As the first bank to issue green bonds, BIDV leaders realized that there are currently no clear mechanisms and policies to create incentives for green bond issuers and investors. Speaking at the Conference on deploying the task of developing the stock market in 2024 held in Hanoi on the morning of February 28

, Mr. Le Ngoc Lam, General Director of the Joint Stock Commercial Bank for Investment and Development of Vietnam

( BIDV

) said that one of the successes of this bank in 2023

was to open a new capital mobilization channel, creating a premise to increase the capacity to supply green capital to the economy through the issuance of green bonds.

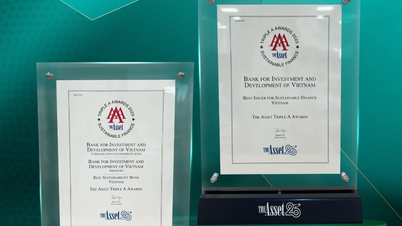

Specifically, BIDV successfully issued VND 2,500 billion worth of bonds according to the green bond standards of the International Capital Market Association (ICMA), making BIDV the first bank to issue green bonds according to international standards in the domestic market.

“ To implement the issuance, BIDV has proactively studied international green bond practices and principles; Thanks to technical advice from the World Bank, the SBV's Technical Assistance Program, and the SSC's Handbook, BIDV has built a Green Bond Framework according to ICMA standards and achieved a very high rating from Moody's. This is an important factor in determining the success of the issuance. Within 2 months of issuance, BIDV has disbursed all bond capital to finance renewable energy and sustainable transport projects

,” said Mr. Lam . However,

according to BIDV's General Director, a limitation noticed during the implementation process

is that there are no clear mechanisms and policies to create incentives for green bond issuers and investors. In the coming time, to encourage the development of the green bond market, thereby attracting investment capital for Vietnam, BIDV has proposed three recommendations

. In particular, there are many recommendations for new mechanisms from the financial sector such as supporting issuance costs, tax incentives for businesses issuing green bonds; preferential policies large enough to encourage investors to buy bonds... Specifically, according to Mr. Lam, it is necessary to complete the legal frameworks related to green bonds including

regulations on classifying and certifying national green projects to apply incentive policies that need to consider the similarities between Vietnam's green criteria and international standards. This makes it convenient for businesses to implement projects, attract domestic and foreign investment according to the same system of standards. In addition, consider regulating green criteria including levels corresponding to different levels of policy incentives. At that time, businesses issuing green bonds can gradually access preferential policies as well as create goals/motivations to achieve sustainable growth; At the same time, issue guidelines for green bond issuance and reporting activities, taking into account specific regulations between the operations of credit institutions and economic organizations. Second, support and encourage businesses to make green transformations and issue green bonds through continued research and expansion of policies to support businesses issuing green bonds such as support for issuance costs, tax incentives, etc.

BIDV leaders also believe that it is necessary to promote training and development of human resources on the environment;

promote propaganda and encourage businesses to make green transformations. Third, encourage investors to participate in green bond investment

. The proposed forms of incentives are to consider issuing incentives large enough to encourage investors to buy bonds (for example, incentives on credit limits, taxes on investment yields, etc.)

and raise awareness of investors' responsibilities towards sustainable development, community and society.

|

| Mr. Le Ngoc Lam, General Director of Vietnam Joint Stock Commercial Bank for Investment and Development BIDV, gave a speech on the topic "Green bonds - a driving force for sustainable growth" - Photo: VGP/Nhat Bac |

As a credit institution, in line with the general development trend of the world as well as the orientation of the Government, BIDV has built a development strategy for the period 2021-2025, with a vision to 2030, and set a goal of becoming a Net Zero Bank by 2050.

The bank's leaders said that BIDV has now established a specialized unit to research, develop and implement the Sustainable Development Strategy and ESG practices at BIDV.

The bank has also completed the development of sustainable financial frameworks according to international standards, applicable to both credit granting, capital mobilization and risk management activities.

BIDV builds credit granting orientations and policies related to ESG. In

particular, shifting the lending structure towards gradually reducing high-carbon emission industries such as coal-fired thermal power, aiming to have no outstanding debt from coal-fired thermal power by 2035; controlling credit limits for steel, cement and fertilizer industries; and

consulting , supporting businesses in technology transformation, reducing greenhouse gas emissions; encouraging businesses to invest in green growth through issuing green credit products in the fields of textiles, rooftop solar power, green transportation, etc. with incentives on interest rates, collateral policies and exchange rates. By the end of 2023, BIDV will be one of the largest green credit institutions in the market with a total outstanding loan balance of VND 71,000 billion, an increase of 11% compared to 2022. Of which, the clean energy and renewable energy sector has an outstanding loan balance of VND 57,000 billion, with 1,600 projects of 1,300 customers. The capital structure for BIDV's green credit includes capital from deposits, loans from domestic and international financial institutions, and entrusted capital.

source

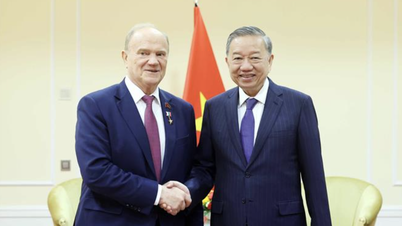

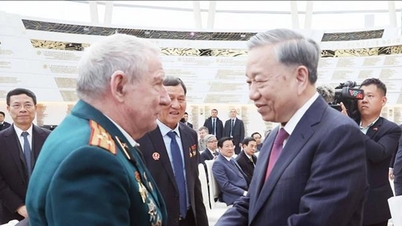

![[Photo] General Secretary To Lam concludes visit to Russia, departs for Belarus](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/0acf1081a95e4b1d9886c67fdafd95ed)

![[Photo] General Secretary To Lam arrives in Minsk, begins state visit to Belarus](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/76602f587468437f8b5b7104495f444d)

![[Photo] General Secretary To Lam meets and expresses gratitude to Vietnam's Belarusian friends](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/c515ee2054c54a87aa8a7cb520f2fa6e)

![[Photo] National Assembly Chairman Tran Thanh Man attends the Party Congress of the Committee for Culture and Social Affairs](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/f5ed02beb9404bca998a08b34ef255a6)

Comment (0)