Editor's note:

The story of Mr. Luong Hoai Nam, General Director of Bamboo Airways, being temporarily suspended from leaving the country because the company owed taxes has opened up a debate about the role of temporary suspension of exit in tax debt collection.

For businesses that deliberately delay and refuse to pay taxes, applying strong measures is necessary. However, many businesses are upset when their leaders are delayed in leaving the country when they only owe 1-10 million VND in taxes.

The series of articles "Behind the temporary suspension of businessmen's exit to collect tax debts" by VietNamNet provides multi-dimensional perspectives from businesses and authorities to find suitable solutions to this problem.

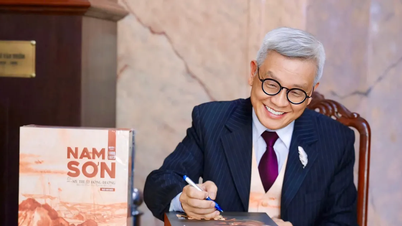

Public opinion and insiders have many conflicting opinions surrounding the issue of businessmen being temporarily suspended from leaving the country because their businesses owe taxes. Mr. Dang Ngoc Minh, Deputy Director General of the General Department of Taxation, shared with PV. VietNamNet the perspective of those who enforce tax laws.

The law does not specify what is considered a small or large tax debt.

- How has the regulation on temporary suspension of exit for people with tax debts been applied, sir?

Mr. Dang Ngoc Minh: This regulation has been in place for many years. Most recently, the 2020 Law on Tax Administration and the Law on Exit and Entry of Vietnamese Citizens (effective from July 2020) also have provisions on temporary suspension of exit for tax debtors.

Under current law, taxpayers with debts over 90 days will be subject to enforcement. The law does not specify what constitutes a small or large tax debt.

Taxpayers (including individuals and businesses) who are subject to tax enforcement must fulfill their tax obligations before leaving the country.

For legal entities that are subject to tax enforcement, if the legal entity has not yet fulfilled its tax obligations, the legal entity's representative will be temporarily suspended from leaving the country.

- There are still opinions that the temporary suspension of exit from the country seems too “heavy-handed” for business leaders when many directors are just employees. What do you think about this opinion?

In fact, those thoughts of some businesses have been noted in the process of building the Tax Administration Law. But the National Assembly has passed the law with such provisions, we have to implement it.

The law has stipulated that an individual is responsible for representing and managing a legal entity. When the legal entity owes taxes, that individual must be temporarily suspended from leaving the country until the legal entity fulfills its tax obligations.

Tax authorities are tax law enforcement agencies and must comply with the law, until further notice.

In the process of performing tax debt collection tasks, tax authorities also base on actual situations and do not apply them rigidly and widely.

Normally, if an individual is not a businessman, the measure of temporary suspension of exit is also very limited. Of course, people with large debts of up to billions of dong, with the risk of budget loss, must also apply.

Departure suspension is only one of the measures to collect tax arrears. If we find that other measures can be applied, then it is not necessary to apply the exit suspension measure. Seeing that there is a high risk of tax loss, this measure is implemented to ensure the interests of the budget.

The number of temporary exit suspension notices issued in 2024 increased significantly.

- How many legal representatives of enterprises have been temporarily suspended from leaving the country due to tax debts? Is this number increased or decreased compared to the same period last year, sir?

From 2023 to August 2024, the tax authority has announced a temporary suspension of exit for 17,952 cases, with a tax debt of VND 30,388 billion. Of these, 10,829 cases are taxpayers who have abandoned their business address with a tax debt of VND 6,894 billion.

In the whole year of 2023, only 2,411 cases of temporary suspension of exit were announced with a total tax debt of 6,719 billion VND.

On February 6, 2024, the General Department of Taxation issued Official Dispatch 511 directing tax departments to consider applying temporary exit suspension measures for cases of tax arrears, especially focusing on cases of abandoning business addresses but still owing taxes.

After this directive, tax departments actively reviewed and applied exit suspension measures, so the number of exit suspension notices issued in 2024 increased significantly.

- Among the cases of legal representatives being temporarily suspended from leaving the country, how many businesses have paid their tax debts?

In 2024, there were 1,424 cases that paid taxes out of a total of 6,539 cases of temporary exit suspension notices, accounting for nearly 21.8%. The total amount of tax arrears paid accounted for 7.04% of the total amount of tax arrears in decisions to temporarily suspend exit.

Among the 9,002 cases of temporary suspension of exit for businesses leaving their business addresses, there were also 5.65% of cases of paying tax arrears.

- Is temporary suspension of exit the strongest measure to collect tax debt, sir?

There are currently many tax enforcement measures, such as: enforcement by account (bank transfer from legal entity's account), enforcement by using invoices, enforcement by revoking business license...

Departure suspension is only a small measure and not the strongest one.

The measure we are applying the most is to stop using invoices. This measure is much stronger. Many large enterprises and systems will be affected immediately when they stop using invoices. It is a tool that the state equips the tax sector with to protect the interests of the budget.

- To increase the efficiency of tax debt collection, what new solutions does the tax industry have?

This year's tax debt collection work has many innovations. In particular, we apply many new technological solutions such as artificial intelligence (AI) in processing business processes, supporting tax officers to carry out enforcement on time, thereby contributing to increasing the efficiency of tax debt collection for the State.

In the context of businesses facing many difficulties after the Covid-19 pandemic, and having just been hit by storms and floods, the State has applied many solutions to extend, postpone, and delay tax payment obligations for individuals, business households, and enterprises.

Although tax debt management has been under great pressure, the General Department of Taxation has promptly directed tax departments to create the most favorable conditions for people and businesses. In cases of difficulties due to natural disasters and epidemics, if there are records of exemption, deferment, or reduction according to the provisions of the Law on Tax Administration, the tax sector will support immediate resolution.

Article 66 of the Law on Tax Administration stipulates: “Taxpayers who are being forced to execute administrative decisions on tax administration, Vietnamese people leaving the country to settle abroad, Vietnamese people settling abroad, and foreigners must fulfill their tax payment obligations before leaving Vietnam; in case they have not fulfilled their tax payment obligations, their exit will be temporarily suspended according to the provisions of the law on exit and entry.” Clause 5, Article 36 of the Law on Entry and Exit stipulates: “Taxpayers, legal representatives of enterprises being forced to execute administrative decisions on tax management, Vietnamese people leaving the country to settle abroad, Vietnamese people residing abroad who have not yet fulfilled their tax payment obligations according to the provisions of the law on tax management before leaving the country”. |

Source: https://vietnamnet.vn/tong-cuc-thue-khong-ap-dung-cung-nhac-quy-dinh-tam-hoan-xuat-canh-khi-no-thue-2324825.html

![[Photo] General Secretary To Lam received the delegation attending the international conference on Vietnam studies](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/26/1761456527874_a1-bnd-5260-7947-jpg.webp)

![[Photo] Enjoy the Liuyang Fireworks Festival in Hunan, China](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/26/1761463428882_ndo_br_02-1-my-1-jpg.webp)

![[Photo] Nhan Dan Newspaper displays and solicits comments on the Draft Documents of the 14th National Party Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/26/1761470328996_ndo_br_bao-long-171-8916-jpg.webp)

![[Photo] Prime Minister Pham Minh Chinh attends the opening of the 47th ASEAN Summit](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/26/1761452925332_c2a-jpg.webp)

Comment (0)