The application of electronic invoices from cash registers not only helps businesses and business households easily and quickly issue invoices, but also facilitates inspection and supervision by tax authorities. An Huy Restaurant, Hung Lam 3 residential group, Hong Thai ward (Viet Yen town) has been in the business of ordering rice, serving rice, and hot pot for many years. Previously, the restaurant issued electronic invoices, but it was not until early 2024 that the restaurant started using electronic invoices generated from cash registers directly connected to the management system of the Tax sector.

|

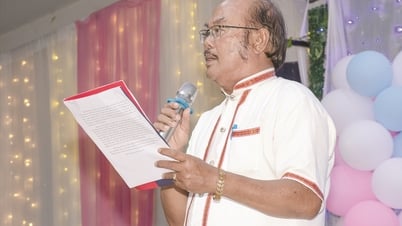

Officers of the Viet Yen-Hiep Hoa Inter-District Tax Team inspect the issuance of electronic invoices at An Huy restaurant, Hong Thai ward (Viet Yen town). |

According to Ms. Nguyen Thi Thu Trang, the restaurant owner, when using electronic invoices from the cash register, she does not have to bother declaring and paying taxes as before, but based on the restaurant's revenue, the tax authority reports the amount of tax to be paid. On average, each quarter, the restaurant pays more than 30 million VND in taxes to the State. According to statistics from the Viet Yen-Hiep Hoa Inter-District Tax Team, the entire town of Viet Yen has 29/117 business households and food and beverage establishments under management that have applied electronic invoices generated from the cash register.

In Bac Giang city, many food and beverage businesses use electronic invoices from cash registers. Mr. Nguyen Van Ha, an officer of the Bac Giang City Tax Team in charge of Dinh Ke ward and Hoang Van Thu ward, informed that up to now, 16 out of 40 tax-paying households in the two wards have applied electronic invoices generated from cash registers. With his function, Mr. Ha continues to propagate and mobilize the remaining households to equip cash registers to generate electronic invoices connected to the Tax sector.

At Dong Duong restaurant in Dinh Ke ward (Bac Giang city), it is known that due to the relatively large number of customers each day and stable revenue, the restaurant pays about 100 million VND in taxes each quarter. Previously, the restaurant spent a lot of time handwriting and checking invoices to issue to customers, sometimes making mistakes and having to cancel them, but applying invoices generated from the cash register is always accurate and saves time. Ms. Nguyen Thanh Huong, an accountant for a business that organizes parties here, said: "When using the service at this restaurant, when paying, we get the invoice quickly, without having to wait long."

Electronic invoices generated from cash registers will reduce errors in the invoicing process and increase transparency in business operations. At the same time, with invoice data continuously updated to the tax authority system, revenue management and inspection will be strict, effectively preventing fraud and tax evasion. According to the Tax Department of Region VI, electronic invoices generated from cash registers have been implemented quite well in many areas in the province. Notably, the petroleum industry, which was previously difficult to control and could result in tax losses, has since been promoted and all establishments have strictly complied with the provisions of the law. Thanks to this, the use of electronic invoices after each sale at petrol stations has become routine.

From the experience of implementing electronic invoices for petroleum business, the Tax sector continues to deploy electronic invoices generated from cash registers for food and beverage services. Up to now, excluding enterprises, the whole province has 142 households and individuals out of a total of 157 individual households and individuals in the food and beverage business that pay taxes according to declarations that have successfully deployed invoices generated from cash registers. These establishments are concentrated in Bac Giang city and Viet Yen town. However, because there is no mandatory regulation that all food and beverage service businesses must install electronic invoice generators, the sector continues to propagate and raise people's awareness to replicate the model of applying electronic invoices in food and beverage service businesses.

In fact, currently, households that are required to declare and pay taxes but have not yet used electronic invoices from cash registers pay lump-sum taxes. However, there is still a lack of accuracy and a risk of tax loss. To increase the rate of using electronic invoices from cash registers, the Tax Department regularly organizes training sessions on the convenience and regulations of tax laws so that businesses can voluntarily install cash register initialization devices; at the same time, guide businesses to apply electronic invoices; upgrade and maintain to ensure a smooth system to support and promptly remove difficulties and obstacles for taxpayers to fulfill their obligations to the state budget from the stages of registration, declaration, tax payment, and electronic tax refund without having to go directly to the tax authority.

Regarding the implementation of electronic invoices generated from cash registers for food and beverage services, speaking at the recent online national conference of the first session of the Government's Steering Committee on Science, Technology, Innovation and Digital Transformation, Prime Minister Pham Minh Chinh requested the Ministry of Finance to vigorously implement this content in June. The Prime Minister suggested that it is possible to study and make the regulation of installing electronic invoices from cash registers one of the mandatory conditions for food and beverage services. Only when there is a mandatory requirement can it be implemented synchronously and thoroughly.

Source: https://baobacgiang.vn/kinh-doanh-dich-vu-an-uong-nhan-rong-hoa-don-dien-tu-khoi-tao-tu-may-tinh-tien-postid415300.bbg

![[Photo] General Secretary attends the parade to celebrate the 80th anniversary of the victory over fascism in Kazakhstan](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/7/dff91c3c47f74a2da459e316831988ad)

![[Photo] Prime Minister Pham Minh Chinh receives delegation from the US-China Economic and Security Review Commission of the US Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/7/ff6eff0ccbbd4b1796724cb05110feb0)

![[Photo] Sparkling lanterns to celebrate Vesak 2025](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/7/a6c8ff3bef964a2f90c6fab80ae197c3)

Comment (0)