HSBC's global private banking division expects the US Federal Reserve (Fed) to start cutting interest rates in June 2024, after 11 consecutive rate hikes since March 2022 to fight inflation.

|

| In Vietnam, the 0% interest rate policy for USD to limit dollarization |

The key interest rates of the USD are currently kept by the Fed at 5.25 - 5.50% - the highest interest rate in more than two decades of this currency.

Dr. Vo Tri Thanh, former Deputy Director of the Central Institute for Economic Management, said that although US inflation has decreased, it has not yet met the Fed's expectation of reducing inflation to 2%.

There are two trends in the global economy in 2024. Some international financial institutions maintain the view that the global economy will continue to face difficulties this year, which will affect consumer demand and reduce exports.

HSBC expects a soft landing in the US economy in 2024 to have a positive impact on supporting global financial markets, especially when most Western central banks have completed their interest rate hike cycle amid continued decline in inflation.

“The Fed has ended its rate hike cycle, and the market tends to recover better than before the first rate cut,” said Fan Cheuk Wan, Asia Investment Director, HSBC Global Private Banking.

Mr. James Cheo - Head of Investment for Southeast Asia and India, Global Private Banking of HSBC said that the new global trade cycle recovery will boost Vietnam's exports. Vietnam is likely to witness a gradual increase in international tourism, the Vietnamese economy will have GDP growth of 6% in 2024, faster than in 2023.

Consumption and investment continue to be seen by foreign financial institutions as key growth drivers, alongside strong foreign direct investment inflows that are likely to continue into 2024, supporting Vietnam’s manufacturing sector.

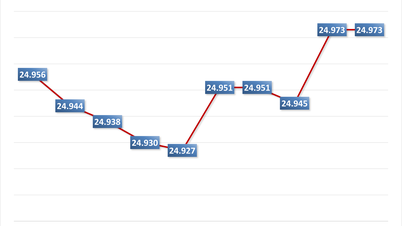

“We forecast the USD/VND exchange rate to reach VND24,400/USD by the end of 2024,” said Mr. James Cheo, agreeing with HSBC’s previous recommendation for Vietnam that inflation has been quite stable in recent times, but there may be risks of an increase due to higher-than-expected energy or food prices. The State Bank of Vietnam will be cautious and keep the operating interest rate unchanged in 2024.

Source link

![[Photo] Prime Minister Pham Minh Chinh chairs conference on anti-smuggling, trade fraud, and counterfeit goods](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/14/6cd67667e99e4248b7d4f587fd21e37c)

Comment (0)