Although not many Asia-Pacific economies have been targeted by the tariffs initiated by US President Donald Trump, they have still suffered significant impacts.

Regarding this issue, Thanh Nien recently had an interview with Mr. Danny Kim, an economist for the Asia- Pacific region (APAC) of Moody's Analytics, a Moody's Group specializing in financial services.

China's economy has been hit by a series of tariffs imposed by the Trump administration.

Still growing but with many difficulties

What is your assessment of the world economy and APAC in 2025? What are the biggest challenges?

The global economy will lose momentum in 2025 but will not collapse, although tariffs and trade wars weigh on exports and investment costs. We expect global growth to slow slightly to 2.6% this year.

Changes in US policy have led to high inflation in the country, causing the US Federal Reserve (Fed) to delay cutting its policy interest rate, so that the policy interest rate remains high. Therefore, central banks in other economies may also perceive the need to keep policy interest rates higher than previously expected to prevent their currencies from depreciating further. This will put pressure on consumer spending and investment in many regions in APAC.

The APAC economy will still grow in 2025 and 2026, but growth will be lower than what was projected before the US election in November 2024. In addition to weak domestic demand, a major challenge facing APAC economies is the threat of an escalating trade war.

Countries with large trade surpluses with the US and those that receive large amounts of foreign direct investment from China are particularly at risk from Washington’s tariffs. Many economies in both Southeast and Northeast Asia are at risk. Since exports are the engine of growth in most APAC economies, higher-than-expected tariffs or disruptions to supply chains would hurt these economies.

Direct and indirect risks, not easy to benefit

More specifically, how will APAC economies be affected by US President Donald Trump's increased tariffs?

Many APAC economies are heavily dependent on trade, so tariffs would hurt economic growth. China and some other export-dependent Southeast Asian economies would be hit in terms of commodity prices.

For APAC, after taking office, President Trump has mainly only made tax moves with China, but other economies in the region have not necessarily "escaped" because most APAC economies have trade surpluses with the US, so they are all in the sights of the US administration under Trump.

Even without US tariffs, APAC economies would still be negatively impacted by disruptions in US trade relations with China and other trading partners.

Some APAC economies may have benefited from the US-China trade war during Trump’s first term. But this time is different, as economies are unlikely to escape the pain. Indeed, export-dependent APAC economies may be particularly vulnerable to tariffs and worsening international trade relations.

What about Vietnam's economy in 2025, sir?

Vietnam’s economy will of course face many challenges despite growing more than 7% last year. The challenge comes from exports. Because the US-China trade war will damage growth and demand in both economies. Meanwhile, both the US and China are Vietnam’s main export markets. When the consumer market is affected, the number of orders will decrease.

Recommendations for Vietnam

So, in your opinion, what measures and policies should Vietnam have?

We expect Vietnam to continue to support the domestic economy to offset the risks from export growth. In January, the Vietnamese government extended a 2 percentage point reduction in value-added tax (VAT) rates for certain goods and services to boost domestic consumption and reduce business costs.

The State Bank of Vietnam should consider easing monetary policy to prevent the exchange rate from depreciating. In addition to direct demand-side support, the government will invest in infrastructure, which is important for long-term growth.

We also expect Vietnam to promote negotiations with the US to avoid or limit the application of tariff measures. In addition, Vietnam needs to find ways to diversify its export markets in Europe and elsewhere to reduce its dependence on the US and China markets.

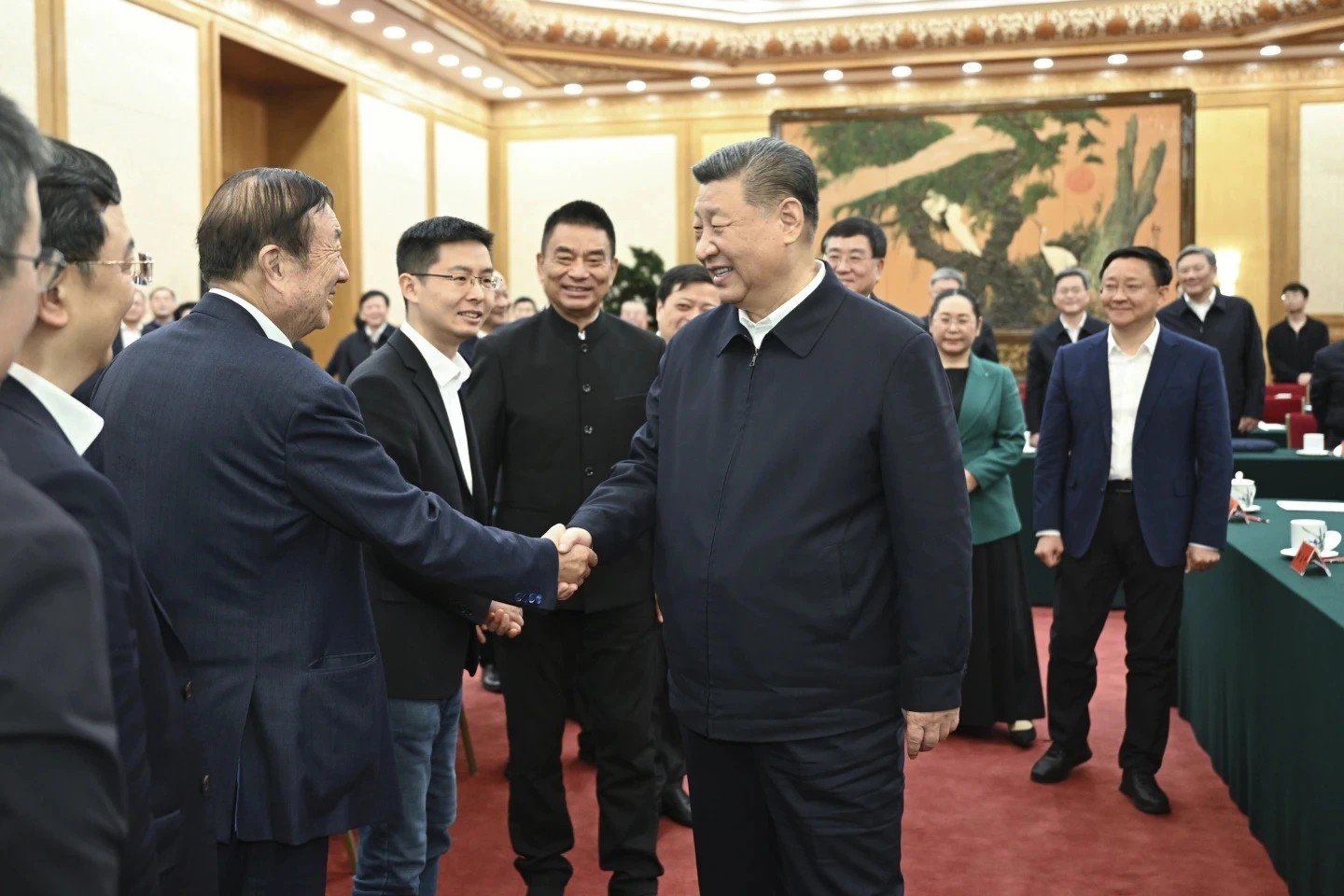

Xi Jinping meets with representatives of private enterprises on February 17.

Xi Jinping meets with private business leaders

During a meeting with private business leaders on February 17, Chinese President Xi Jinping stated that the private sector has broad prospects and huge potential in the new era. Xi affirmed that this is a "golden time" for businesses to fully develop their capabilities, Xinhua News Agency reported. At the meeting, Xi expressed his hope that all parties will make efforts to reach consensus and strengthen trust, thereby promoting the healthy and high-quality development of the private sector.

The leader said China is committed to firmly strengthening and developing the public sector while encouraging, supporting and guiding the development of the private sector. Xi Jinping pointed out the current difficulties and challenges that the private sector can overcome, and called for confidence in the future. He also affirmed that China will wholeheartedly protect the legitimate rights of private enterprises and entrepreneurs according to the law and remove barriers to allow enterprises to compete fairly in the market.

Bao Hoang

Source: https://thanhnien.vn/kinh-te-chau-a-thai-binh-duong-giua-vong-xoay-thuong-chien-185250218222000536.htm

![[Photo] Readers line up to visit the photo exhibition and receive a special publication commemorating the 135th birthday of President Ho Chi Minh at Nhan Dan Newspaper](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/85b3197fc6bd43e6a9ee4db15101005b)

![[Photo] Nearly 3,000 students moved by stories about soldiers](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/21da57c8241e42438b423eaa37215e0e)

Comment (0)