At the end of the session on July 31, VN-Index increased by 6.4 points (+0.52%), closing at 1,251 points.

After an effort to recover at the end of the previous session, Vietnamese stocks continued to increase when entering the trading session on July 31. The increase gradually broadened in the morning session when large-cap stocks such as VNM, HDB, GAS... increased in price, bringing the VN-Index to the 1,255 point area.

However, due to increased selling pressure in the afternoon session, the uptrend gradually narrowed in this session.

At the end of the session, VN-Index increased by 6.4 points (+0.52%), closing at 1,251 points. Liquidity increased with 685.4 million shares matched on the HOSE floor.

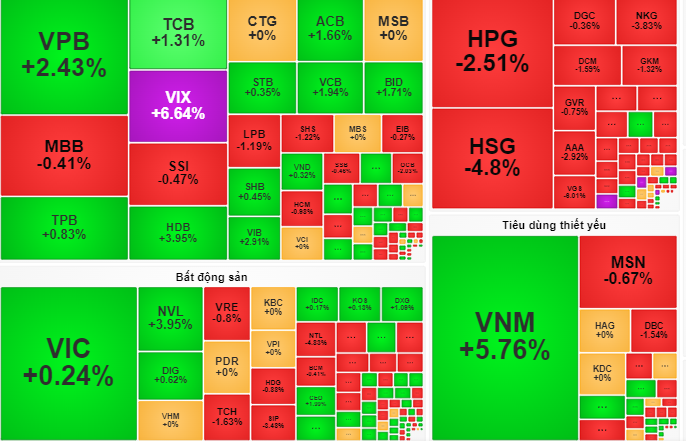

In the group of 30 large stocks (VN30), there were 19 stocks increasing in price including VNM (+5.8%), HDB (+4%), GAS (+3.5%), VIB (+2.9%), VPB (+2.4%) ...

In particular, this session, foreign investors continued to net sell on the HOSE with a value of 604.9 billion VND. eminent, the most notable point is that the group of foreign investors sold more than 901 billion VND of VIC shares, but this code still increased in price by 0.2%.

Foreign investors also sold heavily the following stocks: CTG (-57.6 billion VND), HSG (-56.6 billion VND), TCB (-43.6 billion VND), HVN (-32.6 billion VND) ...

Dragon Viet Securities Company (VDSC) said that many groups of stocks performed well but there was a clear differentiation. Positive impacts on the market were on some large-cap stocks in the food, banking, retail sectors, etc. Groups of stocks with less positive performance were steel, chemicals, transportation, etc.

According to VDSC, liquidity on July 31 increased compared to the previous session. This shows that the supply of stocks increased when the market increased but did not cause much pressure. During the session, the cooling signal from the resistance zone of 1,255 points of VN-Index showed that investors had a cautious buying and selling mentality.

"The market will continue to be under pressure from this area and there will be potential risks in the coming time" - VDSC forecasts.

However, VCBS Securities Company believes that in the next few sessions, the market will likely continue to fluctuate with small amplitudes.

"Stock codes that tend to maintain their prices should be prioritized, but should only be disbursed with a moderate proportion. Stock groups that can be noted are shipping, retail..." - VCBS Securities Company recommends.

Source: https://nld.com.vn/chung-khoan-ngay-mai-1-8-khoi-ngoai-con-ban-manh-co-phieu-vic-196240731175907927.htm

Comment (0)