According to the Department of Trade Defense, Ministry of Industry and Trade, float glass products exported to the United States are required to be investigated for anti-dumping and anti-subsidy.

Float glass exported to the United States is subject to an investigation for anti-dumping and countervailing duties on products from China and Malaysia. Specifically, the Department of Trade Remedies, Ministry of Industry and Trade said that on November 21, 2024, the US Department of Commerce received a request for investigation and application of anti-dumping and countervailing duties on float glass products imported from China and Malaysia. The petition was filed by Vitro Flat Glass, LLC and Vitro Meadville Flat Glass, LLC.

|

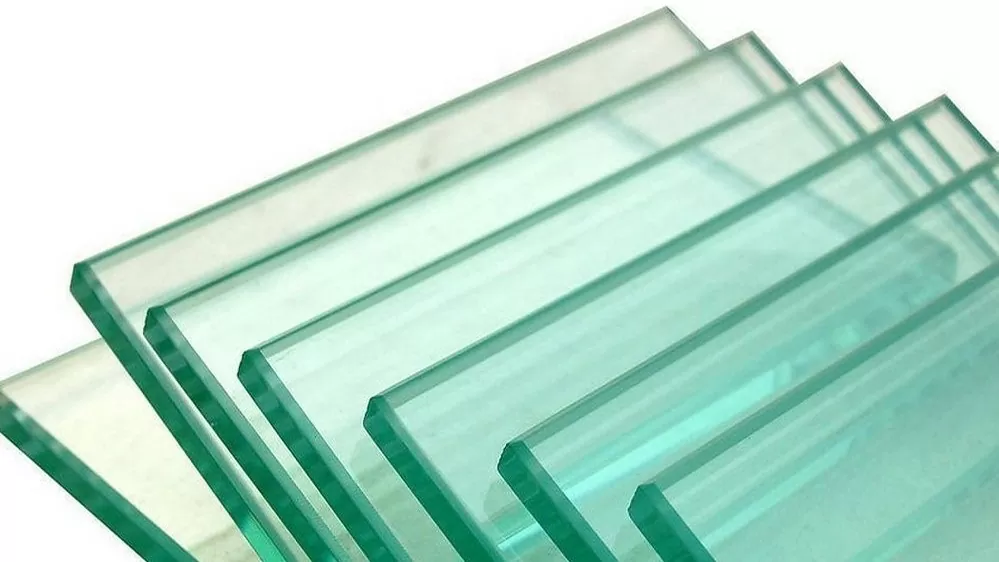

| The US Department of Commerce has accepted a petition to investigate and impose anti-dumping and countervailing duties on float glass products imported from China and Malaysia. Illustrative photo |

The scope of products proposed for investigation and application of anti-dumping and anti-subsidy measures are float glass products made from soda-lime-silica glass produced by floating a continuous strip of molten glass on a fine tin bath (or another liquid metal with a density greater than molten glass), cooling the glass in an annealing furnace and cutting it into suitable sizes. According to the request for investigation, the float glass products subject to the proposed investigation have a nominal thickness of at least 2.0 mm and a nominal surface area of at least 0.37 m2.

The country of origin of each float glass product is determined by the location where the glass was originally manufactured by floating a continuous strip of molten glass onto a fine tin bath and cooling the glass in an annealing furnace, regardless of the location where any further finishing or fabrication operations were performed. Prior to further processing, finishing, or fabrication, float glass products meet the requirements of Type I of ASTM-C1036 of the American Society for Testing and Materials.

Additionally, float glass products may be clear, tinted, tinted, or coated with one or more materials to alter their thermal insulation, electrical conductivity, noise reduction, durability, color, and/or light transmission. Examples of coated float glass products include low-emissivity (“Low-E”) architectural glass and frameless mirrors (i.e., flat glass with a silver, aluminum, or other reflective coating) such as mirror panels.

Float glass products may be annealed, chemically strengthened, heat strengthened or tempered to achieve the desired surface compression, in accordance with ASTM-C1048, ASTM-C1422/C1422M or other similar specifications. Float glass products may be further processed but not limited to finishing operations such as sandblasting, engraving, bending, beveling, notching, drilling, punching, embossing and engraving.

Float glass products may be unassembled or assembled. Examples of assembled float glass products include: Mirrors with one or more light-emitting diodes (“LEDs”) integrated into the mirror, as well as framed mirrors with one or more LEDs integrated into the mirror or mirror frame; and products consisting of two or more panes of glass bonded together with a polymer interlayer (i.e., laminated glass), as well as insulating glass units (“IGUs”), which consist of two or more panes of glass separated by a spacer material and sealed together at the edge to create a thermal barrier of air or one or more gases.

The scope of products subject to the proposed investigation includes, but is not limited to, glass products that meet one or more of the specifications, definitions and/or standards ASTM-C162, ASTM-C1036, ASTM-C1048, ASTM-C1172, ASTM-C1349, ASTM-C1376, ASTM-C1422/C1422M, ASTM-C1464, ASTM-C1503, ASTM-C1651, ASTM-E1300 and ASTM-E2190.

The products subject to the investigation are currently classified under the codes 7005.10.8000, 7005.21.1010, 7005.21.1030, 7005.21.2000, 7005.29.1810, 7005.29.1850, 7005.29.2500, 7007.29.0000, 7008.00.0000, 7009.91.5010, 7009.91.5095 and 7009.92.5010 of the Tariff Schedule of the United States (HTSUS). The products subject to the petition may also be classified under codes 7006.00.4010, 7006.00.4050 and 7007.19.0000. The commodity codes provided are for reference and comparison purposes only, the detailed description of the scope of the proposed product under investigation is the determining factor.

According to the investigation request, Chinese exporters are dumping at margins ranging from 91.05% to 165.11%, while Malaysian exporters are dumping at margins ranging from 141.87% to 344.43%. The investigation request also alleges that Chinese and Malaysian exporters receive significant subsidies, although the request does not specify the level of subsidies.

The US Department of Commerce is expected to make a decision on the investigation by December 11, 2024. Provisional countervailing duties on Chinese and Malaysian enterprises may be imposed from the end of April 2025. Provisional antidumping duties on enterprises may be imposed from the end of June 2025. Official antidumping and countervailing duties may be imposed no later than the end of December 2025.

The Trade Defense Department recommends that Vietnamese enterprises that produce and export float glass and float glass-related products that meet the above description to the United States should closely monitor the developments of the case. In the case of enterprises with large export volumes to the United States or with rapid growth, enterprises should be aware of the risk of the United States continuing to conduct anti-dumping investigations against Vietnamese products. Enterprises that use float glass imported from China and Malaysia as raw materials for production should be aware of the risk of the United States conducting evasion investigations in the event of export activities to this market.

At the same time, float glass manufacturing enterprises with products related to float glass can contact the Department for further guidance and advice in assessing trade defense risks if there are export activities to the US market.

Source: https://congthuong.vn/kinh-noi-xuat-khau-vao-hoa-ky-bi-yeu-cau-dieu-tra-chong-ban-pha-gia-chong-tro-cap-360735.html

![[Photo] Prime Minister Pham Minh Chinh holds talks with Prime Minister of the Kingdom of Thailand Paetongtarn Shinawatra](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/16/23b5dd1e595d429491a54e3c1548fb79)

![[Photo] Welcoming ceremony for Prime Minister of the Kingdom of Thailand Paetongtarn Shinawatra on official visit to Vietnam](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/16/cdd9e93739c54bb2858d76c3b203b437)

Comment (0)