4.884%), Bui Viet Bao (4.867%), Bui Chinh Huu (4.861%), Trinh Quang Nghia (4.854%), Tran Thi Thu Nga (4.792%), Van Le Hang (4.777%), Nguyen Thi Thuy (4.637%), Ta Van Manh (4.536%), Vu Thi An Ninh (3.388%), and Dinh Thanh Nghiep (1.025%).

In addition, related persons of two shareholders Cuong Phat International JSC and shareholder Dinh Thanh Nghiep also own 0.005% and 0.036% of charter capital at PGBank, respectively.

In total, the 16 shareholders and related parties mentioned above currently own 97.457% of PGBank's charter capital. Of which, 3 institutional shareholders are the companies: Gia Linh, Cuong Phat and Vu Anh Duc, currently holding 40% of the bank's charter capital.

These 3 legal entities officially became major shareholders of PGBank from August 2023 after purchasing 120 million PGB shares, equivalent to 40% of shares, from Petrolimex Petroleum Group.

Chairman of the Board of Directors and General Director of Cuong Phat International Joint Stock Company is Mr. Nguyen Van Manh. This businessman born in 1981 was a founding shareholder of PL International Joint Stock Company, a legal entity founded and owned by Mr. Nguyen Toan Thang - younger brother of Thanh Cong Group (TC Group) Chairman Nguyen Anh Tuan.

Meanwhile, Vu Anh Duc Trading JSC has Mr. Vu Van Nhuan (born in 1973) as its Chairman of the Board of Directors. Mr. Nhuan was once known as the director and legal representative of TCHB Company Limited - a unit founded and 100% owned by Thanh Cong Viet Hung Technology Complex Industrial Park JSC.

Viet Hung is a member of Thanh Cong Group, established by Thanh Cong Group Corporation (60%), Hyundai Thanh Cong Vietnam Corporation (25%) and TCG Land Company Limited (15%).

Regarding Gia Linh Import-Export and Trade Development Company Limited, Mr. Nguyen Tien Dung holds more than 99% of the shares.

Mr. Dung used to be the director and legal representative of Thanh Cong Technology Construction Production Joint Stock Company. This company was established in August 2020 with 3 founding shareholders, including Mr. Vu Van Nhuan, TCG Land Company Limited and Ms. Le Hong Anh.

Regarding PGBank, in early March 2024, the bank's Board of Directors announced the results of issuing 120 million bonus shares to existing shareholders with an exercise rate of 40%, equivalent to shareholders owning 10 shares receiving 4 new shares.

The capital for issuing shares is taken from accumulated undistributed profit after tax and charter capital reserve fund, based on the audited 2022 Financial Report of VND 1,200 billion.

After completing the issuance of bonus shares, PGBank's charter capital increased from VND 3,000 billion to VND 4,200 billion.

The bank recently announced a plan to launch a public offering of shares to existing shareholders to increase its charter capital to VND5,000 billion.

Accordingly, PGBank plans to offer to existing shareholders a maximum of 80 million shares at a price of VND10,000/share (equivalent to VND800 billion). The exercise ratio is 4:21 (equivalent to shareholders owning 21 shares will be able to buy 4 new shares). The expected time to complete the charter capital increase is VND5,000 billion in 2024.

PGBank plans to allocate VND800 billion from the issuance of shares to the following activities: Lending to meet short-term capital needs (VND200 billion) and medium- and long-term capital needs of customers (VND305 billion); investing in information technology infrastructure, converting banks (VND230 billion) and supplementing capital to purchase fixed assets (VND65 billion).

Source: https://vietnamnet.vn/lo-dien-to-chuc-va-nguoi-lien-quan-tap-doan-thanh-cong-so-huu-40-von-tai-pgbank-2324090.html

Comment (0)