Footwear is one of the Vietnamese industries that has been significantly affected by the US imposing high reciprocal tariffs. In the photo: workers of TBS Footwear Group (Binh Duong) produce shoes for export to the US market - Photo: TTD

For Vietnam, industries that will be greatly affected include seafood, plastic, rubber, wood, paper, pulp, textiles, footwear, machinery, equipment, components, electronics...

However, there are some goods that will not be subject to reciprocal tariffs, including items subject to tariffs under section 50 USC 1702(b); steel/aluminum and auto/auto parts items already subject to tariffs under section 232; copper, pharmaceuticals, semiconductors, and lumber; all items that may be subject to tariffs under section 232 in the future; gold bullion; energy, and certain minerals not available in the United States.

According to Mr. Hung, the US President's decree reflects the current administration's consistent stance in applying tariff measures to address the trade deficit. This is not just an economic issue but a national emergency that threatens the security and lives of the American people.

These tariffs will therefore remain in effect until President Trump determines that the threats posed by trade deficits and reciprocal treatment cannot be addressed or reduced.

Businesses exporting goods to the US are concerned about the new tariffs imposed by this country on Vietnam. In the photo: a wood export business at Nam Tan Uyen Industrial Park, Binh Duong - Photo: TTD

In fact, Vietnam has shown its goodwill in building a fair trade policy. Through high-level dialogues, Vietnam has always affirmed that it is a responsible trade partner with the US and other countries; emphasizing that Vietnam's recent moves are very positive in strengthening trust and deepening the Vietnam-US comprehensive strategic partnership, especially in the economic field.

Therefore, Mr. Hung hopes to continue to effectively implement cooperation mechanisms and bilateral agreements with the US such as TIFA and BTA. Specifically, increase the import of some of the US's strong products to suit our needs.

Attracting US businesses to invest in strategic fields and products with advantages that both countries have demand for to help increase the content and proportion of US origin ingredients in products.

Along with that, it is necessary to have solutions to control business strategies when exporting to the US to avoid sudden increases. Effectively exploit and diversify Vietnam's export markets, take advantage of the FTAs that Vietnam has signed with other countries, creating momentum and motivation for export growth.

Most US goods entering Vietnam are subject to import taxes of 15% or less.

Many garment businesses selling products to the US will be significantly impacted on the global market - Photo: TU TRUNG

On April 3, at the regular press conference of the Ministry of Finance in the first quarter, Mr. Truong Ba Tuan - Deputy Director of the Department of Tax, Fee and Charge Policy Management and Supervision (Ministry of Finance) - said that the ministry is reviewing all import and export goods, finding the reason why the US imposed a tax of up to 46% on Vietnamese goods. Besides the tax factor, are there any other factors (?), from which appropriate solutions will be proposed.

"According to the latest report from the US Trade Representative's office, Vietnam's average import tax rate is only 9.4%. It is also clear that most US goods exported to Vietnam are subject to import tax of 15% or less. Thus, Vietnam's tariff level is much lower than the 90% or 46% rate announced by the US this morning," Mr. Tuan emphasized.

Mr. Tuan also informed that the Ministry of Finance had previously reviewed the import tax schedule of goods. At the end of March, the Government issued Decree 73, which reduced import tax rates on many groups of goods from major trading partners, including the US.

This tax rate adjustment aims to balance the trade balance with major partners and comprehensive strategic partners. This will help consumers access lower costs, including tax reductions on 16 groups of products such as automobiles, agriculture, etc.

NGOC AN - LE THANH

Source: https://tuoitre.vn/khong-phai-mat-hang-nao-cung-chiu-thue-doi-ung-20250404074730468.htm

![[Photo] President Luong Cuong presents the decision to appoint Deputy Head of the Office of the President](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/501f8ee192f3476ab9f7579c57b423ad)

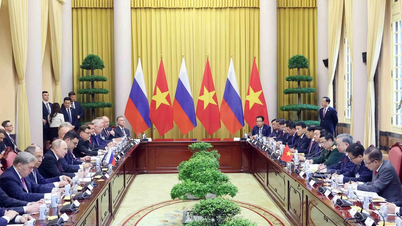

![[Photo] General Secretary concludes visit to Azerbaijan, departs for visit to Russian Federation](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/7a135ad280314b66917ad278ce0e26fa)

![[Photo] National Assembly Chairman Tran Thanh Man chairs the meeting of the Subcommittee on Documents of the First National Assembly Party Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/72b19a73d94a4affab411fd8c87f4f8d)

![[Photo] Prime Minister Pham Minh Chinh meets with the Policy Advisory Council on Private Economic Development](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/387da60b85cc489ab2aed8442fc3b14a)

![[Photo] Prime Minister Pham Minh Chinh talks on the phone with Singaporean Prime Minister Lawrence Wong](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/8/e2eab082d9bc4fc4a360b28fa0ab94de)

Comment (0)