Binh Duong Development and Business (TDC) issues 35 million shares to pay off debt

Binh Duong Trading and Development Joint Stock Company (Code: TDC) is a member of Becamex IDC, a unit specializing in real estate investment and business, construction and production, and trading of construction materials...

Recently, TDC has been approved by shareholders to issue shares to raise funds to pay off maturing bonds.

Specifically, Binh Duong Business and Development will issue 35 million TDC shares, the offering price will be authorized to the Board of Directors to decide but not lower than VND 10,000/share. The offering plan is expected to be implemented from the 4th quarter of 2024 to the 1st quarter of 2025. The offered shares will be restricted from transfer for 1 year from the end date of the offering.

Binh Duong Business and Development (TDC) issues 35 million shares to pay off debt (Photo TL)

The proceeds from the offering will be used to buy back a portion of the TDC.BOND.700.2020 bond lot before maturity.

This is an unsecured bond issued on November 9, 2020, expected to mature on November 15, 2025. The total face value of the bond is VND 700 billion. At the time of issuance, the purpose of raising capital from the bond is to pay dividends and late interest on dividends to the parent company, the Industrial Development and Investment Corporation - Becamex IDC Joint Stock Company.

TDC escaped losses in the second quarter thanks to financial revenue

Regarding business activities, in the second quarter of 2024, Binh Duong Business and Development recorded revenue of VND 115 billion, down 14.2% compared to the previous year. High cost of goods sold caused gross profit to only VND 1.1 billion, down 3% compared to the same period. This gross profit is almost not enough to maintain operating costs.

However, the financial revenue increased dramatically by 72 times, reaching 124.9 billion VND in Q2, helping TDC escape losses in Q2. This sudden increase was due to profits from business cooperation contracts, accounting for 123.2 billion VND.

Financial expenses were only 56.2 billion VND, with all financial expenses being interest expenses. Sales expenses and administrative expenses accounted for 13.9 and 14 billion VND, respectively. After deducting expenses and taxes, TDC reported a profit after tax of 74.2 billion VND, while in the same period it was losing 281.4 billion VND.

TDC's accumulated revenue in the first 6 months of the year reached 234.2 billion VND, profit after tax was 50.1 billion VND, mainly coming from financial profits recorded in the second quarter. Compared with the whole year's business target, revenue of 1,993 billion VND, profit after tax of 218 billion, TDC has only completed 11.8% of the revenue target and 22.9% of the year's profit target.

TDC continuously delays bond interest payments

One of the reasons why TDC had to mobilize money from shareholders to pay off bonds was due to business losses of hundreds of billions of dong.

In 2023, the company only achieved revenue of 301 billion but lost up to 403 billion VND. This is the first time TDC reported a loss and also a record loss, the highest in 13 years of being listed on the stock exchange. This loss has dragged down the entire business results, affecting the company's ability to repay debts.

Accordingly, TDC has continuously delayed bond interest payments 3 times for the TDC.BOND.2020.700 bond lot. Of which, the bond interest payable on February 15, 2023 is VND 23.8 billion. TDC only paid VND 7 billion on time and then paid the entire amount on February 23, 2023.

By May 15, 2023, the interest due is 24.2 billion VND of interest due but TDC only paid 10.2 billion VND. The remaining amount will be paid in full on May 26, 2023. Similarly, by November 15, 2023, the company must pay 20.29 billion VND of bond interest but only paid 3 billion VND and completed payment on November 17, 2023.

Although the delay in payment is not large, it also shows that TDC is having big problems with cash flow.

Source: https://www.congluan.vn/kho-khan-ve-dong-tien-kinh-doanh-va-phat-trien-binh-duong-tdc-phat-hanh-35-trieu-co-phieu-lay-tien-tra-no-post315787.html

![[Photo] Urgently help people soon have a place to live and stabilize their lives](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F09%2F1765248230297_c-jpg.webp&w=3840&q=75)

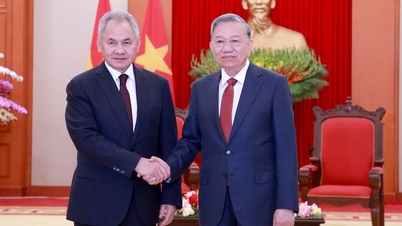

![[Photo] General Secretary To Lam works with the Standing Committees of the 14th Party Congress Subcommittees](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/12/09/1765265023554_image.jpeg)

Comment (0)