Completing public company registration, Vinpearl prepares for IPO day?

The plan to list shares on the stock exchange has been announced before. Completing the public company registration brings Vinpearl closer to this plan.

On November 15, the State Securities Commission issued an official dispatch confirming the completion of Vinpearl Joint Stock Company's public company registration.

According to the records, Vinpearl is located at Hon Tre Island, Vinh Nguyen Ward, Nha Trang City, Khanh Hoa Province, operating under Business Registration Certificate No. 4200456848 first issued by the Department of Planning and Investment of Khanh Hoa Province on July 26, 2006, and the 70th change on March 15, 2024.

Vinpearl is a subsidiary of Vingroup Corporation that owns a chain of hotel, resort, spa brands, conference centers, cuisine, 5-star golf courses and large entertainment areas in Vietnam.

According to the latest Business Registration Certificate, Vinpearl's charter capital is VND17,232.2 billion. Vinpearl has 4 legal representatives including Ms. Nguyen Thu Hang (Chairwoman of the Board of Directors), Mr. Doerr Juergen Peter (General Director), Deputy General Director Vo Thi Phuong Thao and Director Nguyen Dinh Nga.

The company's charter capital has changed a lot over time due to capital increases, mergers, and business separations.

Most recently, in February 2024, Vinpearl increased its charter capital through a private offering to a number of identified investors to supplement investment capital and working capital. The total amount of capital contributed from the share offering was VND 15,617 billion. After the above capital increase transaction, Vingroup's ownership ratio at Vinpearl decreased to 85.51%.

Previously, in May 2023, Vinpearl Company merged with Nguyen Phu Company. According to the merger contract between Vinpearl Company and Nguyen Phu Company, Vinpearl Company issued an additional 10 million shares with a total par value of VND 100 billion to exchange for 10 million shares of Nguyen Phu Company. Then, in July 2023, Vingroup completed the purchase of Vinpearl shares arising from this merger transaction with its partners.

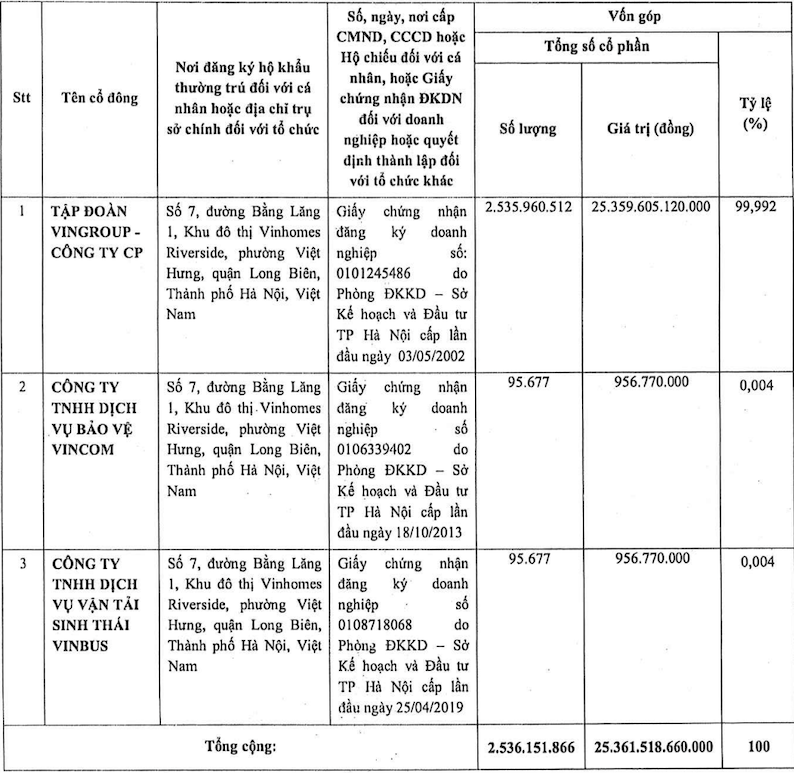

Also in July 2023, Vinpearl split into two companies, Vinpearl Company and Vinpearl Cua Hoi Company, with charter capital of the companies after the split being VND 25,362 billion and VND 1,264 billion, respectively. At this time, Vingroup is one of the three shareholders of Vinpearl after the split with an ownership ratio of 99.992%.

|

| Shareholder structure of Vinpearl Company after separating Vinpearl Cua Hoi. |

In July 2023, Vinpearl merged with Lang Van Company, after the transaction, Vinpearl Company's charter capital increased to VND 25,462 billion. In November 2023, Vinpearl Company split into two companies, Vinpearl Company and Ngoc Viet Company, with the charter capital of the two companies after the split transaction being VND 5,041 billion and VND 20,420 billion, respectively.

By December 2023, Vinpearl Company increased its capital to VND 15,041 billion. The Company transferred part of the right to purchase shares of Vinpearl Company in the capital increase transaction to individuals. The profit of VND 600 billion from this transfer transaction was recorded in Vingroup's separate business performance report. After completing the capital increase transaction, Vingroup's ownership ratio in Vinpearl Company was 97.96%.

Thus, by the end of 2023, small shareholders owned 2.04% of Vinpearl's capital, equivalent to about 30.68 million shares. After the capital increase in February 2024, the ownership ratio of shareholders outside Vingroup Corporation increased to 14.49%, equivalent to nearly 250 million shares.

With the number of additional shares after the issuance in early 2024 being 219.12 million units, the average amount of money new shareholders pay for shares is approximately VND 71,271.

According to regulations, the conditions for becoming a public company are one of two cases. First, the company has a contributed charter capital of VND30 billion or more and has at least 10% of voting shares held by at least 100 investors who are not major shareholders. Second, the company has successfully conducted an initial public offering through registration with the State Securities Commission.

Vinpearl has not yet conducted an IPO, so it is likely to have satisfied the minimum condition of 10% of voting shares held by at least 100 investors who are not major shareholders.

At the 2024 Annual General Meeting of Shareholders, Vingroup leaders said they are carrying out procedures to list Vinpearl on the stock exchange. The successful listing is expected to be at the end of this year.

According to the provisions on obligations in the Securities Law 2019,d), a public company must register its shares for trading on the trading system for unlisted securities within 30 days from the date the State Securities Commission confirms the completion of the public company registration. After 2 years from the first trading date on the trading system for unlisted securities, a public company has the right to submit a listing registration dossier when it meets the conditions for listing securities. In case Vinpearl conducts an IPO, the company is allowed to list its shares or register for trading on the securities trading system within 30 days from the date of completion of the public offering.

Although many public companies have been warned about the above regulation, Vinpearl, with its plan to go public since last year, may soon register to trade on UPCoM or conduct an IPO and list its shares on HoSE or HNX.

Latest update on business results, in the first 6 months of 2024, Vinpearl reported a profit after tax of VND 2,579 billion, 3.8 times higher than the figure of VND 671 billion for the whole year of 2023. As of June 30, Vinpearl's equity reached VND 31,513 billion, 2.3 times higher than at the beginning of the year. The debt to equity ratio is 1.15 times, corresponding to a total debt of about VND 36,240 billion. Thus, Vinpearl's total assets as of June 30, 2024 reached VND 67,750 billion, equivalent to about USD 2.7 billion).

![[Photo] More than 17,000 candidates participate in the 2025 SPT Competency Assessment Test of Hanoi National University of Education](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/e538d9a1636c407cbb211b314e6303fd)

![[Photo] Readers line up to visit the photo exhibition and receive a special publication commemorating the 135th birthday of President Ho Chi Minh at Nhan Dan Newspaper](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/85b3197fc6bd43e6a9ee4db15101005b)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting on science and technology development](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/ae80dd74c384439789b12013c738a045)

![[Photo] Nearly 3,000 students moved by stories about soldiers](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/21da57c8241e42438b423eaa37215e0e)

Comment (0)