At the 2024 Investor Conference held this afternoon, November 27, HDBank revealed that it expects to exceed its annual profit plan, creating high growth momentum for the next period.

Mr. Pham Van Dau - HDBank's financial director - shared at the conference - Photo: QUANG DINH

HDBank expects to achieve 16,000 billion VND in profit

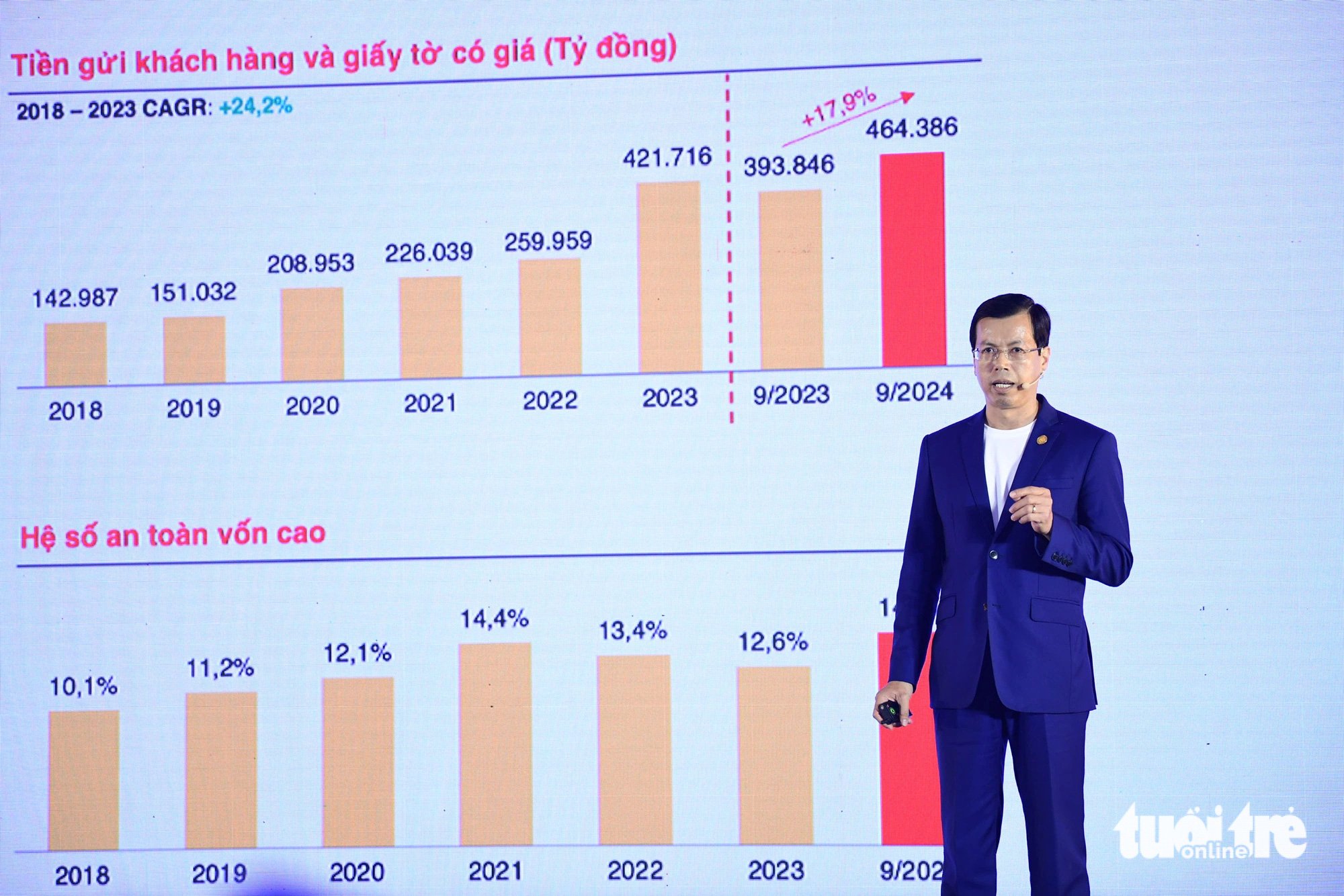

At the conference, HDBank representatives shared high growth business results in the first 9 months of 2024, with pre-tax profit of VND 12,655 billion, up 46.6% over the same period. Total assets reached VND 629,000 billion, up 23.9%.

The bad debt ratio as regulated by the State Bank is controlled at 1.46%, much lower than the industry average. The ROE ratio is 26.7%, ROA is 2.2%, among the leading groups in the industry.

Sharing about the outlook for business results for the whole year of 2024, Mr. Pham Van Dau - HDBank's CFO - said that the bank believes it will exceed the profit target of 15,852 billion assigned by shareholders and is expected to reach over 16,000 billion VND.

The results of 2024 will also create favorable momentum for high growth targets next year, when HDBank possesses strong financial potential, capital safety according to Basel II standards reaching 14.8%, a high level in the leading group of the whole industry; high liquidity safety indicators.

Mr. Tran Hoai Nam - Deputy General Director of HDBank - Photo: QUANG DINH

Regarding the business plan for next year, Mr. Tran Hoai Nam - Deputy General Director of HDBank - shared that HDBank will continue to implement the multi-functional retail banking strategy, promote digital business, promote advantages from the potential customer ecosystem in large value chains, and comprehensively integrate environmental, social and governance (ESG) factors into operations for high and sustainable growth.

HDBank expects its growth targets next year to reach 25%, with pre-tax profit reaching about VND20,000 billion, up 25% compared to 2024. At the same time, the bank will continue its tradition of paying high and regular dividends as planned by the shareholders' meeting.

Mr. Marcin Miller - co-general director of HDBank Digital Bank - said the number of digital transactions increased sharply to nearly 76 million in the first 9 months of the year, an increase of 80.4% over the same period.

The rate of digital transactions also increased to 97%, up 6% over the same period.

Digitizing the customer journey

Mr. Marcin Miller - co-general director of HDBank Digital Bank - said the number of digital transactions increased sharply to nearly 76 million in the first 9 months of the year - Photo: QUANG DINH

This result is due to HDBank pioneering robotic automation. Digitizing the customer journey related to account opening, credit card and term deposit opening, online foreign exchange transactions and letter of credit issuance.

HDBank is also the first bank in Vietnam to cooperate with AWS (cloud computing service provider), a member of Amazon.com, to deploy Amazon Elastic Kubemetes service to support comprehensive digital transformation.

HDBank also promotes the implementation of eKYC and provides leading technology authentication solutions for customer authentication and information security such as OCR, facial recognition, live detection and NFC.

The bank also increased investment in digital transformation as well as agricultural and rural development. HDBank is the first bank to launch a website for 63 provinces and cities with a design specifically for customers in each province/city.

Also according to the announcement, more than 80% of HDBank's new customers in the first 9 months of the year were attracted through digital channels.

HDBank's digital transformation strategy achieved expected results thanks to the application of 3 steps: Automation, redesign, reimagination, thereby improving customer experience.

In the first 9 months of 2024, HDBank attracted more new customers than in the whole of 2023, of which 85% of new customers were through digital channels, while in the same period last year it was 55%.

"This shows that current user habits and behaviors are very different. Therefore, the utilities provided must also meet the needs of digital citizens.

HDBank has also redesigned the process so that customers have the smoothest omni-channel experience," said Mr. Marcin Miller.

HDBank has introduced many services on the HDBank mobile application, allowing customers to manage their personal finances quickly, safely and conveniently. HDBank users can easily register for Skyjoy membership and connect with more than 250 partners in Vietnam…

HDBank proactively implements social responsibility

Recently, HDBank has also proactively implemented its social responsibility. Specifically, HDBank has provided a preferential credit package of VND12,000 billion to provide practical support to customers affected by storms and floods.

Accordingly, the bank launched a VND10,000 billion credit package with a lending interest rate 1-2% lower than usual per year. At the same time, HD SAISON - a member unit of HDBank - launched a VND2,000 billion credit package with a preferential interest rate of only 50% of the normal lending interest rate.

Along with that, HDBank adjusted 1%/year interest rate for existing loans serving production and business of customers in the above-mentioned affected group.

For new business loans, HDBank offers a preferential interest rate reduction of 2%/year for the first 3 months compared to the current interest rate, or 0% for the first month.

HDBank leaders said that with a sense of responsibility and sharing, HDBank uses its own resources from profits and continues to strive to reduce costs, accompanying customers during this period.

Source: https://tuoitre.vn/hoi-nghi-nha-dau-tu-hdbank-2024-ly-giai-chuoi-tang-truong-cao-lien-tuc-20241127200648239.htm

![[Photo] General Secretary To Lam receives leaders of typical Azerbaijani businesses](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/998af6f177a044b4be0bfbc4858c7fd9)

![[Photo] General Secretary concludes visit to Azerbaijan, departs for visit to Russian Federation](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/7a135ad280314b66917ad278ce0e26fa)

![[Photo] Prime Minister Pham Minh Chinh talks on the phone with Singaporean Prime Minister Lawrence Wong](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/8/e2eab082d9bc4fc4a360b28fa0ab94de)

Comment (0)