VN-Index ended the week with a “tug-of-war” session after a continuous increase in the middle of the week. Experts give recommendations for investors at the end of the year.

Market is up, cash flow is still "weak"

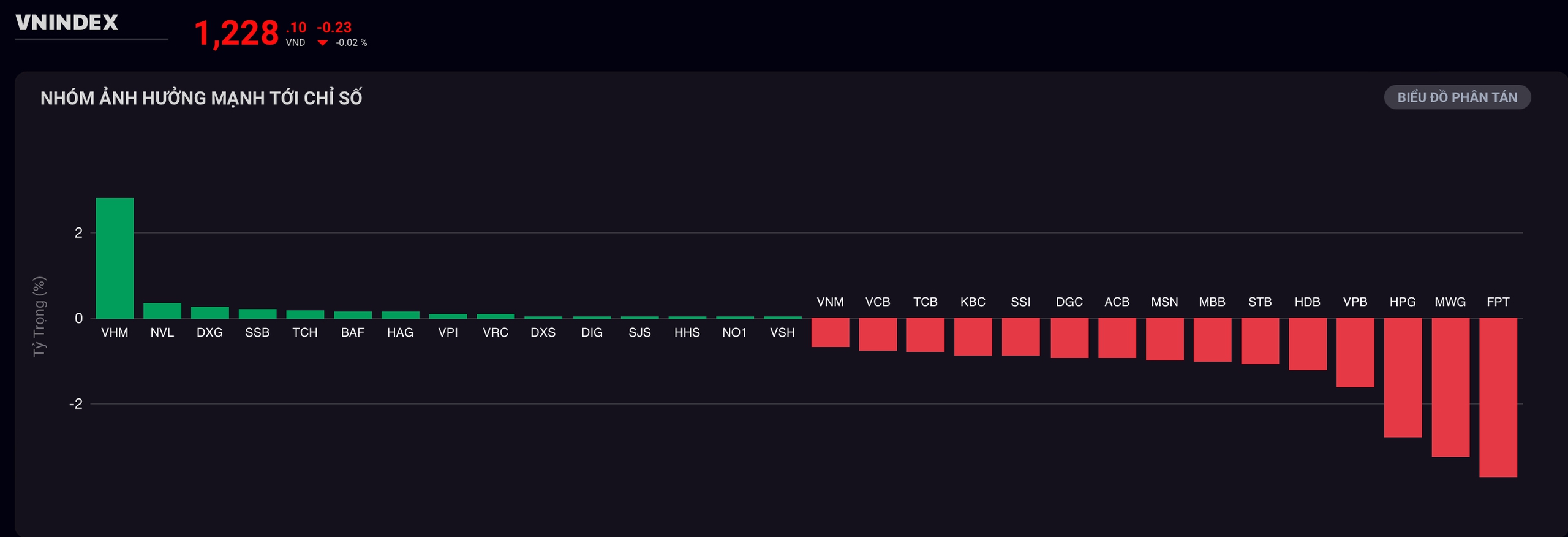

At the end of the weekend session (November 22), after 2 sessions of increasing more than 20 points in the middle of the week, VN-Index appeared to be in a tug-of-war state at the resistance zone of 1,230 points. This was also the third challenging zone of VN-Index, once again the market failed to overcome it successfully, closing with a slight decrease of 0.23 points (equivalent to -0.02%), down to 1,228.1 points.

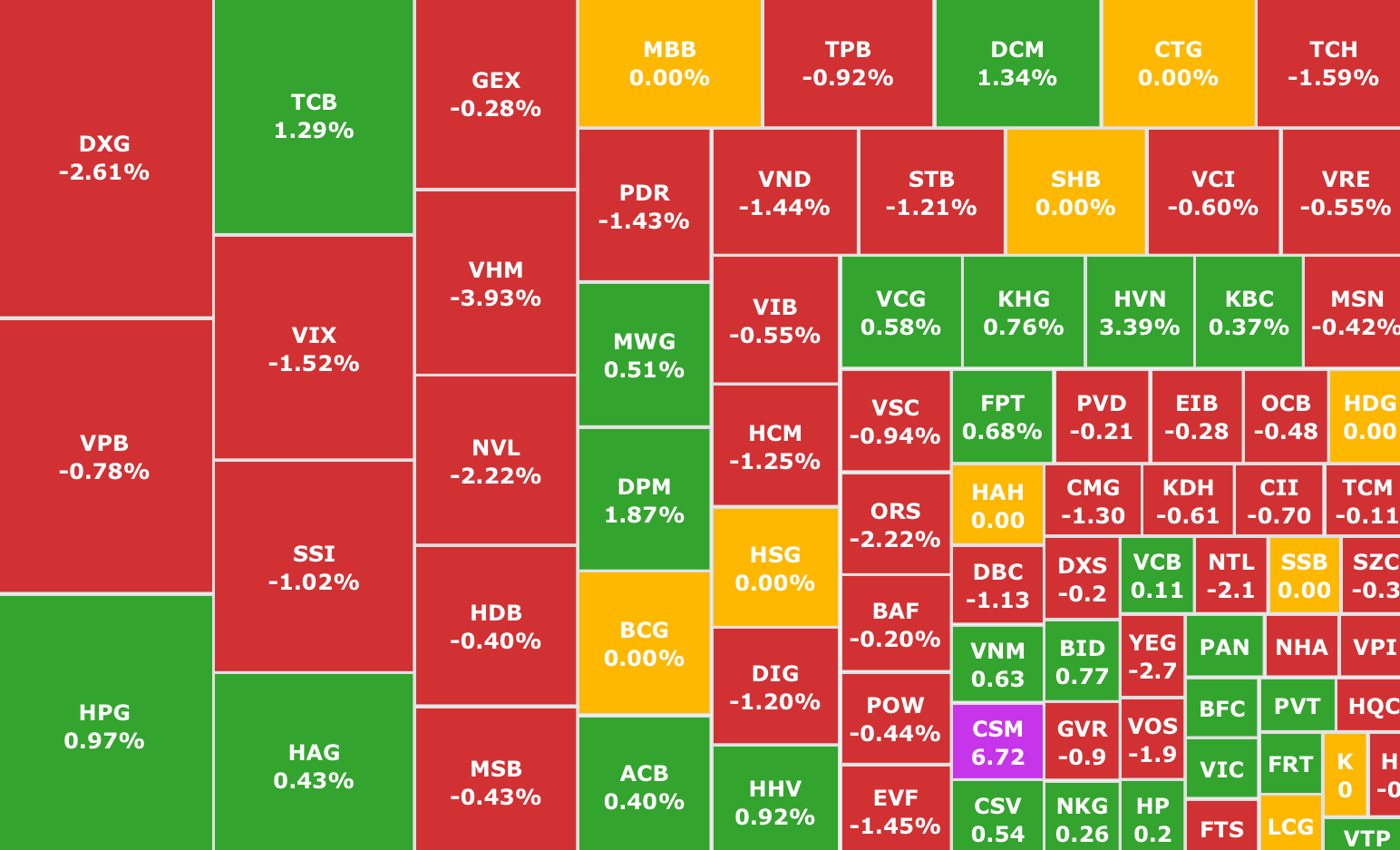

"Red" dominated with 213 stocks decreasing and 151 stocks increasing. Liquidity remained quite modest, reaching only nearly 12,758 billion VND on the HOSE floor.

Large-cap stocks including real estate and securities are under selling pressure: VHM (Vinhomes, HOSE) decreased by 3.93%, NVL ( Novaland , HOSE) decreased by 2.22%, SSI (SSI Securities, HOSE), VND (VNDirect Securities, HOSE),...

However, the "bright spot" of the session was the sudden reversal of foreign investors' net buying after more than a month of strong selling. The total net buying value of the whole market reached 28.1 billion VND, a reversal from the net selling of 928.4 billion VND in the previous session. The focus belonged to stocks HDG (Ha Do Group, HOSE), TCB (Techcombank, HOSE),FPT (FPT, HOSE), MWG (Mobile World, HOSE), etc.

Overall, at the end of today's session, the VN-Index established two consecutive sessions of recovery with more than 10 points each session, but liquidity remained gloomy.

Weak liquidity, sellers still dominated last trading week (Photo: SSI iBoard)

In fact, the Vietnamese stock market has been experiencing rather gloomy trading days since the beginning of November until now, with the VN-Index falling more than 100 points after previously surpassing the 1,300-point threshold. However, this threshold is still not easy to conquer in the context of market cash flow still having many macro concerns.

Mr. Bui Ngoc Trung, consultant, Mirae Asset Securities, said that the trading market was quiet as liquidity remained at a fairly low level, averaging only over VND10,000 billion/session.

This partly reflects the skeptical and cautious psychology of investors when investment opportunities are not really clear and foreign investors continue their net selling position. Since the beginning of the year, foreign investors have net sold about 85 billion VND, causing a lot of pressure on large-cap stocks and making the VN-Index not really have enough momentum to recover quickly.

In addition, other factors are also affecting the market, including: exchange rate pressure, the prospect of interest rate cuts by the US Federal Reserve (Fed) as well as not-so-positive corporate profit factors after the third quarter business results.

Weak liquidity, unclear recovery signals

However, in the past two mid-week sessions (November 20-21), the VN-Index continuously increased strongly with more than 10 points per session , but Mr. Trung said that the recovery signals were still not really clear, especially there was no new turning point in the strength of cash flow and the main trend was still in a state of adjustment, at times the index lost the 1,200 mark.

Mr. Trung commented that the market will maintain this recovery in the short term at the 1,230 - 1,250 point mark with a good average liquidity level of 15,000 billion VND.

In the final stage of this year, investors need to pay attention to the following information: The Fed's interest rate decision and direction in December; Forecast of business results for the fourth quarter of this year along with macro information with many important economic figures for the whole year 2024 to form an overview of the economy as well as assess the market outlook for the direction of 2025.

In addition, investors need to focus on re-evaluating their investment portfolios in the past to develop a strategy for allocating resources in the coming period when the market has almost fully discounted stocks with good fundamentals and will continue to benefit from the low interest rate environment.

The market has really recovered, what are the chances for the 1,300 point mark?

The stock market is going through a difficult period with continuous sharp declines. Therefore, if we talk about the number 1,300 points at this time, many investors will be deeply impressed when hearing about it, as the VN-Index has approached and failed at least twice this year. This seems to be an important psychological threshold, somewhat hindering the market's growth.

However, looking back at the market boom of the past 2-3 years, there were times when we reached higher milestones (VN-Index once traded above 1,520 points).

Therefore, Mr. Trung emphasized, the market will still have the opportunity to soon conquer again and successfully surpass 1,300 points, but the challenges and expected stories may be further away than the end of this year.

Looking to the end of 2024 and the whole picture of 2025, the market is in the final stage of preparing for the market upgrade from frontier to emerging. It is estimated that if Vietnam is successfully upgraded according to MSCI and FTSE standards, our stock market will receive 25 billion USD in investment capital by 2030.

The domestic real estate market is gradually recovering as expected, which will also unblock large domestic capital flows and spread the heat to other potential industries such as Banking and Construction Materials,...

Source: https://phunuvietnam.vn/vn-index-da-xuat-hien-tin-hieu-hoi-phuc-2024112221244173.htm

![[Photo] Draft documents of the 14th Party Congress reach people at the Commune Cultural Post Offices](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/28/1761642182616_du-thao-tai-tinh-hung-yen-4070-5235-jpg.webp)

![[Photo] National Assembly Chairman Tran Thanh Man received a delegation of the Social Democratic Party of Germany](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/28/1761652150406_ndo_br_cover-3345-jpg.webp)

![[Photo] Flooding on the right side of the gate, entrance to Hue Citadel](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/28/1761660788143_ndo_br_gen-h-z7165069467254-74c71c36d0cb396744b678cec80552f0-2-jpg.webp)

![[Photo] President Luong Cuong attends the 80th Anniversary of the Traditional Day of the Armed Forces of Military Region 3](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/28/1761635584312_ndo_br_1-jpg.webp)

Comment (0)