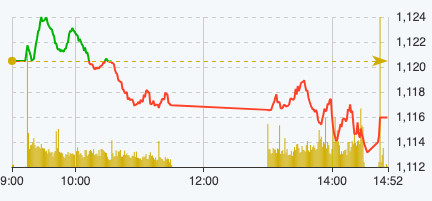

After yesterday's exciting session, the market opened in a tug-of-war above the reference with a fairly wide amplitude. After the first half of the session, the VN-Index reversed below the reference when selling pressure increased, causing more red to appear.

In the large-cap group, 25/30 codes decreased in points, however, the decrease was not much, VJC lost the most points, only down 1.6%. On the contrary, GAS, PLX,FPT increased slightly and BCM increased up to 4.73%.

At the end of the morning session on December 5, VN-Index decreased by 2.99 points, equivalent to 0.27% to 1,117.5 points. The entire floor had 139 stocks increasing and 301 stocks decreasing. HNX-Index increased by 0.61 points to 231.92 points. UPCoM-Index increased by 0.1 points, equivalent to 0.12% to 86.07 points.

VN-Index performance on December 5 (Source: FireAnt).

Entering the afternoon session, investors' sentiment remained quite cautious, causing the market to trade sluggishly. At the end of the trading session on December 5, VN-Index fell 4.52 points, equivalent to 0.4% to 1,115.97 points. The entire floor had 141 stocks increasing, 356 stocks decreasing, and 96 stocks remaining unchanged.

HNX-Index increased by 0.03 points, equivalent to 0.01% to 231.34 points. The whole floor had 63 stocks increasing, 99 stocks decreasing and 66 stocks remaining unchanged. UPCoM-Index increased by 0.06 points to 86.03 points.

The VN30 basket alone recorded 22 stocks decreasing in price. The impact of large-cap stocks was evident when VHM, VCB, VPB, VNM, HPG, MSN, SAB, BID, STB,and ACB took away 4.1 points from the general market.

Red spread in the banking group whenSHB decreased by 1.35%, STB decreased by 1.42%, VPB decreased by 1.79%, EVF decreased by 4.78%, ACB decreased by 0.67%, TPB decreased by 0.87%, TCB decreased by 0.5%,...

The real estate group was differentiated when DXG, NVL, ITA, DXS, IDC, SCR ended the session in green, IJC increased sharply. However, DIG, CEO, PDR, HQC, VHM, TCH, KHG, VIC, VRE, NLG ended the session in red although the decrease was not much.

Notably, in today's session, LDG shares no longer "hit the floor" when they decreased 2.49% to 3,130 VND/share and had the highest matching order in the market with a volume of 37.7 million units.

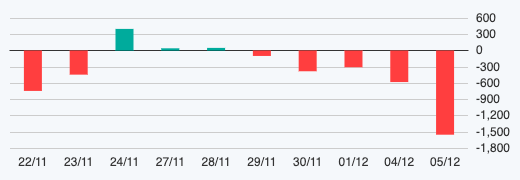

Foreign investors continued to net sell for the 5th consecutive session.

The total value of orders matched in today's session reached 19,873 billion VND, down 30% compared to the previous session, of which the value of orders matched on the HoSE floor reached 17,092 billion VND, down 30%. In the VN30 group, liquidity reached 5,558 billion VND.

Foreign investors continued to net sell for the 5th consecutive session with a value of more than 1,554 billion VND, the highest since January 13, of which this group only disbursed 563.8 billion VND and sold 2,118 billion VND.

The codes that were sold heavily were HPG 188 billion VND, FUESSVFL 173.6 billion VND, VHM 172 billion VND, VCB 100 billion VND, VNM 91.7 billion VND,... On the contrary, the codes that were mainly bought were KBC 11.6 billion VND, VGC 7 billion VND, VHC 4.6 billion VND, FUEMAVND 4 billion VND, DRC 3.5 billion VND,... .

Source

![[Photo] Prime Minister Pham Minh Chinh meets with Speaker of the Hungarian National Assembly Kover Laszlo](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/20/1760970413415_dsc-8111-jpg.webp)

![[Photo] Prime Minister Pham Minh Chinh received Mr. Yamamoto Ichita, Governor of Gunma Province (Japan)](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/21/1761032833411_dsc-8867-jpg.webp)

![[Photo] Da Nang residents "hunt for photos" of big waves at the mouth of the Han River](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/21/1761043632309_ndo_br_11-jpg.webp)

Comment (0)