Information on banking performance in the first 6 months of 2023 and implementation of tasks for the last 6 months of 2023 of the State Bank shows that by the end of June 2023, the average deposit and lending interest rates of new transactions in VND of commercial banks decreased by about 1.0%/year compared to the end of 2022.

At the same time, commercial banks have proactively adjusted and implemented preferential credit programs/packages to reduce lending interest rates by about 0.5-3.0%/year depending on the customer for new loans.

All customers get 1% interest rate reduction per year

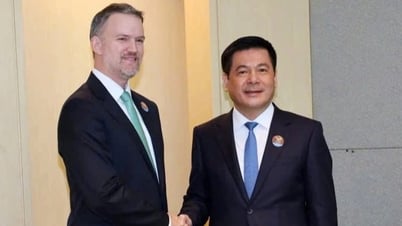

Mr. Nguyen Thanh Tung, General Director of the Joint Stock Commercial Bank for Foreign Trade of Vietnam ( Vietcombank ) said that since the beginning of this year, Vietcombank has assigned credit growth targets to branches at about 13%. Mr. Tung assessed this as an important KPI in addition to the KPI on credit quality control.

Mr. Nguyen Thanh Tung, General Director of Joint Stock Commercial Bank for Foreign Trade of Vietnam (Vietcombank) said that Vietcombank has implemented many solutions to save operating costs. Photo: SBV

According to Mr. Tung, previously, Vietcombank had implemented many solutions to save operating costs, effectively manage liquidity in accordance with market developments, creating room to lower lending interest rates and maintain lending interest rates at the lowest level in the market.

In the first 6 months of the year, Vietcombank pioneered 10 reductions in deposit interest rates and 5 reductions in lending interest rates for all segments of individual and corporate customers. At the same time, Vietcombank implemented many reductions in lending interest rates for existing customer loans.

Mr. Nguyen Thanh Tung said that, accumulated to June 30, 2023, Vietcombank has reduced nearly VND 1,300 billion in interest for more than 242,000 customers with outstanding debt of more than VND 1 million billion, accounting for 87% of Vietcombank's total outstanding debt.

Vietcombank also pioneered the policy of exempting all management fees and money transfer fees on the digital banking channel Digibank, helping tens of millions of individual customers save thousands of billions of VND in transaction fees each year, thereby actively contributing to the implementation of the Government 's Project on developing non-cash payments.

Mr. Phan Duc Tu - Chairman of the Joint Stock Commercial Bank for Investment and Development of Vietnam ( BIDV ) said that BIDV has launched 25 preferential credit packages with a total scale of 484 trillion VND, reducing lending interest rates for corporate customers from 0.5%/year - 2%/year, for individual customers from 1%/year - 1.5%/year. From May 11, 2023, BIDV continues to reduce lending interest rates for customers to support economic recovery and development with a reduction of 0.3%/year - 0.8%/year.

With the interest rate support program from the State budget according to Decree 31 of the Government and Circular 03 of the State Bank, as of June 30, 2023, BIDV is providing interest rate support for hundreds of customers, with cumulative loan turnover of nearly 16 trillion VND and outstanding loan balance with interest rate support of over 5 trillion VND.

BIDV implements debt restructuring and maintains debt groups according to Circular No. 02/2023/TT-NHNN: By June 30, 2023, the outstanding debt with restructured repayment terms and maintained debt groups is about more than 20 trillion VND.

Mr. Tu Tien Phat, General Director of Asia Commercial Joint Stock Bank (ACB), said that implementing the policies of the Government and the State Bank, ACB has implemented many solutions to save costs, thereby reducing lending interest rates such as: Diversifying mobilization channels, making efforts to reduce average mobilization interest rates. Saving operating costs.

As a result, more than 500 billion was saved in the first 6 months of the year compared to the original plan; the cost-to-revenue ratio decreased from 40% to nearly 30%.

However, this process has faced many challenges because the average deposit interest rate has not decreased, or even increased in the first 6 months of the year compared to the end of the year, although the State Bank has lowered the operating interest rates 4 times and the banking system has continuously reduced deposit interest rates. ACB has reduced deposit interest rates 10 times.

In addition, ACB has implemented many solutions to encourage credit growth and reduce interest rates for borrowers, including:

Preferential loan program of 30 trillion, maximum reduction of 3% compared to the interest rate schedule. The program is widely applied to all customers, without limitation on subjects or fields. Up to now, 2/3 of the program budget has been disbursed, about 20 trillion applied to about 60 thousand customers.

Reduce interest rates by 0.5% - 2% for existing customers with loans that are due for interest rate changes. Summarizing the above programs, the first 6 months of the year is 488 billion, the first 9 months of 2023 is expected to be 900 billion and the whole year of 2023 is 1,000 billion. The bank also implements many business connection programs.

Many promotional packages up to 3% off

Not only reducing interest rates for all customers, many banks also implement some special interest rate programs for some specific subjects with interest rate reductions of up to 3%.

Mr. Nguyen Thanh Tung said that Vietcombank has proactively implemented many loan programs with preferential interest rates for priority segments and subjects: Preferential short-term loan program; Loan program for FDI customers; Fixed interest rate loan program for 1-5 years; Preferential production and business loan program for small and medium customers, business households; Interest rate assurance program...

Meanwhile, ACB has a 2% interest rate support package for customers. After more than 1 year of implementation, as of June 30, 2023, ACB has achieved positive results with total disbursement revenue of VND 1,529 billion, total outstanding balance of interest rate support loans of VND 647 billion.

BIDV implements the social housing lending program in accordance with Resolution No. 33/NQ-CP dated March 11, 2023 and Document 2308/NHNN-TD of the State Bank with a disbursement scale of VND 30,000 billion. BIDV is the first bank to announce the approval of credit for a social housing project in Phu Tho province in the program.

Mr. Phan Duc Tu, Chairman of BIDV Board of Directors, said that in the last 6 months of 2023, BIDV will continue to lower lending interest rates and continue to cut costs to minimize lending interest rates. Photo: SBV

In addition, the bank actively and promptly implemented preferential interest rate programs according to the direction of reducing the lending interest rate level of the Government and the State Bank. In the first 6 months of 2023, BIDV adjusted the lending interest rate floor 4 times from 1.1-1.3%/year.

Continue to lower interest rates

BIDV Chairman said: “In the last 6 months of 2023, BIDV will focus on closely following the direction of the Government and the State Bank. BIDV Bank will continue to propose solutions such as: Continuing to prioritize credit capital to serve the production and business activities of enterprises, especially priority areas, encouraging development according to the Government's policies and the direction of the State Bank; continuing to review processes and operations, increasing technology limits, continuing to lower lending interest rates, continuing to reduce costs, to minimize lending interest rates; continuing to implement interest rate support programs…”

Meanwhile, Vietcombank is researching digitalization of the entire lending process for small and medium-sized enterprises to significantly reduce the time for loan approval and appraisal, creating conditions for customers to quickly and conveniently access bank credit sources.

In the coming time, Vietcombank will continue to promote the implementation of the Government and the State Bank's instructions on simplifying and digitizing lending processes, continuing to reduce costs to lower lending interest rates to effectively support businesses and people to overcome difficulties, restore production and investment.

Source

![[Photo] Nearly 3,000 students moved by stories about soldiers](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/21da57c8241e42438b423eaa37215e0e)

![[Photo] More than 17,000 candidates participate in the 2025 SPT Competency Assessment Test of Hanoi National University of Education](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/e538d9a1636c407cbb211b314e6303fd)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting on science and technology development](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/ae80dd74c384439789b12013c738a045)

![[Photo] Readers line up to visit the photo exhibition and receive a special publication commemorating the 135th birthday of President Ho Chi Minh at Nhan Dan Newspaper](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/85b3197fc6bd43e6a9ee4db15101005b)

Comment (0)