|

Regulations on monthly pension payment schedule

According to Decision 166/QD-BHXH in 2019 promulgating the procedure for settling social insurance benefits and paying social insurance and unemployment insurance benefits, monthly pension and social insurance benefits payment starts from the 2nd day of the month of payment.

Thus, the monthly pension payment schedule starts from the 2nd of the month.

Pension and social insurance benefits payment schedule for December 2023

According to Ho Chi Minh City Social Insurance, implementing Decision 166/QD-BHXH dated January 31, 2019 of Vietnam Social Insurance on promulgating the process of settling social insurance benefits, paying social insurance and unemployment insurance benefits (BHTN), the payment of monthly pensions and social insurance benefits starts from the 2nd day of the month of payment. Because December 2, 2023 is Saturday, Ho Chi Minh City Social Insurance announces the pension and social insurance benefits payment schedule for December 2023 as follows:

- Payment by cash: starting from December 2, 2023 to December 25, 2023.

- For non-cash payment:

+ Ho Chi Minh City Post Office transfers money to the beneficiary's account no later than December 2, 2023.

+ However, for beneficiaries with pension accounts at the following banks: Vietnam Bank for Agriculture and Rural Development, Vietnam Joint Stock Commercial Bank for Investment and Development, Asia Commercial Joint Stock Bank: Ho Chi Minh City Post Office will transfer money to the beneficiary's account on December 4, 2023 (Monday), because the above banks do not work on Saturdays.

The City Social Insurance requests the City Post Office, Thu Duc City Social Insurance and District Social Insurance to notify beneficiaries.

- Pension payment schedule for November 2023

Pension payments for November 2023 will start from October 2.

For payments at post offices and service points of Vietnam Post, pension payment schedule is from the 11th to the 25th.

The specific pension payment schedule in each locality will be decided by the provincial social insurance agency.

- Pension payment schedule for October 2023

Payment of monthly pensions and social insurance benefits starts from the 2nd to the 10th of the month of payment.

For payments at post offices and service points of Vietnam Post, pension payment schedule is from the 11th to the 25th of the month.

The October 2023 pension payment schedule of provinces and cities across the country will be specifically announced to pension beneficiaries by local Social Security.

- Pension payment schedule for September 2023 in Hanoi and Ho Chi Minh City

According to Vietnam Social Security, from September 2023 onwards, the Social Security agency will pay pensions according to the schedule as in July 2023.

However, because the National Day holiday on September 2, 2023 falls on a weekend, officials, civil servants and employees will have a holiday until September 4, 2023, so the pension payment schedule for September 2023 will also change and is expected to start paying pensions from September 5, 2023.

**In Ho Chi Minh City, according to Official Dispatch 3453/BHXH-KHTC in 2023, the pension payment schedule for September 2023 is as follows:

- Cash payment: starting from September 5, 2023 to September 25, 2023.

- Payment via ATM: starting from September 5, 2023 to September 6, 2023.

**In Hanoi: In some districts, pension and cash allowance payments will be implemented from September 6, 2023.

- Pension and social insurance benefit payment schedule for August 2023

On July 20, 2023, Vietnam Social Security issued Official Dispatch No. 2206/BHXH-TCKT on payment of pensions, social insurance benefits, and monthly benefits for the payment period of August 2023.

Pursuant to Decree 42/2023/ND-CP on adjusting pensions, social insurance benefits and monthly allowances (effective from August 14, 2023); Circular 06/2023/TT-BLDTBXH guiding the adjustment of pensions, social insurance benefits and monthly allowances; Official Dispatch 5277/VPCP-KTTH dated July 13, 2023 and Official Dispatch 2664/LDTBXH-BHXH dated July 13, 2023.

To ensure that pensioners, social insurance beneficiaries, and monthly beneficiaries enjoy the policies prescribed in Decree 42/2023/ND-CP as soon as possible after Decree 42/2023/ND-CP takes effect, Vietnam Social Security announces the plan to organize the payment of social insurance benefits for August 2023 as follows:

Organize the payment of pensions, social insurance benefits, monthly benefits for August 2023 and collect the additional difference amount for July 2023 according to the new benefit levels prescribed in Decree 42/2023/ND-CP, Circular 06/2023/TT-BLDTBXH from August 14, 2023.

Thus, the pension payment schedule for August 2023 starts from August 14, 2023.

- Pension and social insurance benefits payment schedule for July 2023 in Ho Chi Minh City

On June 20, 2023, Ho Chi Minh City Social Insurance issued Official Dispatch 2900/BHXH-KHTC on the schedule for paying pensions and social insurance benefits for July 2023.

Because July 2, 2023 is a Sunday, Ho Chi Minh City Social Insurance announces the schedule for pension and social insurance benefits payment for July 2023 as follows:

- Cash payment: starting from July 3, 2023 to July 25, 2023.

- Payment via ATM: starting from July 3, 2023 to July 4, 2023.

Ho Chi Minh City Social Insurance requests Ho Chi Minh City Post Office, Thu Duc City Social Insurance, districts and counties to notify beneficiaries.

Formula for calculating monthly pension

Article 7 of Decree 115/2015/ND-CP stipulates the formula for calculating monthly pensions for employees as follows:

Monthly pension | = | Monthly pension rate (%) | X | Average monthly salary for social insurance contribution |

In there:

- For employees retiring from January 1, 2016 to before January 1, 2018, the monthly pension rate is calculated at 45% corresponding to 15 years of social insurance payment, then for each additional year of social insurance payment, an additional 2% is calculated for men and 3% for women; the maximum level is 75%;

- For female employees retiring from January 1, 2018 onwards, the monthly pension rate is calculated at 45% corresponding to 15 years of social insurance payment, then for each additional year of social insurance payment, an additional 2% is calculated; the maximum level is 75%;

- For male employees retiring from January 1, 2018 onwards, the monthly pension rate is calculated at 45% corresponding to the number of years of social insurance contributions according to the table below, then for each additional year of social insurance contributions, an additional 2% is calculated; the maximum level is 75%.

Year of retirement | Number of years of social insurance payment corresponding to pension rate of 45% |

2018 | 16 years |

2019 | 17 years |

2020 | 18 years |

2021 | 19 years |

From 2022 onwards | 20 years |

Average monthly salary for social insurance payment to calculate pension

The average monthly salary for social insurance contribution to calculate pension and one-time allowance prescribed in Article 62 of the Law on Social Insurance is stipulated as follows:

(1) For employees subject to the salary regime prescribed by the State and having paid social insurance for the entire period under this salary regime, the average monthly salary for the number of years of paying social insurance before retirement shall be calculated as follows:

- If you started participating in social insurance before January 1, 1995, the average monthly salary for social insurance contributions of the last 5 years before retirement will be calculated;

- Starting to participate in social insurance between January 1, 1995 and December 31, 2000, the average monthly salary for social insurance contributions of the last 6 years before retirement is calculated;

- Starting to participate in social insurance between January 1, 2001 and December 31, 2006, the average monthly salary for social insurance contributions of the last 8 years before retirement is calculated;

- Starting to participate in social insurance between January 1, 2007 and December 31, 2015, the average monthly salary for social insurance contributions of the last 10 years before retirement is calculated;

- Starting to participate in social insurance from January 1, 2016 to December 31, 2019, the average monthly salary for social insurance contributions of the last 15 years before retirement is calculated;

- Starting to participate in social insurance from January 1, 2020 to December 31, 2024, the average monthly salary for social insurance contributions of the last 20 years before retirement will be calculated;

- Starting to participate in social insurance from January 1, 2025 onwards, the average monthly salary for social insurance payment for the entire period will be calculated.

(2) For employees who have paid social insurance for the entire period under the salary regime decided by the employer, the average monthly salary for social insurance payment for the entire period shall be calculated.

(3) Employees who have both paid social insurance premiums subject to the salary regime prescribed by the State and paid social insurance premiums under the salary regime decided by the employer shall have their average monthly salary for social insurance premiums calculated for all periods, in which the period for paying social insurance premiums under the salary regime prescribed by the State shall be calculated as the average monthly salary for paying social insurance premiums according to the provisions of Clause (1) based on the time of starting to participate in compulsory social insurance. In case the number of years prescribed in Clause (1) is not enough, the average monthly salary of the months for which social insurance premiums have been paid shall be calculated.

(4) Employees who have paid social insurance for 15 years or more at the following salary levels and change to another job with lower social insurance payment levels, upon retirement, will be entitled to take the highest salary of the job specified in Point a below or the salary before changing the industry corresponding to the number of years specified in Clause (1) to calculate the average salary as the basis for calculating pension benefits:

- Particularly arduous, toxic, dangerous and arduous, toxic, dangerous in the salary scale and payroll prescribed by the State;

- Officers and professional soldiers in the people's army, professional officers and technical officers in the people's police, and people working in cryptography receive salaries as soldiers and people's police who change careers to work at agencies, organizations, units and enterprises subject to the salary regime prescribed by the State.

(5) Employees who have paid social insurance before October 1, 2004 under the salary regime prescribed by the State and receive social insurance from October 1, 2016 onwards, the monthly salary used to pay social insurance as the basis for calculating social insurance benefits will be converted according to the salary regime prescribed at the time of leaving work to serve as the basis for calculating social insurance benefits.

(6) Employees who are subject to the salary regime prescribed by the State and have paid social insurance including seniority allowances and then change to a profession that is not entitled to seniority allowances and whose monthly salary for social insurance payment as the basis for calculating pension does not include seniority allowances shall have their average monthly salary used as the basis for social insurance payment at the time of retirement, plus seniority allowances (if received) calculated according to the time of social insurance payment including seniority allowances, converted according to the salary regime prescribed at the time of retirement as the basis for calculating pensions.

In case an employee changes to a profession that is entitled to seniority allowance and the monthly salary for social insurance payment used as the basis for calculating pension includes seniority allowance, the average monthly salary for social insurance payment used to calculate pension shall be implemented according to the provisions in Clause (1).

Source

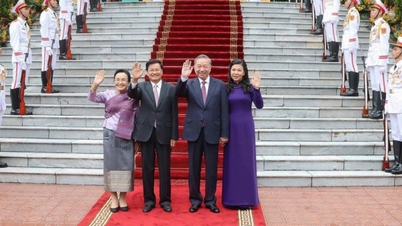

![[Photo] Prime Minister Pham Minh Chinh receives President of Cuba's Latin American News Agency](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F01%2F1764569497815_dsc-2890-jpg.webp&w=3840&q=75)

Comment (0)