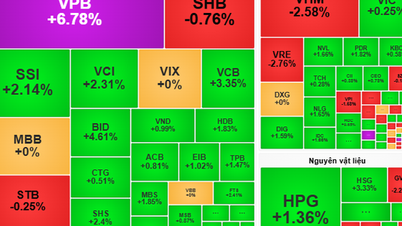

Bank stocks boom

In the trading session on January 4, the stock market was bustling with liquidity soaring above the billion-dollar threshold thanks to the breakthrough and cash flow into banking stocks and some groups benefiting from the Government's efforts to stimulate economic growth.

Banking stocks stood out with most of the codes increasing in price, including some codes that increased explosively, sometimes reaching the ceiling price, such as CTG shares of Vietinbank or MBB shares of Military Bank MBBank.

During the session, MBB increased by 7% to VND20,450/share, before closing the trading session on January 4 at VND20,100/share. Before that, MBB also had 4 consecutive increasing sessions. In the last 10 sessions, MBB had 8 increasing sessions, 1 stable session and 1 slight decreasing session.

MBBank is known as a bank that has made strong breakthroughs in recent years and has had strong profit growth, partly thanks to consumer credit.

According to VNDirect, in 2023, MBBank will grow strongly thanks to its abundant credit growth limit (over 25%), much higher than the industry-wide plan (14%). This is a bank participating in restructuring weak credit institutions and has advantages in areas with high growth potential such as renewable energy or retail.

Vietinbank (CTG) shares also performed strongly, at times hitting the ceiling price of VND29,500/share, before closing on January 4 at VND28,600/share.

In addition, Vietcombank's VCB shares also increased sharply by VND1,400 to VND85,900/share. Techcombank (TCB) of billionaire Ho Hung Anh increased by VND500 to VND33,100/share.

In fact, banking stocks have begun to show positive signs, becoming the main driving force of the market since the last session of last year (December 29, 2023), after a long period of "quietness" under pressure from bad debt and credit growth bottlenecks. HDBank (HDB) shares, chaired by billionaire Nguyen Thi Phuong Thao, skyrocketed by more than 4.9% on December 29, bringing HDB shares to their highest price in 2023. HDBank's liquidity also reached more than 12.4 million units, 20 times higher than the average matched volume of the previous 10 sessions.

In the session of January 4, banking stocks increased sharply thanks to hot information about the credit policy of the State Bank of Vietnam (SBV).

Waiting for profit to break out

On December 31, the State Bank of Vietnam sent a document to credit institutions on the credit growth plan for 2024 with a credit growth target of 15% in 2024, while handing over all credit room to banks from the beginning of the year.

Not limited to 15%, the State Bank will also adjust the credit growth target for 2024 and adjust the credit growth target of each bank, creating conditions for credit institutions to provide sufficient and timely credit capital for the economy.

Information about strong credit growth at the end of 2023, bringing the annual increase to 13.5%, not too much lower than the target of 14%, also positively affected investor sentiment.

Currently, deposit interest rates are very low, while lending interest rates are also decreasing rapidly. This is a factor expected to help credit grow rapidly, especially for the real estate sector. Low interest rates will stimulate people's home buying activities.

Securities expert Huynh Minh Tuan - founder of Investment Consulting & Asset Management unit FIDT - said that data on credit growth and the move to allocate credit room from the beginning of the year by the State Bank clearly shows the Government's determination to focus on the goal of supporting economic growth and will be more drastic in 2024.

Accordingly, the 13.5% increase in 2023 shows that the Government has made very strong moves in credit growth, especially in the last weeks of the year. This figure exceeds the projections of most parties, which only expected around 12.x%.

According to Mr. Tuan, if we analyze more closely, in December alone, credit increased by 4.35% (equal to nearly 1/3 of the year's increase), the highest December credit growth in more than a decade. The move to boost both monetary and fiscal policy in the fourth quarter of 2023 is seen as creating conditions for economic recovery in 2024 and more clearly in the second half of the new year.

Mr. Tran Duc Anh, Director of Macroeconomics at KB Securities, assessed that despite facing many challenges and difficulties, the banking industry's picture in 2024 is considered to have many positive bright spots.

Accordingly, low interest rates are expected to continue in 2024, thereby creating momentum to promote credit and improve capital costs for banks. Low interest rates will boost credit demand for production, along with the effective support policies of the Government, boosting domestic consumption demand. In addition, legal problems in the real estate sector continue to be resolved, helping this market to soon overcome the recession period.

MBS Securities also believes that profit growth will be positive thanks to the reduction in capital costs. Currently, the industry's deposit interest rates are lower than the bottom level during the Covid-19 pandemic, with the average 12-month term of 4.9% and 5.1% for the group of state-owned commercial banks and joint stock commercial banks, respectively. It is likely that the low interest rate level will last for at least 6-9 months, helping banks increase their net interest margin (NIM).

On the other hand, Mr. Luu Chi Khang, Director of the Research Center of Kien Thiet Securities Company (CSI), gave a more cautious assessment. Mr. Khang said that on January 4, the pressure to take profits on bank stocks increased sharply at the end of the session.

According to Mr. Khang, bank profit growth may not be high when the bad debt ratio is high. In 2024, it is likely that most of the profit will be provisioned. In general, the banking industry's outlook is average, with investment higher than savings interest rates. However, this is the largest capitalization stream and profits account for the largest proportion of the stock market.

MBS Securities also believes that the pressure to set aside provisions in 2024 is significant, but there is a clear differentiation among banks. Banks that have increased their provisions in 2023 have the advantage of high profit growth in 2024.

Source

![[Photo] Prime Minister Pham Minh Chinh chairs conference on anti-smuggling, trade fraud, and counterfeit goods](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/14/6cd67667e99e4248b7d4f587fd21e37c)

Comment (0)