In the context of the world economy gradually stabilizing, Vietnam's economy in 2024 has recorded impressive progress. The most prominent is GDP growth with a forecast of 7.0% - 7.1%, leading the ASEAN region thanks to active support from the government in public investment and strong FDI attraction. The main drivers for the recovery include industrial production, international trade growth, public investment and flexible economic policies.

|

| Petrovietnam maintains an average crude oil production output of 7.5-8.5 million tons/year, and gas production of 6-8 billion m³/year. (Photo: Oil and gas exploitation on Vietnam's continental shelf.) |

Industrial production and international trade are the engines of growth.

In 2024, the industrial and construction sector will contribute 46.2% to the total GDP, with a growth rate of 8.2%. Of which, electricity production will increase by 11.1% compared to the same period in 2023, while the construction industry will increase by 7.5%. This is the result of efforts to boost public investment and encourage national infrastructure projects such as the North-South Expressway and Long Thanh Airport projects.

Vietnam’s industrial production index has increased by 8.4% since the beginning of the year, significantly higher than the 1% growth rate in the same period in 2023. The manufacturing of rubber products (+25.6%), furniture (+24.7%), and motor vehicles (+18.3%) recorded significant jumps. However, mining was the minus point, falling by 7.3% due to low oil and coal prices.

Looking at international trade, import and export will continue to be a highlight in 2024. This is not only a testament to the international integration capacity of the Vietnamese economy but also demonstrates its ability to adapt to global fluctuations. Export turnover reached about 369.9 billion USD, up 14.4% over the same period last year. This achievement has contributed to increasing foreign exchange reserves, consolidating macroeconomic stability, and creating more room for fiscal policies to promote investment and consumption. This increase not only reflects good momentum from key export industries such as electronics, machinery and wood, but also marks a strong recovery in international trade. This contributes to enhancing Vietnam's position in the global supply chain, while improving foreign exchange reserves, ensuring flexibility in fiscal and monetary policies.

“These benefits create a financial ‘buffer’, helping Vietnam better cope with global fluctuations and attract more international investors. This is a leap from the 6% decline in 2023. Some key export groups such as electronics (+26.3%), machinery (+21.6%) and wood (+21.2%) have achieved high growth,” said Ms. Tran Thi Khanh Hien, Director of Analysis at Military Commercial Joint Stock Bank Securities Company (MBS).

The US market continues to be Vietnam's largest export partner with a turnover of 108.9 billion USD, up 24%. Exports to the EU increased by 18.1%, while exports to China decreased slightly by 0.9%, showing that demand in China has not fully recovered.

On the other hand, imports increased sharply by 16.4%, especially production materials such as electronic equipment (+22.4%) and iron and steel (+20.3%). By the end of the year, Vietnam had a trade surplus of 24.3 billion USD, reflecting the balance between production and consumption. This surplus also shows the increase in the export capacity of high value-added products, helping to gradually reduce dependence on imported raw materials. This not only strengthens economic autonomy but also increases the competitiveness of Vietnamese goods in the international market.

Public investment spillover supports demand for the economy

According to MBS, Vietnam accelerated public investment in 2024, especially in national projects. Total public investment capital reached VND572 trillion in the first 11 months of 2024, completing 73.5% of the annual plan. However, achieving the 95% target is still a challenge due to difficulties in site clearance and administrative procedures. In particular, key projects such as the North-South Expressway and Long Thanh Airport have been accelerated thanks to drastic solutions from the government.

|

| The difficult process of completing the Song Hau 1 Thermal Power Plant Project has contributed to affirming that Vietnamese people and Vietnamese enterprises completely master technologies and large projects. |

In addition, the growth rate of capital disbursed from the state budget reached 2.4% over the same period, demonstrating efforts in optimizing capital sources. Projects such as the 500kV line 3 and key expressways have contributed to significantly improving transport capacity and promoting regional connectivity. The focus on public investment not only improves infrastructure but also creates a spillover effect, stimulating the activities of the industrial and construction sectors, thereby supporting comprehensive economic growth.

Realized FDI capital reached a five-year high of 21.68 billion USD, up 7.1%. Newly registered projects such as the Bio-BDO factory (730 million USD) and Foxconn Quang Ninh (contributing 278.2 million USD) are evidence of the trend of shifting supply chains to Vietnam. Notably, the processing and manufacturing industries continued to lead, accounting for 64.4% of the total newly registered FDI capital, demonstrating Vietnam's strong attraction in attracting high-tech and high value-added projects.

Realized FDI capital reached a five-year high of 21.68 billion USD, up 7.1%. Newly registered projects such as the Bio-BDO factory (730 million USD) and Foxconn Quang Ninh (contributing 278.2 million USD) are evidence of the trend of shifting supply chains to Vietnam.

Meanwhile, domestic consumption is gradually stabilizing. Total retail sales of goods in 2024 increased by 8.8%, but only 5.8% when excluding inflation. However, tourism was a bright spot with more than 15.8 million international visitors, up 41% compared to last year.

The government has introduced a number of policies to stimulate demand, such as reducing VAT to 8% by 2025 and increasing the basic salary by 30%. These policies have had a positive impact on domestic consumption, especially in the second half of 2024 when purchasing power improved significantly thanks to rising incomes and more stable prices. The retail and service sectors also recorded positive growth during this period, demonstrating the effectiveness of stimulus measures. However, people remain cautious in spending due to inflation risks.

Good control of inflation creates positive outlook for 2025

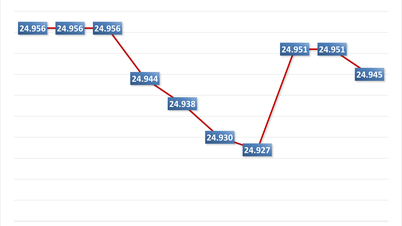

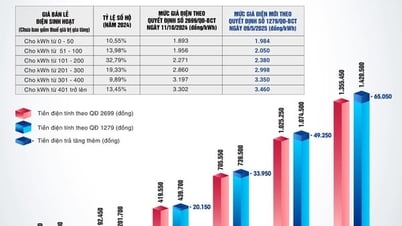

Statistics show that CPI in the first 11 months of the year increased by 3.7%, and is forecast to reach 3.9% for the whole year, lower than expected. The housing and construction materials group was the main factor causing the CPI increase (+5.2%), due to the increase in input material costs, rental costs along with the price of electricity (+7.7%) after EVN adjusted the average retail price of electricity since the end of last year. The food and catering services group also contributed greatly when the food group increased sharply by 13%. In addition, the education group increased by 5.98% due to the increase in tuition fees in some localities.

Although the highest CPI was recorded in May (4.4%), the cooling trend from June to the end of the year shows the government's effective motivation to control inflation. Flexible monetary policy, combined with measures to reduce production costs, has helped maintain a stable economic environment and restrain price pressures. Thanks to that, Vietnam has ensured an average CPI target of below 4%, creating the premise for other policy reforms in 2025. These are positive signs, creating conditions for maintaining a flexible monetary policy in 2025.

Regarding the 2025 outlook, MBS said that Vietnam is forecast to continue to maintain its growth momentum with GDP expected to exceed 7%. Driving factors include public investment in strategic projects such as the North-South Expressway and Long Thanh Airport, along with increased FDI inflows into key industries such as renewable energy and high technology. At the same time, free trade agreements (FTAs) will expand export markets, helping Vietnam diversify its trading partners and reduce risks from dependence on a few markets. Efforts to improve the investment environment and enhance national competitiveness will continue to be a solid foundation for Vietnam to maintain stable growth in the medium and long term.

Source: https://thoibaonganhang.vn/kinh-te-2024-phuc-hoi-vung-chac-tao-trien-vong-tich-cuc-cho-nam-2025-159218.html

![[Photo] Prime Minister Pham Minh Chinh starts construction of vital highway through Thai Binh and Nam Dinh](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/52d98584ccea4c8dbf7c7f7484433af5)

![[Photo] Buddha's Birthday 2025: Honoring the message of love, wisdom, and tolerance](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/8cd2a70beb264374b41fc5d36add6c3d)

![[Photo] General Secretary To Lam meets and expresses gratitude to Vietnam's Belarusian friends](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/c515ee2054c54a87aa8a7cb520f2fa6e)

Comment (0)