Orient Commercial Joint Stock Bank (OCB ) has just increased its deposit interest rates from today. Specifically, OCB increased the deposit interest rates by 0.2%/year for terms from 1-8 months, and by 0.1%/year for terms from 9-11 months. The interest rates for terms from 12-36 months remain the same.

According to the online interest rate table, 1 month term is 3.9%/year, 2 months is 4%/year, 3-4 months is 4.1%/year, and 5 months is 4.5%/year.

Also with an increase of 0.2%/year, the bank interest rate for 6-8 month term is listed at 5.1%/year.

OCB increased 0.1%/year interest rate for 9-11 month term deposits to 5.1%/year.

Currently, interest rates for 12-15 month terms remain at 5.2%/year, 18 months at 5.4%/year, 21 months at 5.5%/year, 24 months at 5.6%/year, and 36 months at 5.8%/year.

OCB is also the only bank to adjust savings interest rates this morning. Previously, this bank had reduced 0.2%/year deposit interest rates for 24-36 month terms on August 16 after 4 consecutive interest rate increases in June and July.

According to statistics, since the beginning of September, 8 banks have increased deposit interest rates including: Dong A Bank, OceanBank, VietBank, GPBank, Agribank , Bac A Bank, NCB, and OCB.

On the contrary, ABBank is the first bank to reduce deposit interest rates by 0.1-0.4%/year for terms of 1-12 months.

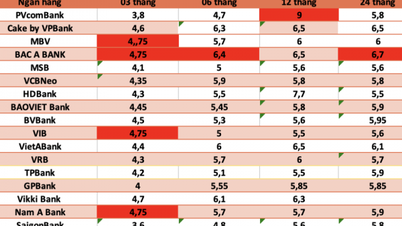

| HIGHEST INTEREST RATES AT BANKS ON SEPTEMBER 13, 2024 (%/YEAR) | ||||||

| BANK | 1 MONTH | 3 MONTHS | 6 MONTHS | 9 MONTHS | 12 MONTHS | 18 MONTHS |

| AGRIBANK | 2 | 2.5 | 3.3 | 3.3 | 4.7 | 4.7 |

| BIDV | 2 | 2.3 | 3.3 | 3.3 | 4.7 | 4.7 |

| VIETINBANK | 2 | 2.3 | 3.3 | 3.3 | 4.7 | 4.7 |

| VIETCOMBANK | 1.6 | 1.9 | 2.9 | 2.9 | 4.6 | 4.6 |

| ABBANK | 3.2 | 3.7 | 5 | 5.2 | 5.6 | 5.7 |

| ACB | 3 | 3.4 | 4.15 | 4.2 | 4.8 | |

| BAC A BANK | 3.65 | 3.95 | 5.15 | 5.25 | 5.7 | 5.85 |

| BAOVIETBANK | 3.3 | 4 | 5.2 | 5.4 | 5.8 | 6 |

| BVBANK | 3.7 | 3.8 | 5.1 | 5.5 | 5.8 | 6 |

| CBBANK | 3.8 | 4 | 5.55 | 5.5 | 5.7 | 5.85 |

| DONG A BANK | 3.8 | 4 | 5.2 | 5.5 | 5.8 | 6 |

| EXIMBANK | 3.8 | 4.3 | 5.2 | 4.5 | 5.2 | 5.1 |

| GPBANK | 3.2 | 3.72 | 5.05 | 5.4 | 5.75 | 5.85 |

| HDBANK | 3.85 | 3.95 | 5.1 | 4.7 | 5.5 | 6.1 |

| KIENLONGBANK | 3.7 | 3.7 | 5.2 | 5.3 | 5.6 | 5.7 |

| LPBANK | 3.4 | 3.5 | 4.7 | 4.8 | 5.1 | 5.6 |

| MB | 3.3 | 3.7 | 4.4 | 4.4 | 5.1 | 5 |

| MSB | 3.7 | 3.7 | 4.6 | 4.6 | 5.4 | 5.4 |

| NAM A BANK | 3.5 | 4.1 | 5 | 5.2 | 5.6 | 5.7 |

| NCB | 3.8 | 4.1 | 5.45 | 5.65 | 5.8 | 6.15 |

| OCB | 3.9 | 4.1 | 5.1 | 5.1 | 5.2 | 5.4 |

| OCEANBANK | 3.8 | 4.2 | 5 | 5.1 | 5.6 | 6.1 |

| PGBANK | 3.2 | 3.7 | 5 | 5 | 5.5 | 5.8 |

| PVCOMBANK | 3.3 | 3.6 | 4.5 | 4.7 | 5.1 | 5.8 |

| SACOMBANK | 3.3 | 3.6 | 4.9 | 4.9 | 5.4 | 5.6 |

| SAIGONBANK | 3.3 | 3.6 | 4.8 | 4.9 | 5.8 | 6 |

| SCB | 1.6 | 1.9 | 2.9 | 2.9 | 3.7 | 3.9 |

| SEABANK | 2.95 | 3.45 | 3.75 | 3.95 | 4.5 | 5.45 |

| SHB | 3.5 | 3.8 | 5 | 5.1 | 5.5 | 5.8 |

| TECHCOMBANK | 3.25 | 3.45 | 4.55 | 4.55 | 4.95 | 4.95 |

| TPBANK | 3.5 | 3.8 | 4.7 | 5.2 | 5.4 | |

| VIB | 3.2 | 3.6 | 4.6 | 4.6 | 5.1 | |

| VIET A BANK | 3.4 | 3.7 | 4.8 | 4.8 | 5.4 | 5.7 |

| VIETBANK | 3.8 | 4 | 5.2 | 5 | 5.6 | 5.9 |

| VPBANK | 3.6 | 3.8 | 5 | 5 | 5.5 | 5.5 |

Source: https://vietnamnet.vn/lai-suat-ngan-hang-ngay-13-9-2024-ngan-hang-thu-8-tang-lai-suat-tu-dau-thang-2321579.html

![[Photo] General Secretary To Lam receives the Director of the Academy of Public Administration and National Economy under the President of the Russian Federation](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F08%2F1765200203892_a1-bnd-0933-4198-jpg.webp&w=3840&q=75)

Comment (0)