According to the vision of "National digital transformation by 2025, orientation to 2030" approved by the Prime Minister, the goal by 2025 is to digitize 50% of banking operations, 70% of customer transactions conducted on digital channels and digitize 50% of retail loans and personal consumption. In order to implement the goals and directions of the Government, at the same time understanding the difficulties in accessing loans and wanting to create a solid shield for business households against market fluctuations, KiotViet has made efforts to cooperate with domestic and foreign banks to bring small traders convenient, easy and fast loan solutions right on its platform. Recently, the application has cooperated with MB Bank to deploy a capital support package of up to 1,000 billion VND exclusively for business owners at the end of the year. After only 3 months of implementation, the cooperation has supported more than 1,000 business households across the country. Capital up to 1,000 billion VND The financial support package is worth up to 1,000 billion VND with preferential interest rates, flexible conditions, simple and quick registration process. Specifically, customers who are business owners of the application in need of capital can quickly register for a loan of up to 300 million VND, without collateral and disburse online on the MBBank App. The maximum loan term is up to 12 months with attractive interest rates. In particular, customers receive dedicated consulting support from experts from both sides. Small traders using the service can easily access capital from MB, helping to supplement business resources to prepare abundant goods for the upcoming increased shopping demand. KiotViet representative said: "We understand that small traders need more sales management solutions, because they need more abundant capital to expand and develop during the period of high market demand. Therefore, this cooperation is an effort of KiotViet and MB in meeting the payment and loan needs of small traders, helping them increase efficiency." According to the representative of the unit, the reason KiotViet chose MB to implement the above cooperation is because MB is a leading bank in the retail customer segment, has great prestige as well as wide coverage in the national market. Along with that, the loan interest rate is good and the loan process is clear and transparent.

MB is committed to providing a solution to support the loan needs of small business customers with leading technology, speed and process, ensuring that it meets the needs and purposes of loans and business models, helping customers easily expand their business from direct to online.

Capital support package up to 1,000 billion exclusively for business owners

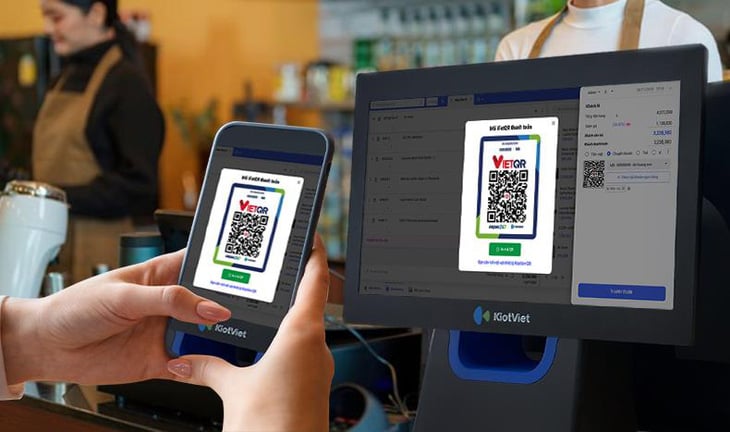

Payment cash flow management solution Along with the capital support solution for business owners, in this cooperation program, the two sides have also successfully integrated the payment solution and received dynamic QR transaction result notifications from the bank right on the application software. This is very necessary for business owners during the time when year-end shopping demand increases, the cashier counter is overloaded and customers always have to wait in line to pay. This seamless integration helps store owners track payment status right on the software screen. From there, revenue & cash flow management also becomes simpler, tighter & more effective.

Dynamic QR payment, receive MB account change notifications right on KiotViet

With the above mentioned cooperation program, both sides are committed to creating the most favorable conditions for small traders, helping them to do business effectively in favorable market times, while contributing to building a strong financial foundation for the small business community. Thereby accelerating the speed of goods circulation in the economy, supporting GDP growth. In the future, both sides will continue to expand cooperation, with many financial solutions suitable to the desire for the small trader community to develop sustainably and prosperously.

Source: https://tuoitre.vn/kiotviet-cung-mbbank-giai-ngan-goi-1-000-ti-tiep-suc-ho-kinh-doanh-20241127181044432.htm

![[Photo] Prime Minister Pham Minh Chinh receives Ambassador of the French Republic to Vietnam Olivier Brochet](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/13/f5441496fa4a456abf47c8c747d2fe92)

![[Photo] President Luong Cuong attends the inauguration of the international container port in Hai Phong](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/13/9544c01a03e241fdadb6f9708e1c0b65)

![[Photo] Prime Minister Pham Minh Chinh meets with US business representatives](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/13/5bf2bff8977041adab2baf9944e547b5)

Comment (0)