Chinese President Xi Jinping's efforts to change the country's growth model are facing unprecedented hurdles.

For decades, China has accelerated its economy by investing in factories, skyscrapers and roads. This model has produced breakneck growth, transforming China into the world's second-largest economy and the world's manufacturing powerhouse.

But now they face unprecedented hurdles. The $18 trillion economy is slowing. Consumers are reluctant to spend. Exports are down. Prices are falling, and more than 20% of young people are unemployed. Country Garden, the country’s largest private real estate developer with 3,000 projects, is at risk of default. Zhongzhi Enterprise Group, one of China’s largest underground banks, is facing customer backlash over delayed payments.

Much of this comes from China’s leaders’ efforts to shift its growth model away from relying as heavily on debt as previous governments , which has meant that even as the property crisis worsened, China has refrained from taking drastic measures.

This has led many foreign banks such as JPMorgan Chase, Barclays and Morgan Stanley to lower their growth forecasts for China this year, below the government's target of 5%. Foreign investors are also withdrawing money, forcing the People's Bank of China (PBOC) to seek ways to stop the yuan's decline.

A stalled highway project in Guizhou (China). Photo: Bloomberg

While the US has spent trillions of dollars supporting households and building infrastructure to stimulate the economy, Chinese President Xi Jinping wants to avoid relying on speculative construction and more debt for growth. Experts say the contrasting policies between the world’s two largest economies are changing global investment flows. It could also slow China’s overtaking of the US, or even prevent it from happening at all.

The biggest risk for Chinese officials is that their refusal to provide a strong stimulus could undermine confidence in the 1.4 billion-strong market. "China is experiencing a recession of expectations. When people expect growth to slow, it will slow," Bert Hofman, former World Bank country director for China, told Bloomberg.

In the worst case scenario, China could fall into the same stagnation that Japan has suffered over the past few decades, economists warned after July CPI figures showed China was slipping into deflation. Falling prices are a sign of weak demand and slowing future growth as households delay purchases, corporate profits fall and real borrowing costs rise.

SCMP commented that the lack of confidence in China’s economic growth is spreading, as the post-Covid-19 recovery gradually loses momentum. In the second quarter, the world’s second largest economy’s GDP increased by 6.3% compared to the same period last year. This rate is higher than the first quarter (4.5%), but lower than the forecast of many organizations.

Another indicator of economic confidence is the yuan, which has lost 6% of its value against the dollar since the start of the year. The yuan has fallen due to China’s monetary policy being at odds with the US, investor concerns about weak Chinese growth and the risk of defaults in the real estate sector.

In recent weeks, observers say Chinese authorities have been trying to prevent the yuan from falling too much. The PBOC has set a daily reference rate to help the yuan strengthen. State-owned banks have also been selling dollars.

Economists believe China is entering a period of much slower growth, due to its unfavorable demographics and its desire to be independent from the United States and its allies, which threatens foreign trade and investment. More than just a temporary slowdown, the Chinese economy could enter a period of prolonged stagnation.

"We are witnessing a change that could lead to the strongest turning point in economic history," Adam Tooze, a professor specializing in economic crisis research at Columbia University, commented on the Wall Street Journal.

In times of market volatility, a Chinese slide could trigger a global sell-off in risky assets. That happened in 2015, when China’s devaluation of the yuan and a stock market crash forced the Federal Reserve to halt rate hikes. That’s not the case now. But if things get worse, the Fed could have to cut rates sooner than expected.

China’s leaders aren’t sitting still, either. After a meeting last month, they made a number of proposals, including increased infrastructure spending, liquidity support for real estate firms and reduced home-buying regulations. Last week, China unexpectedly cut interest rates.

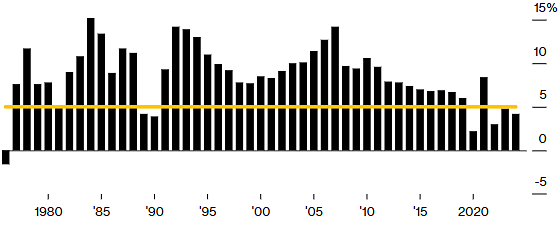

China's annual GDP growth rate since 1976. Chart: Bloomberg

A Global Times article last week also said that what China's economy needs most now is confidence. The announcement of the interest rate cut shows the government's determination to support the economy.

The Global Times acknowledged that China is facing many challenges, such as a weakening global economic recovery and unbalanced domestic growth. New problems that arose in the first half of this year have complicated the macro management of the country's authorities. However, they said that "China's economy is gradually recovering" and the country "has enough tools to maintain stable growth", for example, lowering interest rates.

In fact, some parts of China’s economy are still booming, like electric vehicles, solar, wind, and batteries. Investment and exports in these sectors are growing at double-digit rates—the kind of green, high-tech growth that China’s leaders crave. The country is also issuing bonds to fund high-speed rail and renewable energy projects at a world-class scale. It has also cut lending rates for businesses and provided generous subsidies for electric vehicle buyers.

Tourism and restaurants are also booming compared to last year’s lockdown. Starbucks reported a 46% increase in revenue in China last quarter. Domestic flights are 15% busier than before the pandemic. Travelers are complaining that low-cost hotels are increasing prices due to the surge in demand. All this is creating jobs, helping to ease officials’ concerns about unemployment.

The trouble is, these new growth engines are not enough to offset the huge property slump. Beijing estimates that the “new economy” (which includes green manufacturing and high-tech sectors) grew 6.5% in the first half of this year and accounts for about 17% of GDP. By contrast, construction spending fell 8% in the first half. The sector accounts for 20% of GDP, both directly and indirectly.

China's real estate market has been in turmoil since late 2020, when the government introduced the "three red lines" policy to curb the debt bubble and slow the rise in home prices. However, it also caused real estate companies to lose key capital. Real estate giant China Evergrande Group defaulted on its debt at the end of 2021 and filed for bankruptcy protection in the US last week. Recently, another major Chinese real estate company, Country Garden, also warned of "uncertainty" when considering its ability to repay bonds.

Property sales in China are now less than 50% of their 2020 peak. Not only are real estate and related industries (construction, steel, cement, glass) affected, but household confidence has also plummeted. This is because real estate accounts for about 70% of Chinese household assets, according to Citigroup. Real estate also accounts for 40% of assets held as collateral by banks.

Falling home prices make families feel poorer, forcing them to cut back on spending, further squeezing growth. As businesses reduce their profit expectations, cutting back on investment and hiring, the ripple effects are greater.

Some experts have called on Beijing to break this vicious cycle with confidence-building measures. PBOC adviser Cai Fang recently urged the government to provide direct support to consumers. Other economists have also suggested the government could borrow several trillion yuan (hundreds of billions of dollars) to stimulate consumption.

But Beijing has rejected these proposals. “The best way to support consumption is to support employment, which means supporting the corporate sector through tax cuts,” said Wang Tao, an economist at UBS. Xi has also repeatedly warned Chinese officials that growth should not be sacrificed for the environment, national security, and risk prevention.

However, observers say that the possibility of China taking drastic measures cannot be ruled out. For example, last year, the country suddenly abandoned its Zero Covid policy after 3 years of application.

Zhu Ning, a professor at the Shanghai Advanced Institute of Finance who advises the Chinese government, has noticed a recent shift in the authorities' view of the real estate sector. Zhu predicts that China will roll out more aggressive support measures.

"The question is whether they are willing to sacrifice fiscal deficits. Right now, they are hesitant. But economic reality may change their minds," he concluded.

Ha Thu (according to Bloomberg, WSJ, Global Times)

Source link

![[Answer] Should I install an elevator for an old renovated house?](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/11/25/1764039191595_co-nen-lap-thang-may-cho-nha-cai-tao-cu-khong-04.jpeg)

Comment (0)