The highest listed interest rate of banks is currently 6.15%/year, after NCB Bank raised interest rates from the beginning of September, applied to online deposits with terms from 18-36 months.

The interest rate of 6.1%/year is also considered rare today and is only listed by a few banks for long-term deposits.

specifically, HDBank listed this interest rate for an 18-month term; SHB and Saigonbank are also listed an interest rate of 6.1%/year for a 36-month term, while OceanBank has long listed this interest rate for term deposits from 18-36 months.

Meanwhile, the interest rate of 6%/year is being applied at joint stock commercial banks: Bao Viet (BaoViet Bank) for a term of 15-36 months; Ban Viet (BVBank) and Dong A (Dong A Bank) for a term of 18-36 months; Saigon Bank for Industry and Trade (Saigonbank) for a term of 13-24 months and HCMC Development ( HDBank ) for a term of 15 months.

The remaining banks all listed the highest mobilization interest rate at less than 6%/year. In addition, some banks, although not officially posting interest rates of 6%/year or more, have also been "quietly" increasing interest rates.

Among them, Vietnam Prosperity Bank (PGBank) and Vietnam Public Bank (PVCombank) are displaying signs inviting depositors to deposit money with interest rates up to 6%/year in front of their transaction offices.

Global Petroleum Bank (GPBank) even put up a sign inviting people to deposit money with an interest rate of up to 6.25%/year, which is considered the highest interest rate currently.

In fact, the interest rate tables posted by these banks all show interest rates below 6%/year.

In addition to official and “unofficial” deposit interest rates, some banks also apply “special interest rate” policies.

In particular, PVCombank is known as the bank that maintains the highest "special interest rate" policy in the market, up to 9.5%/year when depositing money at the counter.

The condition to enjoy the interest rate of 9.5%/year is that customers deposit money for a term of 12-13 months, with a deposit amount of 2,000 billion VND or more.

In addition, some other banks such as DongA Bank, ACB , MSB,... are also maintaining special interest rates.

At MSB, the special interest rate has been reduced from 8.5%/year to 7%/year, with the condition that customers need to have a minimum deposit balance of VND500 billion and deposit for a term of 12-13 months.

However, MSB also applies a "special interest rate" policy for "ordinary" customers, allowing depositors to receive real interest rates 0.3-0.5% higher per year than the online deposit interest rate announced by the bank.

specifically, MSB listed online term deposits with "special interest rate" at 5.1%/year for 6-month terms, 5.7%/year for 12-month, 15-month and 24-month terms.

HDBank listed "special interest rates" for 13-month term deposits at up to 8.1%/year, and 12-month term deposits at 7.7%/year. These interest rates are 2.3%-2.5%/year higher than the interest rates at the counter applied to regular customers. The condition to receive the above interest rates is that customers deposit at least VND500 billion and receive interest at the end of the term.

Dong A Bank is also one of the banks that pay a “special interest rate” of up to 7.5%/year for 13-month term deposits, 2.2%/year higher than the normal mobilization interest rate listed by this bank. Depositors only need to have a deposit balance of VND200 billion or more.

The deposit limit of VND200 billion is also a condition for ACB Bank to allow customers to enjoy a "special interest rate" when making a 13-month deposit at the counter. However, this interest rate is lower than the normal interest rate at many other banks, only at 5.9%/year and 5.7%/year if choosing to receive interest at the beginning of the term.

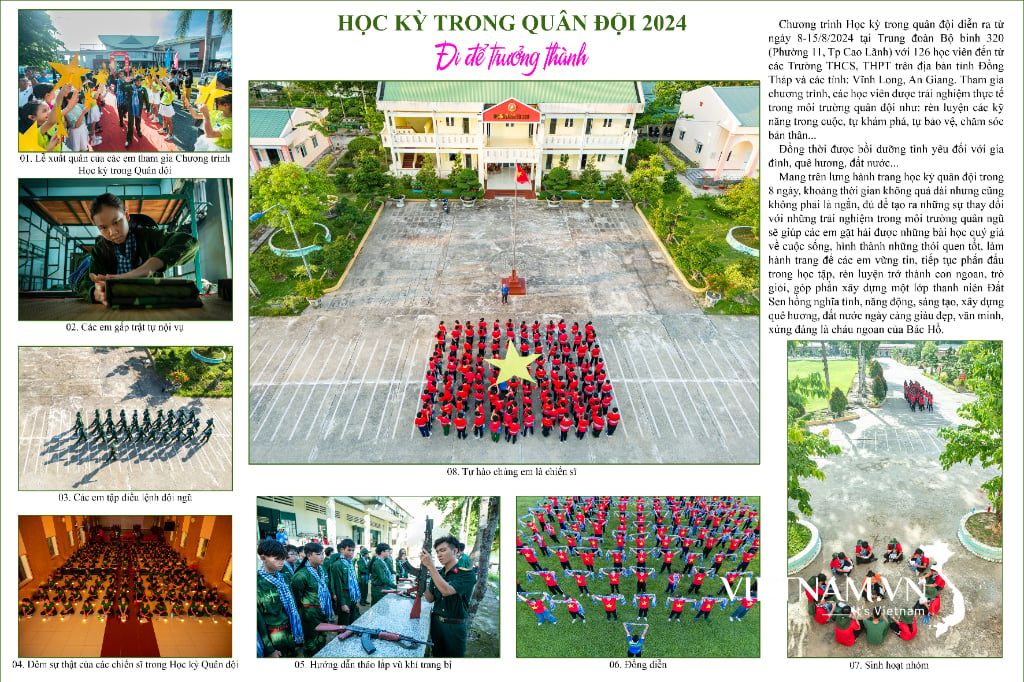

| HIGHEST DEPOSIT INTEREST RATES AT BANKS ON SEPTEMBER 16, 2024 (%/YEAR) | ||||||

| BANK | 1 MONTH | 3 MONTHS | 6 MONTHS | 9 MONTHS | 12 MONTHS | 18 MONTHS |

| AGRIBANK | 2 | 2.5 | 3.3 | 3.3 | 4.7 | 4.7 |

| BIDV | 2 | 2.3 | 3.3 | 3.3 | 4.7 | 4.7 |

| VIETINBANK | 2 | 2.3 | 3.3 | 3.3 | 4.7 | 4.7 |

| VIETCOMBANK | 1.6 | 1.9 | 2.9 | 2.9 | 4.6 | 4.6 |

| ABBANK | 3.2 | 3.7 | 5 | 5.2 | 5.6 | 5.7 |

| ACB | 3 | 3.4 | 4.15 | 4.2 | 4.8 | |

| BAC A BANK | 3.65 | 3.95 | 5.15 | 5.25 | 5.7 | 5.85 |

| BAOVIETBANK | 3.3 | 4 | 5.2 | 5.4 | 5.8 | 6 |

| BVBANK | 3.7 | 3.8 | 5.1 | 5.5 | 5.8 | 6 |

| CBBANK | 3.8 | 4 | 5.55 | 5.5 | 5.7 | 5.85 |

| DONG A BANK | 3.8 | 4 | 5.2 | 5.5 | 5.8 | 6 |

| EXIMBANK | 3.8 | 4.3 | 5.2 | 4.5 | 5.2 | 5.1 |

| GPBANK | 3.2 | 3.72 | 5.05 | 5.4 | 5.75 | 5.85 |

| HDBANK | 3.85 | 3.95 | 5.1 | 4.7 | 5.5 | 6.1 |

| KIENLONGBANK | 3.7 | 3.7 | 5.2 | 5.3 | 5.6 | 5.7 |

| LPBANK | 3.4 | 3.5 | 4.7 | 4.8 | 5.1 | 5.6 |

| MB | 3.3 | 3.7 | 4.4 | 4.4 | 5.1 | 5 |

| MSB | 3.7 | 3.7 | 4.6 | 4.6 | 5.4 | 5.4 |

| NAM A BANK | 3.5 | 4.1 | 5 | 5.2 | 5.6 | 5.7 |

| NCB | 3.8 | 4.1 | 5.45 | 5.65 | 5.8 | 6.15 |

| OCB | 3.9 | 4.1 | 5.1 | 5.1 | 5.2 | 5.4 |

| OCEANBANK | 3.8 | 4.2 | 5 | 5.1 | 5.6 | 6.1 |

| PGBANK | 3.2 | 3.7 | 5 | 5 | 5.5 | 5.8 |

| PVCOMBANK | 3.3 | 3.6 | 4.5 | 4.7 | 5.1 | 5.8 |

| SACOMBANK | 3.3 | 3.6 | 4.9 | 4.9 | 5.4 | 5.6 |

| SAIGONBANK | 3.3 | 3.6 | 4.8 | 4.9 | 5.8 | 6 |

| SCB | 1.6 | 1.9 | 2.9 | 2.9 | 3.7 | 3.9 |

| SEABANK | 2.95 | 3.45 | 3.75 | 3.95 | 4.5 | 5.45 |

| SHB | 3.5 | 3.8 | 5 | 5.1 | 5.5 | 5.8 |

| TECHCOMBANK | 3.25 | 3.45 | 4.55 | 4.55 | 4.95 | 4.95 |

| TPBANK | 3.5 | 3.8 | 4.7 | 5.2 | 5.4 | |

| VIB | 3.2 | 3.6 | 4.6 | 4.6 | 5.1 | |

| VIET A BANK | 3.4 | 3.7 | 4.8 | 4.8 | 5.4 | 5.7 |

| VIETBANK | 3.8 | 4 | 5.2 | 5 | 5.6 | 5.9 |

| VPBANK | 3.6 | 3.8 | 5 | 5 | 5.5 | 5.5 |

According to statistics, since the beginning of September, 8 banks have increased deposit interest rates including: Dong A Bank, OceanBank, VietBank, GPBank, Agribank, Bac A Bank, NCB and OCB. On the contrary, ABBank is the first bank to reduce deposit interest rates, with a reduction of 0.1-0.4%/year for terms of 1-12 months. |

Source: https://vietnamnet.vn/lai-suat-ngan-hang-ngay-September 16, 2024-soi-muc-lai-suat-khong-chinh-thuc-cao-nhat-2322476.html

Comment (0)