Investment analysis

Bao Viet Securities (BVSC) : The VN-Index is currently consolidating within a range bounded by an upper resistance zone of 1,115 - 1,125 points and a lower resistance zone of 1,055 - 1,075 points. The index will need to break above the resistance zone formed by the converging MA200 and MA50 lines to open up opportunities for a short-term upward movement in the last month of 2023.

Investors continue to implement trading strategies at the boundaries of the price channel. In a positive scenario, if the VN-Index breaks above the MA200 line, investors may consider increasing their stock holdings.

East Asia Securities (DAS) : With positive signals from the disbursement of public investment capital in the final stages of the year, the VN-Index rose, breaking out of the sideways trading range, possibly marking the beginning of a final wave of 2023.

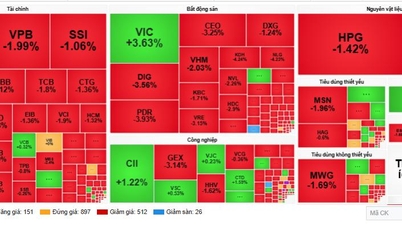

Stock prices are quite attractive for medium- to long-term investment portfolios, with investment opportunities coming from stocks benefiting from public investment as disbursement is in the urgent phase at the end of the year, in addition to the energy (oil and gas, electricity), retail, and industrial park sectors. For short-term strategies, consider stocks in the securities, real estate, steel, and construction materials sectors.

Asean Securities (Aseansc) : Aseansc believes the short-term market trend has become more positive as the VN-Index opened strongly higher, creating a gap and breaking out of the MA50 line with high liquidity. The next resistance zone will be the 1,125 - 1,130 point area, and the VN-Index is likely to experience slight fluctuations there.

Therefore, Aseansc recommends that investors closely observe the market and consider increasing the proportion of stocks in their portfolios during periods of volatility.

Stock market news brief

- The Fed chairman rejected expectations of an early interest rate cut. Chairman Jerome Powell did not believe the Fed would aggressively cut interest rates in the near future, stating that it was still too early to declare victory over inflation. Despite many positive signals regarding inflation, the Fed leader said the Federal Open Market Committee (FOMC) intends to maintain its "tightening" policy until it feels confident that inflation is sustainably heading towards 2%.

- Bank of Japan: It's too early to lift its monetary easing policy. With inflation exceeding the Bank of Japan's 2% target for over a year, the market is increasingly expecting the BoJ to lift its monetary easing policy next year. Japan has yet to achieve the price increases driven by wage increases to offset recent high inflation due to rising cost factors. This suggests it's too early to lift the Bank of Japan's (BoJ) monetary easing policy, according to BoJ board member Asahi Noguchi .

Source

Comment (0)