Update average interest rate March

Regarding deposit interest rates, the average VND deposit interest rate of domestic commercial banks is at 0.1-0.2%/year for demand deposits and deposits with terms of less than 1 month; 3.1-4.0%/year for deposits with terms from 1 month to less than 6 months; 4.5-5.4%/year for deposits with terms from 6 months to 12 months; 4.8-6.0%/year for deposits with terms from over 12 months to 24 months and 6.9-7.1%/year for terms over 24 months.

|

| Recent interest rate market developments |

Thus, the average interest rate of commercial banks for customers in March remained unchanged and stable compared to February.

Meanwhile, the average lending interest rate of domestic commercial banks for new and old outstanding loans is at 6.6-9.0%/year (6.7-9.0%/year in February). The average short-term lending interest rate in VND for priority sectors is about 3.9%/year, continuing to be lower than the maximum short-term lending interest rate as prescribed by the State Bank (4%/year).

Interbank interest rates tend to decrease

The State Bank also has the latest update on the interbank market for the week from April 14 to April 18, 2025.

Regarding transaction turnover, according to reports of credit institutions and foreign bank branches through the statistical reporting system, transaction turnover in the interbank market during the period in VND reached approximately VND 2,464,399 billion, an average of VND 492,880 billion/day, an increase of VND 4,489 billion/day compared to the previous week; transaction turnover in USD converted to VND during the week reached approximately VND 544,614 billion, an average of VND 108,923 billion/day, a decrease of VND 3,590 billion/day compared to the previous week.

By maturity, VND transactions mainly focus on overnight terms (93% of total VND transaction turnover) and 1-week terms (2% of total VND transaction turnover). For USD transactions, the terms with the largest turnover are overnight and 1-week terms with proportions of 86% and 9% respectively.

|

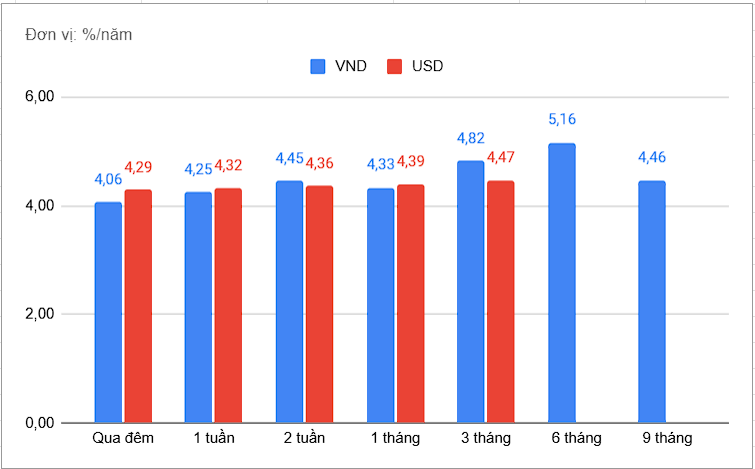

| Average interbank interest rates of key terms in the week from April 14 to 18, 2025 |

Regarding interest rate developments in this market, for transactions in VND: Average interest rates tend to decrease in most key terms compared to last week. Specifically, average interest rates for overnight, 1-week and 1-month terms decreased by 0.07%/year, 0.08%/year and 0.19%/year, respectively, to 4.06%/year, 4.25%/year and 4.33%/year.

Meanwhile, for USD transactions: Average interest rates for terms tend to fluctuate less compared to last week. Specifically, the average interest rates for overnight and 1-week terms remained unchanged compared to last week and remained at 4.29%/year and 4.32%/year, respectively. The average interest rate for 1-month terms decreased slightly by 0.02%/year to 4.39%/year.

Source: https://thoibaonganhang.vn/lai-suat-huy-dong-dien-bien-on-dinh-163190.html

![[Infographic] Cross exchange rates of Vietnamese Dong with some foreign currencies to determine taxable value from May 1-7](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/5/2/e4631afaeaf54451b5132f3c5d3341cd)

![[Photo] Thousands of Buddhists wait to worship Buddha's relics in Binh Chanh district](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/5/3/e25a3fc76a6b41a5ac5ddb93627f4a7a)

Comment (0)