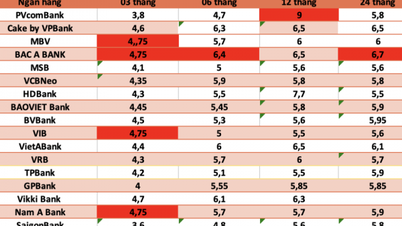

Bank interest rates today February 17, 2025, small-scale banks are leading the market in 6-month term deposit interest rates. There are still banks that only list this term at 2.9%/year

Today (February 17) continues to be a day when the market does not record any bank adjusting deposit interest rates. For 6-month deposit interest rates, small-scale banks are the ones paying the highest interest rates.

However, compared with interest rates for terms of 12 months or more, the interest rate difference for terms of 6 months is quite large.

Specifically, VCBNeo Bank is leading in online deposit interest rates for 6-month terms with the highest rate of 5.85%/year. Meanwhile, KienlongBank is second when paying interest rates of 5.8%/year for online deposits for this term. These are also the two banks leading in 9-month deposit interest rates, up to 5.8%/year.

After the two banks above, DongA Bank (now Vikki Bank) is the only bank applying an interest rate of 5.5%/year for 6-month term deposits.

MBV and ABBank both listed interest rates for this term at 5.5%/year.

Three banks BaoVietBank, BVBank and NCB are listing interest rates of 5.45%/year for 6-month online deposits.

5.4%/year is the interest rate for the same term listed by Eximbank and VietBank, while IVB and GPBank both listed the interest rate at 5.35%/year.

HDBank (5.3%/year), OCB, Viet A Bank (5.2%/year), LPBank (5.1%/year) and Bac A Bank (5.05%/year) are the remaining banks listing 6-month term deposit interest rates at over 5%/year.

Some banks listed this term interest rate at 5% such as: MSB, Nam A Bank, PGBank,SHB and VPBank.

The 6-month term interest rate under 5%/year is still applied by many banks. Of which, Sacombank and VIB are listed at 4.9%/year; TPBank and Saigonbank 4.8%/year; Techcombank 4.65%/year; MB 4.6%/year; PVCombank 4.5%/year;ACB 4.2%/year.

Some banks also listed 6-month term interest rates below 4%/year. Of which, the savings interest rate at SeABank is 3.95%/year, at Agribank 3.7%/year, BIDV and VietinBank listed deposit interest rates at 3.3%/year for 6-month term.

In particular, Vietcombank and SCB only listed interest rates of 2.9%/year for 6-month online deposits.

According to statistics, banks adjusting interest rates since the beginning of February 2025 include: TPBank (reducing deposit interest rates for terms of 1 - 2 - 3 and 12 months), Techcombank (increasing interest rates for terms of 6-36 months), Bac A Bank (reducing interest rates for 1-36 months) and Eximbank (increasing interest rates for 1-12 months, reducing interest rates for 15-36 months), Viet A Bank (increasing interest rates for terms of 12-36 months).

| INTEREST RATE TABLE FOR ONLINE DEPOSITS ON FEBRUARY 17, 2025 AT BANKS (%/YEAR) | ||||||

| BANK | 1 MONTH | 3 MONTHS | 6 MONTHS | 9 MONTHS | 12 MONTHS | 18 MONTHS |

| VCBNEO | 4.15 | 4.35 | 5.85 | 5.8 | 6 | 6 |

| KIENLONGBANK | 4.3 | 4.3 | 5.8 | 5.8 | 6.1 | 6.1 |

| VIKKI BANK | 4.1 | 4.3 | 5.55 | 5.7 | 5.8 | 6.1 |

| ABBANK | 3.2 | 4 | 5.5 | 5.6 | 5.8 | 5.6 |

| MBV | 4.3 | 4.6 | 5.5 | 5.6 | 5.8 | 6.1 |

| BAOVIETBANK | 3.3 | 4.35 | 5.45 | 5.5 | 5.8 | 6 |

| BVBANK | 3.95 | 4.15 | 5.45 | 5.75 | 6.05 | 6.35 |

| NCB | 4.1 | 4.3 | 5.45 | 5.55 | 5.7 | 5.7 |

| EXIMBANK | 4.1 | 4.4 | 5.4 | 5.4 | 5.6 | 6.5 |

| VIETBANK | 4.2 | 4.4 | 5.4 | 5 | 5.8 | 5.9 |

| GPBANK | 3.5 | 4.02 | 5.35 | 5.7 | 6.05 | 6.15 |

| IVB | 4 | 4.35 | 5.35 | 5.35 | 5.95 | 6.05 |

| HDBANK | 3.85 | 3.95 | 5.3 | 4.7 | 5.6 | 6.1 |

| OCB | 4 | 4.2 | 5.2 | 5.2 | 5.3 | 5.5 |

| VIET A BANK | 3.7 | 4 | 5.2 | 5.4 | 5.8 | 6 |

| LPBANK | 3.6 | 3.9 | 5.1 | 5.1 | 5.5 | 5.8 |

| BAC A BANK | 3.6 | 3.9 | 5.05 | 5.15 | 5.6 | 6 |

| MSB | 4.1 | 4.1 | 5 | 5 | 6.3 | 5.8 |

| NAM A BANK | 4.3 | 4.5 | 5 | 5.2 | 5.6 | 5.7 |

| PGBANK | 3.4 | 3.8 | 5 | 5 | 5.5 | 5.8 |

| SHB | 3.5 | 3.8 | 5 | 5.1 | 5.5 | 5.8 |

| VPBANK | 3.8 | 4 | 5 | 5 | 5.5 | 5.5 |

| SACOMBANK | 3.3 | 3.6 | 4.9 | 4.9 | 5.4 | 5.6 |

| VIB | 3.8 | 3.9 | 4.9 | 4.9 | 5.3 | |

| SAIGONBANK | 3.3 | 3.6 | 4.8 | 4.9 | 5.8 | 6 |

| TPBANK | 3.5 | 3.8 | 4.8 | 4.9 | 5.2 | 5.5 |

| TECHCOMBANK | 3.35 | 3.65 | 4.65 | 4.65 | 4.85 | 4.85 |

| MB | 3.7 | 4 | 4.6 | 4.6 | 5.1 | 5.1 |

| PVCOMBANK | 3.3 | 3.6 | 4.5 | 4.7 | 5.1 | 5.8 |

| ACB | 3.1 | 3.5 | 4.2 | 4.3 | 4.9 | |

| SEABANK | 2.95 | 3.45 | 3.95 | 4.15 | 4.7 | 5.45 |

| AGRIBANK | 2.4 | 3 | 3.7 | 3.7 | 4.7 | 4.7 |

| BIDV | 2 | 2.3 | 3.3 | 3.3 | 4.7 | 4.7 |

| VIETINBANK | 2 | 2.3 | 3.3 | 3.3 | 4.7 | 4.7 |

| SCB | 1.6 | 1.9 | 2.9 | 2.9 | 3.7 | 3.9 |

| VIETCOMBANK | 1.6 | 1.9 | 2.9 | 2.9 | 4.6 | 4.6 |

Source: https://vietnamnet.vn/lai-suat-ngan-hang-hom-nay-17-2-2025-ky-han-6-thang-cao-nhat-bao-nhieu-2371907.html

![[Photo] National Assembly Chairman Tran Thanh Man holds talks with President of the Senate of the Czech Republic Milos Vystrcil](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F11%2F21%2F1763715853195_ndo_br_bnd-6440-jpg.webp&w=3840&q=75)

![[Photo] General Secretary To Lam receives President of the Senate of the Czech Republic Milos Vystrcil](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F11%2F21%2F1763723946294_ndo_br_1-8401-jpg.webp&w=3840&q=75)

![[Photo] Visit Hung Yen to admire the "wooden masterpiece" pagoda in the heart of the Northern Delta](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F11%2F21%2F1763716446000_a1-bnd-8471-1769-jpg.webp&w=3840&q=75)

![[Photo] President Luong Cuong receives Speaker of the Korean National Assembly Woo Won Shik](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F11%2F21%2F1763720046458_ndo_br_1-jpg.webp&w=3840&q=75)

Comment (0)