Top interest rate reduced from 11.5% to 11%

Since the beginning of 2023, following the direction of the Prime Minister and the State Bank, the commercial banking system has continuously reduced deposit interest rates. Therefore, the deposit interest rate level has dropped to a much lower level than before.

Specifically, information released by the State Bank shows that by the end of June 2023, the average deposit and lending interest rates of new transactions in VND of commercial banks will decrease by about 1.0%/year compared to the end of 2022.

According to the State Bank, commercial banks have proactively adjusted and implemented preferential credit programs/packages to reduce lending interest rates by about 0.5-3.0%/year depending on the customer for new loans.

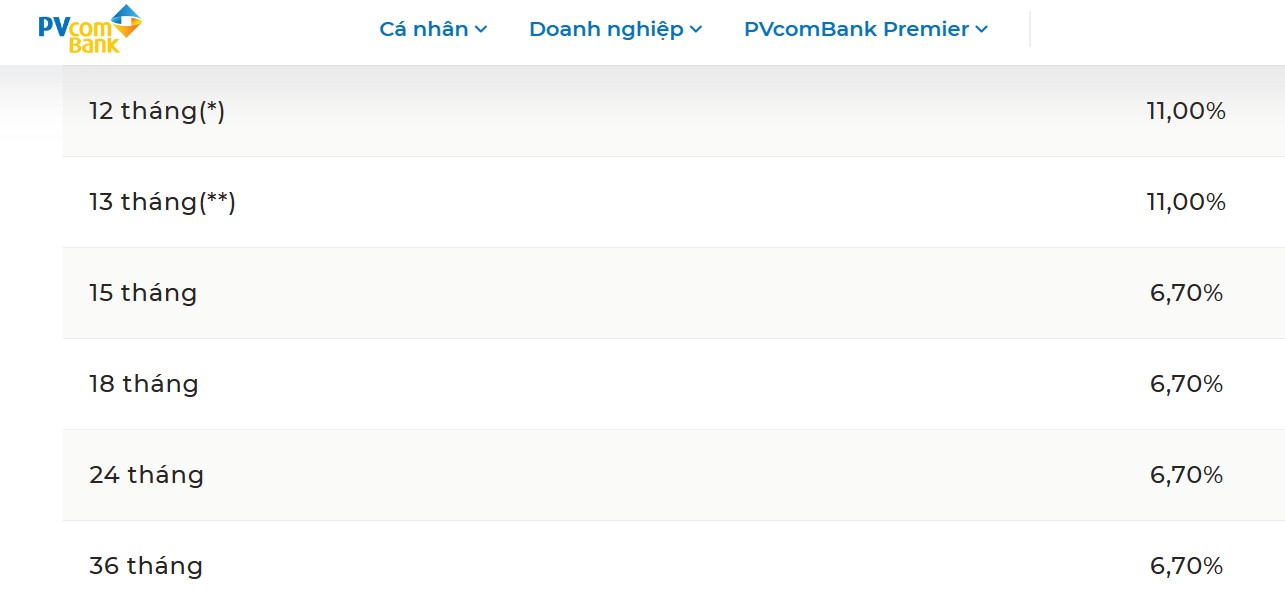

At PVCombank, the highest interest rate has been reduced from 11.5%/year to 11%/year, applied to deposits worth over VND2,000 billion. Screenshot

Not stopping there, by the end of July 2022, the mobilization interest rate continued to be adjusted to a lower level. Long-term interest rates have "broken" the 7%/year mark at many units.

As for banks with the highest deposit interest rates, the decision to adjust them down was also made not long ago.

For a long time, Vietnam Public Joint Stock Commercial Bank (PVCombank) has been in the position of a bank with outstandingly high deposit interest rates at 11.5%/year applied to 12-month and 13-month terms.

However, this incentive is not for the majority but only for the super rich when PVCombank stipulates a rate of 11.5% applied to new deposit contracts with a value of over 2,000 billion VND.

However, currently, PVCombank has adjusted this maximum rate down from 11.5%/year to 11%/year. The remaining conditions remain unchanged.

Meanwhile, the credit institution with the second highest interest rate on the market, An Binh Commercial Joint Stock Bank (ABBank), still maintains the figure of 10.9%/year applied for a 13-month period. And only customers depositing savings of over VND1,500 billion are eligible for this policy.

Ho Chi Minh City Development Joint Stock Commercial Bank (HDBank) is the unit with the third highest interest rate on the market. Accordingly, for a 13-month term and a deposit amount of over VND300 billion, customers will enjoy an interest rate of 9.1%/year. For a 12-month term and a deposit amount of over VND300 billion, the preferential rate will be 8.6%/year.

Vietnam-Russia Joint Venture Bank (VRB) once attracted attention when it listed its deposit interest rate at 8.9%/year. But recently, VRB has adjusted it down to 8.4%/year and is currently at 8.3%/year.

In addition, there is another bank with a mobilization interest rate of over 8%/year. That is Construction Bank (CB) with 8.4%/year.

Big4 reduces short-term interest rates

In interest rate cuts, Big4 (a group of 4 state-owned commercial banks including Joint Stock Commercial Bank for Foreign Trade of Vietnam - Vietcombank, Joint Stock Commercial Bank for Investment and Development of Vietnam - BIDV, Joint Stock Commercial Bank for Industry and Trade of Vietnam - VietinBank and Vietnam Bank for Agriculture and Rural Development - Agribank) are often the pioneers. Interest rates at Big4 are among the lowest in the market.

After a temporary "break", this weekend, Big4 suddenly reduced interest rates for short terms.

After the State Bank's most recent adjustment of operating interest rates to bring the ceiling interest rate down to 4.75%/year, Big4 applied terms under 6 months to below the ceiling.

Specifically, at Vietcombank, from the second half of June 2023, the interest rate for 4-month and 5-month terms will be below the ceiling, only 4.1%/year. For 2-month and 3-month terms, the interest rate is 3.4%/year.

However, from next week, the new listing schedule will be applied. Accordingly, the 4-month and 5-month terms will still maintain the interest rate of 4.1%/year. However, the interest rate for the 2-month and 3-month terms will decrease by 0.1% to 3.3%/year. The highest rate is still 6.3%/year for terms of 12 months or more.

For online savings, Vietcombank adjusted the 1-month term interest rate from 3.6%/year to 3.4%/year. The 3-month term interest rate decreased by 0.1 percentage point to 4.2%/year. The 6-month and 9-month term interest rates decreased by 0.1% to 5.1%/year.

At the rest of the Big4, the same thing is happening.

Source

![[Photo] National Assembly Chairman works with leaders of Can Tho city, Hau Giang and Soc Trang provinces](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/c40b0aead4bd43c8ba1f48d2de40720e)

![[Photo] The moment Harry Kane lifted the Bundesliga trophy for the first time](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/68e4a433c079457b9e84dd4b9fa694fe)

![[Photo] Discover the beautiful scenery of Wulingyuan in Zhangjiajie, China](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/1207318fb0b0467fb0f5ea4869da5517)

![[Photo] Prime Minister Pham Minh Chinh chairs the fourth meeting of the Steering Committee for Eliminating Temporary and Dilapidated Houses](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/e64c18fd03984747ba213053c9bf5c5a)

Comment (0)