More than 11 billion USD of residential real estate inventory

Statistics from the third quarter 2023 financial reports of 10 residential real estate enterprises on the stock exchange show that the total value of net inventories as of September 30 reached VND 270,099 billion (about USD 11.1 billion), up 4% over the same period last year.

However, compared to September 30, 2021, the inventory growth figure of this group is up to 35%.

Among these 10 enterprises, No Va Real Estate Investment Group Joint Stock Company (Novaland - stock code: NVL) has the largest inventory of about VND 137,594 billion, up 6% over the same period last year. This inventory ratio accounts for nearly 51% of the total inventory value of the above group of enterprises.

According to the financial statement, Novaland's largest inventory is real estate for sale under construction (mainly including land use fees, design consultancy, construction and other costs). This item recorded approximately VND 126,796 billion, accounting for 92.3% of inventory.

Novaland said that as of September 30, the group used VND57,025 billion worth of inventory as collateral for loans.

In second place in terms of inventory is Vinhomes Joint Stock Company (stock code: VHM) with VND 55,104 billion, a slight increase of 1% compared to the end of the third quarter of last year. Compared to the end of the third quarter of 2021, the inventory of this enterprise increased by 72%.

Similar to Novaland, the majority of Vinhomes' inventory is real estate for sale under construction at VND52,044 billion, at urban projects such as Dream City, Dai An, Grand Park, Vinhomes Ocean Park...

Another company with a sharp increase in inventory is Khang Dien House Investment and Trading Joint Stock Company (stock code: KDH). At the end of the third quarter, the company's net inventory was VND17,153 billion, up 35% year-on-year and 150% compared to the end of the third quarter of 2021.

Most of this unit's inventory is unfinished real estate in ongoing projects to develop residential areas such as Khang Phuc - Tan Tao Residential Area, Doan Nguyen - Binh Trung Dong, Binh Trung - Binh Trung Dong, Binh Trung Moi - Binh Trung Dong...

Nam Long Investment Joint Stock Company (stock code: NLG) recorded inventory at the end of the third quarter at VND16,800 billion, a slight increase of 4%.

This group's inventory is concentrated in unfinished projects such as Izumi Project (VND 9,037 billion), Waterpoint Phase 1 (VND 3,556 billion), Waterpoint Phase 2 (VND 1,528 billion), Akari (VND 1,045 billion) and some other projects.

Understand correctly?

In fact, not everyone fully understands the meaning of real estate business inventory items.

According to Mr. Nguyen Huu Thanh - Deputy General Director & Strategic Consultant, Weland Company - real estate is a specific business sector different from the manufacturing sector. For manufacturing enterprises, when inventory increases, it can be understood that the enterprise cannot sell its products. But with real estate, the more inventory, the larger the land fund the enterprise has.

Even a large inventory is a good sign that the business has products available to deliver to customers. Meanwhile, a business running out of inventory shows that there is no new land fund, new products to sell to the market. This is a sign that the future cash flow, future sales of the business are likely to be disrupted.

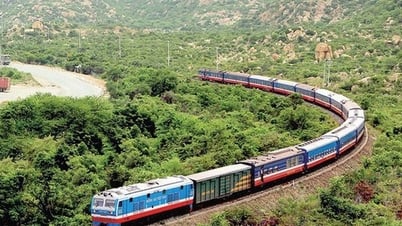

High inventory shows that real estate businesses have large land funds (Photo: Tran Khang).

Mr. Thanh said that there are many types of costs that make up the inventory of real estate businesses. The costs with large values are project purchase costs, site clearance costs, and construction costs.

Therefore, to analyze real estate businesses, it is necessary to compare projects of similar scale in terms of cost structure that make up inventory. Businesses with a large proportion of site clearance costs have lower inventory liquidity than businesses with mostly unfinished real estate.

An important indicator to evaluate a business's inventory is the inventory turnover ratio. This ratio is the number of times the average inventory turns over during the period.

According to accounting, the higher the inventory turnover ratio, the faster the business sells and the less inventory is stuck. Conversely, the lower the ratio, the slower the business sells and the more inventory is stuck.

Through the inventory turnover ratio, we are able to assess whether customer demand for a business's goods is good or not.

Data shows that this index of most businesses in the above group decreased compared to the same period 2 years ago. Only Vinhomes, Khang Dien, and Ha Do recorded an increase, with an improvement in inventory clearance compared to the same period in 2022.

Notably, businesses such as Phat Dat, Quoc Cuong Gia Lai, and Novaland have low ratios of only 0.01 to 0.03 rounds/quarter.

Source

![[Photo] Prime Minister Pham Minh Chinh chairs conference on anti-smuggling, trade fraud, and counterfeit goods](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/14/6cd67667e99e4248b7d4f587fd21e37c)

Comment (0)