Attending the event were comrade Tran Minh Luc, member of the Provincial Party Committee, Vice Chairman of the Provincial People's Council; Vice Chairmen of the Provincial People's Committee: Nguyen Long Bien, Le Huyen, Trinh Minh Hoang; leaders of departments, branches, localities, related units and enterprises in the province.

In 2023, the provincial budget revenue will be 3,965 billion VND, reaching 117% of the estimate assigned by the Ministry of Finance; reaching 108% of the estimate assigned by the Provincial People's Council. In particular, 2023 is also the first year in the 2022-2025 budget stabilization period, the provincial budget land use fee collection will be 203.8 billion VND, reaching 102% and the district budget land use fee collection will be 269.71 billion VND, reaching 140% of the estimate assigned by the Provincial People's Council.

In 2024, the state budget revenue assigned by the Provincial People's Council is 4,000 billion VND, including: Domestic revenue in the province is 3,947 billion VND, and revenue from import-export activities is 53 billion VND. Of the domestic revenue, the revenue managed by the Tax sector is 3,885.473 billion VND and the revenue managed by the Department of Finance is 61.527 billion VND (including revenue from sponsorships, mobilized contributions from agencies, organizations and individuals according to the provisions of law is 20 billion VND; revenue from the sale of state assets, including land use fees attached to assets on land managed by local units is 41.527 billion VND).

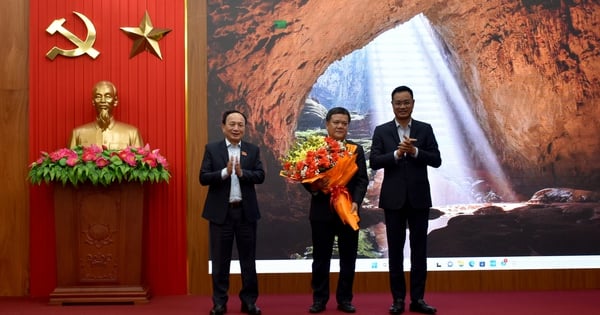

Comrade Tran Quoc Nam, Deputy Secretary of the Provincial Party Committee, Chairman of the Provincial People's Committee chaired the conference to deploy solutions for budget collection in 2024.

At the conference, leaders of departments, branches and localities focused on exchanging new ways of doing things, improvements and feasible methods; proposing many solutions to create new sources of revenue and nurture balanced sources of revenue in the following years. Accordingly, for revenues managed by the Tax sector, the Tax sector will proactively and regularly coordinate with relevant units and localities to grasp and closely monitor the developments in the business situation, production and business activities of taxpayers to assess and forecast the situation of taxpayers' budget collection, propose appropriate collection solutions; focus on supporting and promptly removing difficulties and obstacles for taxpayers, stabilizing production and business, creating sustainable sources of revenue for the State budget; creating an equal business environment to encourage and attract investment, creating sources of increased revenue for the State budget.

Regarding the revenues managed by the Department of Finance, from the beginning of 2024, the Department of Finance advised the People's Committee to issue Decision No. 44/QD-UBND dated January 18, 2024 on the Plan to organize the auction of surplus houses and land after rearrangement according to Decree No. 167/2017/ND-CP and Decree No. 67/2021/ND-CP of the Government.

On the side of the Customs Branch, it will focus on promptly removing difficulties and obstacles for enterprises, especially enterprises importing machinery and equipment to implement investment projects in the province, creating conditions for enterprises to carry out customs procedures and pay taxes in the province; at the same time, coordinate with the Department of Planning and Investment and relevant agencies to make a list of investment projects in the province that need to import machinery and equipment, support and facilitate the settlement of procedures, contributing to increasing revenue for the budget.

On the part of the People's Committees of districts and cities, they will closely coordinate with the Tax sector to successfully complete the State budget revenue estimates in the area assigned by the Provincial People's Council; focus on promoting the work of preventing budget losses, reviewing tax arrears to promptly collect them into the State budget according to regulations; continue to remove difficulties to complete new renewable energy projects, create new production capacity, and create new sources of revenue for the State budget. At the same time, focus on reviewing land use plans and planning, attracting investors to implement residential and urban areas assigned by the province (for districts under 10 hectares, for Phan Rang-Thap Cham city under 20 hectares); carry out the renovation, create conditions for people to change the purpose of land use; review interspersed land plots for auction to recover to the State budget; promote the determination of specific land prices, focus on removing difficulties in the obstacles of projects being implemented in the area, to soon put them into operation...

Concluding the conference, the Chairman of the Provincial People's Committee emphasized that 2024 is the year of "Acceleration", which is very important to fulfill the goals and tasks of the Resolution of the 14th Provincial Party Congress, the 5-year Socio-Economic Development Plan 2021-2025 in the context of many forecast difficulties and challenges; therefore, to contribute to the successful and comprehensive completion of the goals and tasks set out in 2024, he requested the Tax Department, Ninh Thuan Customs Branch, Departments, People's Committees of districts and cities to thoroughly grasp and strictly implement the Party's guidelines and policies, the State's policies and laws with the motto of solidarity, discipline, flexibility, creativity, and effective acceleration; strengthen revenue management, strive to complete the assigned revenue estimates at the highest level to ensure resources for implementing socio-economic development goals. Promoting the role of setting an example, the sense of responsibility of the leader associated with the discipline, responsibility, and public ethics of the team of cadres and civil servants; agencies continue to advise on resolving difficulties and obstacles, issue policies to remove difficulties, and unlock resources for business development; urgently advise on specific plans and take action right from the first months of the year, completing tasks early and on time according to the set Plan. The Provincial People's Committee will absorb, perfect and have optimal solutions in directing and operating the State budget collection work to achieve the best efficiency, contributing to the comprehensive victory of the goals and tasks assigned by the Government, the Provincial Party Committee, and the Provincial People's Council in 2024.

Xuan Nguyen

Source

![[Photo] Prime Minister Pham Minh Chinh chairs Government Conference with localities on economic growth](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/2/21/f34583484f2643a2a2b72168a0d64baa)

Comment (0)