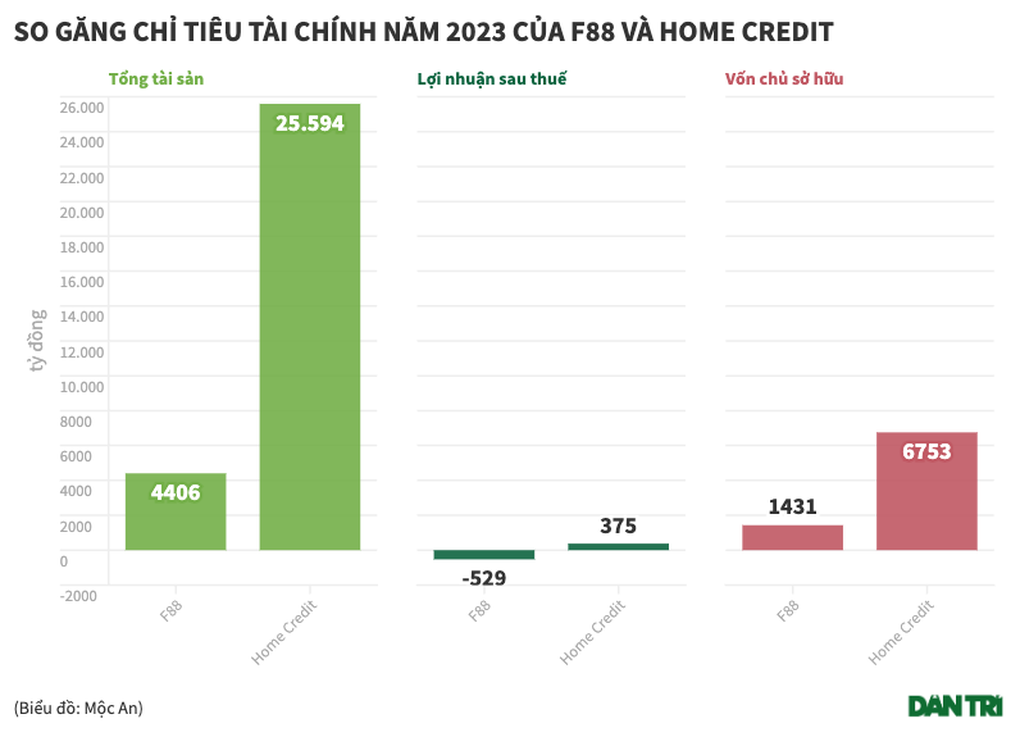

Financial figures for 2023 of F88 Trading Joint Stock Company (F88), Home Credit Finance Company Limited (Home Credit) were announced on the Hanoi Stock Exchange (HNX).

After a year of many fluctuations, the 2023 business results of the two "big guys" in consumer lending decreased relatively compared to 2022. Specifically, F88 recorded a loss after tax of 528.8 billion VND in 2023. In 2022, the business recorded a profit of 208.1 billion VND.

Home Credit achieved 375.3 billion VND in profit after tax, down 68% compared to 2022. On average, each day in 2023, Home Credit earned about 1 billion VND while F88 lost about 1.4 billion VND.

F88, Home Credit reduce interest rates significantly in 2023 (Chart: Moc An).

With heavy losses in 2023, F88's return on equity fell from 24% to negative 37%. For Home Credit, although ROE in 2022 lost to F88 at only 19%, last year was still positive at 6%.

The common feature of these two enterprises is that in 2023, the debt to equity ratio will decrease sharply. As of December 31, 2022, this ratio of both units is above 4 times. By December 31, 2023, F88 reduced its leverage to 1.8 times and Home Credit to 2.79 times.

F88 also reduced its bond debt to equity from 1.71 times to 0.18 times. Home Credit's ratio has remained at 0.17 times over the past two years.

From the published data, it can be calculated that the total assets of F88 and Home Credit recorded at the end of 2023 were more than VND 4,006 billion and VND 25,594 billion, respectively.

According to HNX, F88 has issued 35 bonds, of which 3 will be issued in 2023 with an interest rate of 11.5-12%/year. The other 32 bonds have been completely canceled.

In addition, according to information from the National Registration Office for Secured Transactions ( Ministry of Justice ), F88 also has loans from domestic individuals, foreign organizations such as Lendable SPC, Lion Asia VIII (RB) Limited (located in the Cayman Islands) or banks. The collateral for these loans is used cars or deposit accounts at banks.

Home Credit has issued 3 bonds and has 1 bond lot in circulation. These bonds have a total value of 1,100 billion VND, with an interest rate of 7.2-7.4%/year.

Before raising bonds, this enterprise borrowed capital from domestic and foreign banks such as Credit Suisse AG, Maybank International, Symbiotics SA, Micro, Small & Medium Enterprises Bonds SA on behalf of Compartment "One", First Abu Dhabi bank PJSC, Taishin International bank, E. sun commercial bank, Bank of Kaohsiung, Taiwan Cooperative Bank.

Source: https://dantri.com.vn/kinh-doanh/home-credit-va-f88-giam-lai-soc-20240415142504379.htm

![[Photo] Urgently help people soon have a place to live and stabilize their lives](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F09%2F1765248230297_c-jpg.webp&w=3840&q=75)

![[Photo] General Secretary To Lam works with the Standing Committees of the 14th Party Congress Subcommittees](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/12/09/1765265023554_image.jpeg)

Comment (0)