Nam Tan Uyen Industrial Park (NTC) third quarter profit growth thanks to deposits and dividends

Nam Tan Uyen Industrial Park Joint Stock Company (UPCoM code: NTC) has just announced its third quarter business results. Of which, net revenue reached VND54.3 billion, up 2% over the same period. Most of the revenue mainly comes from land leasing services with developed infrastructure at Nam Tan Uyen Industrial Park, Tan Uyen town, Binh Duong province.

Cost of goods sold was only recorded at VND 16.2 billion, gross profit reached VND 38.2 billion, equivalent to gross profit margin in the period increased from 69.2% to 70.3%.

Financial revenue increased by one and a half times, from 40 billion to 61.6 billion VND. This includes interest on deposits, interest on loans accounting for 29.7 billion VND, interest on deferred sales of 4.1 billion VND and dividends distributed accounting for 27.9 billion.

Nam Tan Uyen Industrial Park (NTC) profit growth in Q3 mainly thanks to deposit interest (Photo TL)

This dividend is the dividend distributed from related parties including: 15.2 billion VND dividend from Bac Dong Phu Industrial Park JSC; 8.1 billion VND from Binh Long Rubber Industrial Park JSC.

Financial revenue increased sharply while financial expenses only accounted for 2.5 billion VND. This created a driving force to help NTC's second quarter profit grow compared to the same period. The after-tax profit of Nam Tan Uyen Industrial Park reached 76.7 billion VND, up 25.9%.

In fact, without the above-mentioned sudden increase in financial revenue, NTC's third-quarter profit would have seen negative growth compared to the same quarter last year.

NTC's cumulative revenue in the first 9 months of the year reached 172.5 billion VND, profit after tax reached 232 billion VND. Compared with the 2023 target, revenue of 812.5 billion VND, profit after tax of 284.4 billion VND, NTC has currently completed 35% of the revenue plan and 81.5% of the annual profit target.

Long-term debt is nearly 3,000 billion, 3 times higher than equity

At the end of the third quarter, NTC's total assets reached VND4,429.8 billion, up 9% compared to the beginning of the year. Of which, the company is holding VND3.6 billion in cash.

Along with that are 1,210.2 billion VND in short-term deposits and 190 billion VND in long-term deposits at banks. This is relatively understandable because in the current volatile economic conditions, many companies choose the safe option of depositing money instead of expanding their business.

NTC also currently has financial investments of VND585.5 billion in affiliated companies. Notable investments include:

Binh Long Rubber Industrial Park JSC (MH3) 174.8 billion, equivalent to 37.8% of charter capital; Bac Dong Phu Industrial Park JSC 120 billion, equivalent to 40% of charter capital; Nam Tan Uyen Urban and Industrial LLC 80 billion, equivalent to 20% of charter capital; Saigon VRG Investment JSC 91 billion, equivalent to 9.06% of charter capital...

In addition, in the investment in Truong Phat Rubber JSC with a value of 10 billion VND, equivalent to 20% of charter capital, NTC is temporarily recording a loss of 2.1 billion VND.

NTC's capital is 80% debt with short-term debt accounting for 520 billion VND. Mainly, 158.7 billion VND is short-term prepayment from buyers. Short-term loans and financial leasing debts tend to increase from 71.6 billion to 248.2 billion VND. Thus, in just 9 months, short-term debt has increased 3.5 times.

Long-term debt recorded mainly consists of long-term unrealized revenue, accounting for VND 2,936.7 billion. This is all revenue received in advance for land and industrial park infrastructure rental.

Owner's equity accounts for VND940.9 billion, equivalent to 21.2% of total capital. Of which, undistributed profit after tax currently accounts for VND420.1 billion, up 55.4% compared to the beginning of the year.

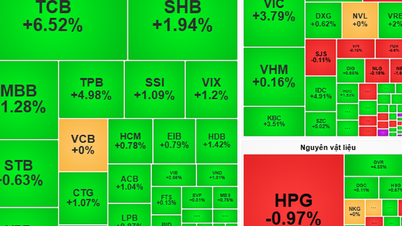

In the trading session on October 18, 2023, NTC shares were trading at VND 194,000/share, the selling force was still temporarily overwhelming, causing the stock price to slightly decrease by 1.75% compared to the previous session.

Source

![[Photo] Buddha's Birthday 2025: Honoring the message of love, wisdom, and tolerance](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/8cd2a70beb264374b41fc5d36add6c3d)

![[Photo] Prime Minister Pham Minh Chinh works with the Standing Committee of Thai Binh Provincial Party Committee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/f514ab990c544e05a446f77bba59c7d1)

![[Photo] Prime Minister Pham Minh Chinh starts construction of vital highway through Thai Binh and Nam Dinh](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/52d98584ccea4c8dbf7c7f7484433af5)

Comment (0)