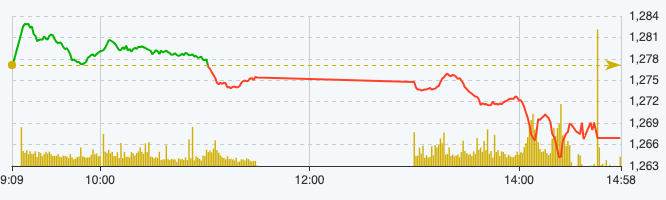

The market opened on a positive note, but short-term profit-taking pressure emerged, causing buyers to gradually lose their positions. The main indices went from a positive increase at the beginning of the session to weakening and struggling around the reference level before reversing at the end of the morning session.

VPB, TCB, BCM, HPG, MSN codes that increased positively from the beginning of the session were also under pressure to take profit at the end of the morning session. The VN30 basket was a burden when it took away more than 8 points, of which 16 codes decreased and only 8 codes increased.

At the end of the morning session on May 22, VN-Index decreased by 1.74 points, equivalent to 0.14% to 1,275.4 points. The entire floor had 199 stocks increasing and 219 stocks decreasing.

Entering the afternoon session, widespread profit-taking pressure caused the market to plummet, mainly concentrated in the banking, chemical and real estate groups.

At the end of trading on May 22, VN-Index decreased by 10.23 points, equivalent to 0.8% to 1,266.91 points. The entire floor had 173 stocks increasing, 291 stocks decreasing, and 50 stocks remaining unchanged.

HNX-Index increased by 1.86 points to 245.15 points. The entire floor had 88 stocks increasing, 80 stocks decreasing and 64 stocks remaining unchanged. UPCoM-Index increased by 0.25 points to 94.7 points.

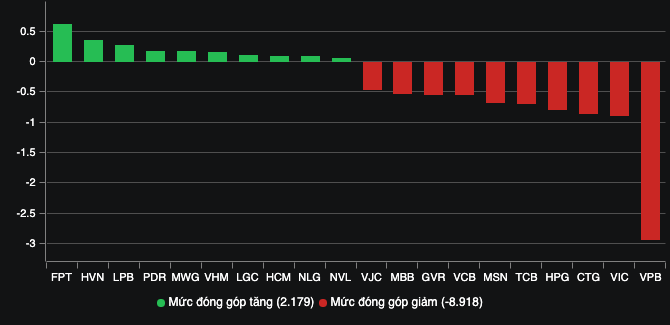

The VN30 basket was a burden, taking away 17.16 points and having 24 stocks decrease in price. VPB became the culprit when leading the market's decline and took away nearly 3 points. Following in turn were VIC, CTG, HPG, TCB, MSN, VCB, GVR, MBB, VJC.

Banking stocks were under the strongest pressure to sell profits, causing negativity to cover the entire industry. In addition to the 5 codes in the top 10 that negatively affected the market mentioned above, the codesSHB , ABB, EIB, ACB, STB, VIB, HDB, BID, MSB also ended the session in red.

Notably, ABBank's ABB code was under net selling pressure from foreign investors of up to VND883 billion in today's session. Just yesterday, this code attracted attention in the banking group when its stock price increased by 12.35% to VND9,100/share. Liquidity yesterday was also at a record high when more than 68.7 million ABB shares were matched with a transaction value of more than VND620 billion. At the end of the session on May 21, ABB decreased by 6.59% to VND8,500/share.

Similarly, the chemical group also sank into negativity under the pull of the big brother GVR when it took away more than 0.5 points from the market. The codes AAA, APH, DCM, DGC, DDV, HCD, NHH, DPR, CSV also ended the session in red. Only NTP was still "alone" increasing to the ceiling after the news of SCIC's divestment. In just 3 sessions, NTP increased by 26% to 53,900 VND/share, including 2 sessions reaching the ceiling.

On the positive side,FPT led the market's increase when contributing more than 0.6 points to the general index, continuing to set a new peak of 138,000 VND/share. Notably, since the beginning of the year, with only 93 trading sessions, this code has set a new peak 24 times. This means that on average, every 4 sessions, FPT surpasses the peak once.

Codes that affect the market.

The total value of matched orders in today's session was VND33,643 billion, up 17% compared to yesterday, of which the value of matched orders on the HoSE floor reached VND28,049 billion. In the VN30 group, liquidity reached VND11,461 billion.

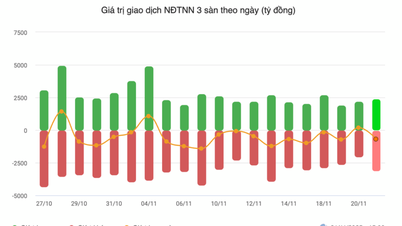

Foreign investors net sold for the fourth consecutive session with a value of VND856 billion today, of which this group disbursed VND1,391 billion and sold VND2,248 billion.

The codes that were sold heavily were ABB 883 billion VND, VHM 128 billion VND, VIC 114 billion VND, HPG 81 billion VND, VNM 79 billion VND,... On the contrary, the codes that were mainly bought were NLG 62 billion VND, HCM 49 billion VND, DBC 41 billion VND, PDR 40 billion VND, NVL 38 billion VND,... .

Source: https://www.nguoiduatin.vn/khoi-ngoai-dot-ngot-xa-ban-rong-880-ty-dong-mot-co-phieu-ngan-hang-a664771.html

Comment (0)