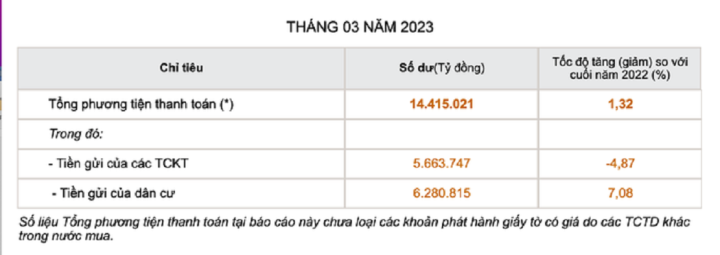

The State Bank has just announced the data on customer deposits at credit institutions as of the end of March 2023, showing surprising numbers. Accordingly, while deposits of economic organizations decreased sharply by 4.87% compared to the end of last year, reaching more than VND 5.66 million billion, deposits of residents increased sharply by 7.08% and reached more than VND 6.28 million billion.

If calculated from the beginning of 2023 until now, people's deposits have exceeded 6 million billion VND and have continuously increased. Within 3 months of this year, people have deposited an additional 415,000 billion VND into the banking system.

Deposits from individuals increased sharply, in contrast to the decline in deposits from economic organizations.

People's deposits in the banking system increased in the context of high savings interest rates in late 2022 and early 2023. It was not until mid-March that the State Bank began to reduce operating interest rates and after about 3 months, it has reduced operating interest rates 3 times.

At this time, the mobilization interest rate has decreased rapidly. Many banks only mobilize the highest interest rate of around 8%/year in the joint stock commercial bank sector, while in state commercial banks, the highest interest rate is about 6.8%/year.

Analysis by some experts shows that people's deposits in the banking system are increasing rapidly while other investment channels such as real estate, stocks, gold, foreign currencies, etc. are not attractive. Stocks have only been on the rise for about 2 months now and officially surpassed the 1,100 point mark in early June.

Meanwhile, economic organizations' deposits have decreased sharply compared to the end of last year, reflecting difficulties forcing businesses to withdraw payment deposits and savings deposits to pay for production, business and investment activities, instead of having "plenty" of cash as before.

Analysts from SSI Securities Company said that the deposit interest rate level continues to cool down in terms, but is still quite differentiated between groups of state-owned commercial banks and joint-stock banks for terms over 6 months.

In its recently published June strategy report, Yuanta Vietnam Securities Company said that the current average 12-month deposit interest rate listed at commercial banks has fallen to below 8%/year.

The State Bank also requires banks to reduce lending rates by using credit limits for management. Therefore, interest rates are continuing to decrease, however, lending rates have a lag in decreasing due to slow credit growth.

(Source: Lao Dong Newspaper)

Useful

Emotion

Creative

Unique

Source

![[Photo] Urgently help people soon have a place to live and stabilize their lives](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F09%2F1765248230297_c-jpg.webp&w=3840&q=75)

![[Photo] General Secretary To Lam works with the Standing Committees of the 14th Party Congress Subcommittees](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/12/09/1765265023554_image.jpeg)

Comment (0)